In brief

- Crypto Santa's making a list, he's checking it twice.

- He's going to find out who's naughty and nice.

- Crypto Santa's coming to town.

We do the research, you get the alpha!

Twas the night before Christmas…

The crypto gifts are wrapped under the Christmas tree, the sherry and mince pies laid out on the mantelpiece, and Crypto Santa is drawing up his list of who's been bad or good this year.

And what a year it's been. Bitcoin shot past $20,000, Ethereum 2.0 launched, and the summer of DeFi saw new decentralized finance tokens rise and fall in a matter of days. There have been heroes and villains, and everything in between.

So who deserves a pat on the head and a tangerine, and who's getting a lump of coal in their stocking? With your blessing and our thanks, we present you with our humble crypto Santa’s naughty n’ nice list. Enjoy!

The Nice List

1. PayPal

PayPal tops our nice list for 2020. The US payments giant last month rolled out crypto trading services to the entire US, with plans to expand to other markets soon after.

Grinches have griped that PayPal’s offering goes against the principles of crypto; technically, you don’t actually buy crypto from PayPal, but instead buy IOUs that represent crypto that PayPal has kindly purchased on your behalf.

So why has it topped our list? Because PayPal, like a joyous Christmas caroler, has brought the gospel of crypto to the doorsteps and tingly fingertips of unconverted pagans.

Millions of unbelievers with no prior experience of the cryptocurrency markets can now hold positions in Bitcoin, Bitcoin Cash, Litecoin or Ethereum, or use it to pay for things at one of PayPal’s nine trillion merchants worldwide. Surveys suggest that it’s already boosting crypto trading among users.

2. The Wyoming Legislature

We give thanks to thee O Wyoming Legislature, which this year has been ever so kind to crypto.

This year, Wyoming awarded the first crypto banking license to US crypto exchange Kraken. This licensed Kraken to set up a bank (via an independent company, Kraken Financial), that holds custody over its customers’ cryptocurrencies and lets its customers easily switch between fiat and crypto. (The bank can’t offer loans, however, and must maintain a one-to-one reserve of all of its customers’ funds.) Then Wyoming awarded a subsequent banking charter to crypto bank Avanti.

Further spreading cheer and merriment among the crypto fraternity, Cynthia Lummis, who started this year a Bitcoin-friendly Republican congressman, was elected as Senator for Wyoming in the November US General Election, and promptly hired “Crypto Cowboy” Tyler Lindholm as State Policy Director.

3. Sam Bankman-Fried

Sam Bankman-Fried, the CEO of crypto exchange FTX and a recent Forbes ‘30 under 30’ nominee, has secured a place on our ‘nice’ list this year. We like him, curly locks and all.

We liked his DeFi initiatives, like when he grew his blockchain, Solana—but in that achievement, Bankman-Fried shares his spot with the countless other DeFi developers who sparked this summer’s DeFi bull run.

We liked his candor; in October this year, he called decentralized exchange volumes “bullshit”, taking aim at the huge money-printing operations undertaken by decentralized finance protocols hoping to convince investors to keep money locked in their protocols. Soon afterward, DEX volumes tanked.

But most importantly, we thank Bankman-Fried for his grace in saving SushiSwap. The DeFi protocol was thrown for a loop when the pseudonymous creator of the protocol, Chef Nomi, cashed out $14 million worth of ETH from its contracts and headed for the door. After some soul-searching, Chef Nomi returned the money, before appointing Bankman-Fried as the temporary operator of the protocol.

1) A way forward for Sushi, and a way further back.

— SBF (@SBF_FTX) September 6, 2020

Resisting the temptation to abuse his newfound power, Bankman-Fried dutifully supervised the protocol’s migration of all the money held in SushiSwap to a new, decentralized system. And for that, we praise him.

The Naughty List

1. DeFi hackers and scammers

DeFi hackers ground the gears of many a crypto trader this year. They were the scourge of innovation—or, put another way, proof that no shortcuts can be taken when creating decentralized finance protocols that handle billions of dollars.

There were, roughly, three types of hacks and exploits.

- The first was the straightforward “give me 1 BTC and I send you 2 BTC” scams that have blighted crypto for a decade or so, albeit with a new twist. New DeFi protocols sprung up thick and fast, with a tiny window of opportunity for making tremendous profits. Since these new DeFi protocols were far too complicated to understand in their entirety, many scammers found luck in convincing people that their supposed auto-trading bot was legitimate.

- The second was the rug-pull. Scammers built a DeFi protocol then, without warning, withdrew all of the money from the smart contracts, disappearing into the ether. Or Ether, if you will.

- The third was the exploit or vulnerability; someone exploiting a bug within the DeFi protocol for money. Often, these vulnerabilities exist because the code isn’t audited, or because the developers have rushed the project to get it to market as quickly as possible.

This year, several attacks took advantage of similar exploits. These involved taking out a flash loan (a short crypto loan) from a DeFi lending protocol, then using that loan to manipulate the price of cryptocurrency held in another DeFi protocol. In the past few months, Harvest Finance lost $34 million, Cheese Bank lost $3.3 million; Akropolis suffered a $2 million loss; Value DeFi lost $6 million; Pickle Finance lost $20 million; and Warp Finance lost $8 million.

2. The Twitter Hackers

A special mention this year goes to the Twitter hackers, who this past summer socially engineered their way into the social network site. With access to Twitter’s ‘God Mode' developer dashboard, they took control of the accounts of over 1,000 of the world’s political leaders, CEOs, and blue-tick celebrities—everyone from Joe Biden to Kim Kardashian. With all that power at their disposal, the hackers could have done anything: start a war, vow to cure cancer, progress toward world peace. But no, they resolved to turn the whole thing into a petty Bitcoin scam—and one that didn’t even make that much money.

By obtaining employee credentials, they were able to target specific employees who had access to our account support tools. They then targeted 130 Twitter accounts - Tweeting from 45, accessing the DM inbox of 36, and downloading the Twitter Data of 7.

— Twitter Support (@TwitterSupport) July 31, 2020

It’s strange. The hackers, mostly in their late-teens and early-twenties, had greater ambitions than most in hacking Twitter. But still, when they hacked one of the largest social media networks in the world… all they did was make Bill Gates, one of the richest men in the entire world, tweet out a request for Bitcoin. The whole thing, disappointingly, only made a touch over $100,000 anyway, and resulted in the arrests of its perpetrators.

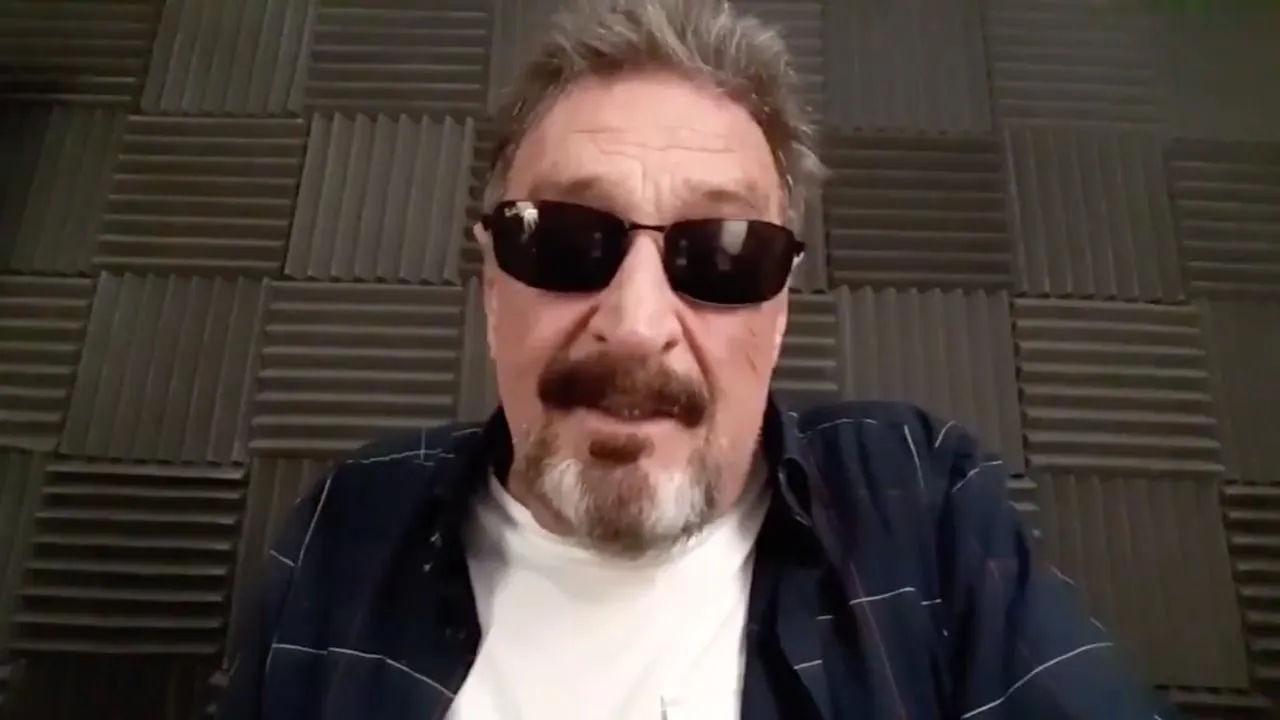

3. John McAfee

John McAfee was never meant for Decrypt’s “nice” list. The antivirus tycoon gave up the suits years ago when he fled to Belize to escape tax, live a life of luxury and promote Bitcoin; later, he mounted a Presidential campaign from his boat. So why has McAfee made it on the naughty list this year, when so many of his outlandish antics are so public anyway?

McAfee rightly earned this coveted spot when Spanish authorities apprehended him in October. He now sits in a Spanish jail, awaiting extradition to the US. There, he’ll square off against the US government, which alleges that McAfee dodged taxes for years and promoted initial coin offerings for crypto projects, without disclosing that the projects were paying him huge sums of money. Oh well, it's all good material for the movie.