- Team McAfee charged crypto projects up to 20 percent of their total supply of tokens in return for promoting them.

- The total amounts involved add up to $778,000 at today’s prices— some $16.6 million at each coin’s peak price.

- Multiple partners left Team McAfee unhappy with a lack of promotion.

- One company threatened a lawsuit in the event it did not get its tokens back.

- An email alleged to have been sent by McAfee to his then CEO says McAfee made $700,000 in cash deals while at the Malta Blockchain Summit. The email said he was also working on an $800,000 Russian cash deal.

It’s a little like the old joke about the two elderly people complaining about a restaurant they dislike—the food’s no good, and the portions are too small.

That describes, in some ways, John McAfee’s crypto-promotions business, say people who’ve done business with him during the past 14 months. While it’s well known that McAfee, 73, has accepted large fees to promote token offerings—he admitted a year ago that he charges $105,000 per tweet—what’s less known is that a number of former and current partners are grousing that they didn’t get what they paid for. Worse, some of them say they fear speaking out, since his negative tweets can cause far more damage than any good they had received.

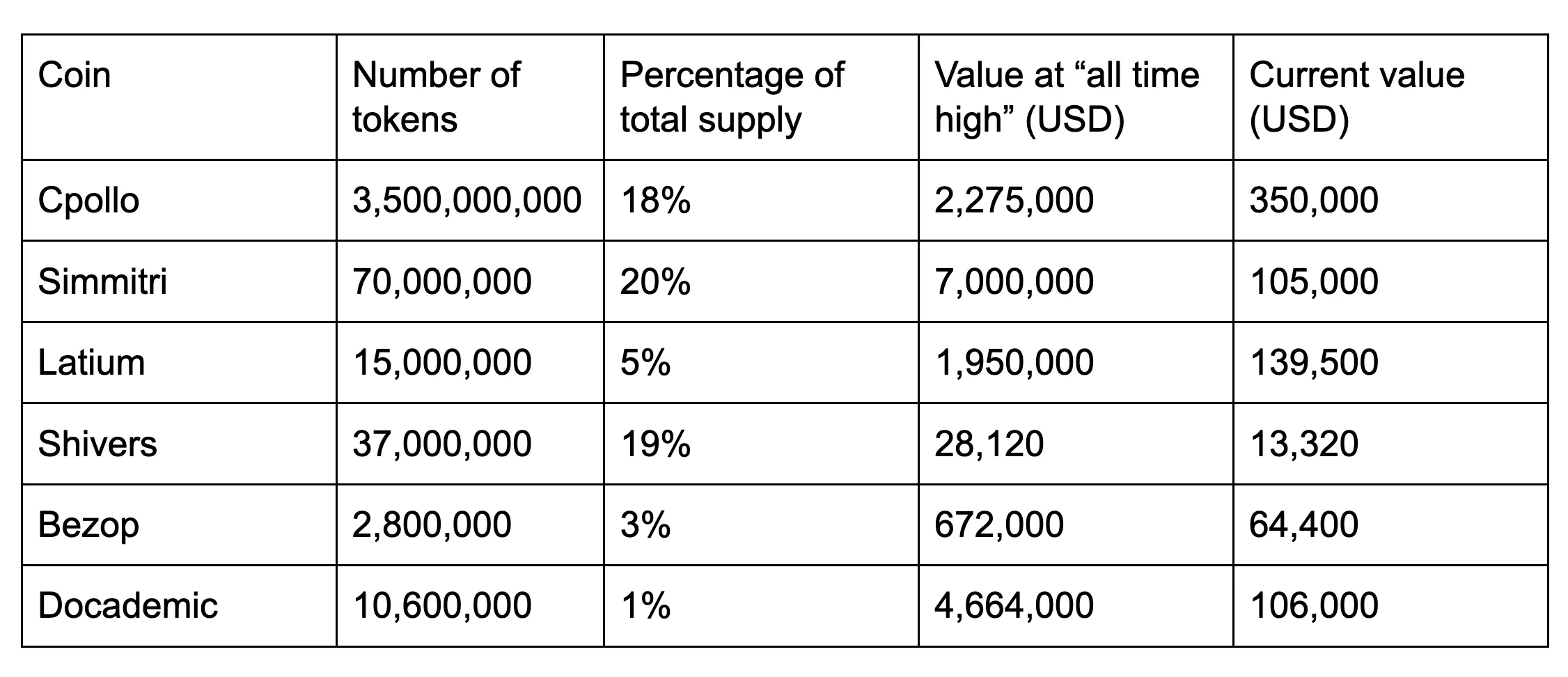

According to interviews with his ex-CEO and a number of current and former partners, as well as written communication and contracts obtained by Decrypt, McAfee has sought up to 20% of the tokens issued in a variety of ICOs, in exchange for his public endorsement.

The amounts he received—at their peak, pre-crash prices—were worth millions of dollars.

“His model is sign a deal, do a couple of tweets then basically turn on them for something,” said ex-CEO Jimmy Watson. “That’s why you see so many people mad at him because they’re like ‘hey, what the fuck happened?’ What are those tokens for? That’s for sustained promotion.”

One former partner, who asked that his and his company’s name be withheld, elaborated: “It has become clear that the ‘Alliance’ was just an attempt to gain momentum in the space together, but Team McAfee has failed to deliver any real value. Our company feels as if there was no earnest effort to produce any exposure for [the project] and we are frustrated, disappointed and remorseful.”

Reached by email, McAfee dismissed the claims as false, blaming his former CEO for any bad business dealings that might have occurred, and alleged that the documents provided to Decrypt were forged. “All I can say is ‘Laugh my fucking ass off,’ ” he said, in emails that seemed to be intentionally riddled with typos. “Where are the specifics? Who asked for their money back? Dude, i will rip you a new asshole in court if you dib't unclude hard data to support thwse hiksrioys statements. I could use the money yoy'll be paying me.”

In addition, questions have been raised over the legality of promoting ICOs, which the SEC has deemed to be—for the most part—securities. In June, 2018, McAfee seemed to back away from the promotions business due to the SEC’s belligerent stance. Yet, contracts shared with Decrypt show he has continued to accept money for promoting ICOs toward the end of last year.

A long and winding road

Last December, just before the great crypto bubble popped, New York Magazine ran a story that quoted McAfee as saying, “my power to demolish is ten times greater than my power to promote.” The feature also dubbed McAfee, “the spokesman for the crypto bubble.”

That description was not hyperbole. As was often the case in his career, McAfee was in the right place at the right time, to make the most of a trend.

A charismatic tech mogul, McAfee made his millions practically inventing the dubious, computer “anti-virus” industry, just as personal computers themselves were becoming a mass-market phenomenon. After selling his company, he got involved in a number of wild adventures—attracting controversy at every turn—until he found his way into bitcoin mining nearly two years ago with MGT Capital. MGT is currently facing a class-action lawsuit for allegedly running pump-and-dump schemes.

By December, 2017, McAfee had launched his “Coin of the Day” tweets, amassing hundreds of thousands of followers while pumping a variety of altcoins. His first one caused the price of Electroneum to nearly double. A number of freely available and paid-for trading bots that made automatic buy orders based on the contents of his tweets started to materialize, giving rise to the so-called “McAfee Effect.” Though his tweets sometimes led to immediate price gains, some say they often immediately gave way to losses; and if his touts made anyone rich, it went unnoticed.

Nevertheless, the beyond-colorful, Teflon-coated McAfee continues to be one of crypto twitter’s biggest celebrities, with some 901,000 followers.

He launched his promotions business, Team McAfee, in February, 2018. And he made no bones about the purpose of the enterprise, advertising that, “John McAfee’s tweets are by far the most influential in the field of cryptocurrency.” A dozen startups took him at his word, and happily coughed up hefty fees for his endorsements.

Things started to go sideways when the bubble popped, and the SEC’s interest in ICOs—and the people who promoted them—intensified.

The SEC has been going after “celebrities” who have promoted ICOs—which the SEC views as securities—without disclosing payments in each and every advertisement. In November, 2018, Floyd Mayweather and DJ Khaled paid almost $700,000 in fines for advertising the Centra ICO on social media, setting a precedent. While the SEC has issued one no-action letter for an ICO which meets certain guidelines, the majority of ICOs don’t appear to fit the criteria for exemption.

The SEC made its position clear back in November 2017. In a public statement, chairman Jay Clayton said, “Any such activity that involves an offering of securities must be accompanied by the important disclosures, processes and other investor protections that our securities laws require.”

So it was unsurprising that, in June, 2018, McAfee tweeted he was no longer promoting ICOs “due to SEC threats.”

Yet, according to documents obtained by Decrypt, since then he has made new promotional agreements with ICO projects and promoted them, without disclosing the payments. For example, Team McAfee signed an agreement with smart-energy company Simmitri in August, 2018, according to a contract provided to Decrypt. The company agreed to make promotional tweets, such as this one, from McAfee’s official Twitter account in exchange for 70 million SIM tokens ($140,000).

And in December, 2018, McAfee doubled down, tweeting he was “not worried about the SEC.”

“Come for me SEC,” he tweeted. “I will, in every media outlet in this country, rip you a new asshole worthy of parking a tractor trailer in.”

A few weeks later, he fled the U.S. on his yacht, for the Bahamas, where, presumably, he has been living ever since.

Taking one for the Team

Most of the projects that came to McAfee were ICOs looking to raise awareness, and of course, money.

And some were willing to part with up to 20 percent of the total supply of their coins, a sizeable amount usually reserved as founders rewards, or for exchange listing fees. In exchange, McAfee was to promote the projects, largely using his Twitter handle, and also on Russian television, according to the Cpollo contract obtained by Decrypt. Team McAfee also offered to help get the project listed on exchanges using a subset of the tokens.

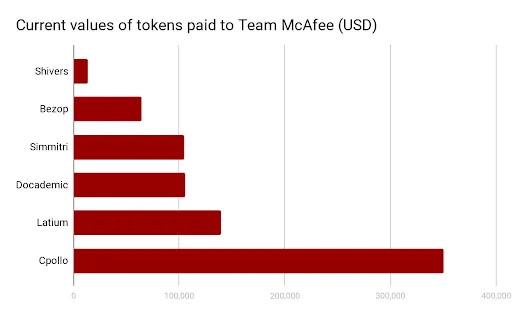

According to information obtained by Decrypt, Team McAfee received tokens worth $778,000 from a dozen or so of the ICOs, in fees, at today’s prices; those fees would have been worth $16.6 million at each coin’s all-time high.

It’s unknown whether, when or how much McAfee might have sold.

The following list showing the value of tokens that were paid to Team McAfee in exchange for promotion is by no means exhaustive, since McAfee has supported other projects beyond the seven listed below, and he may have received additional payments for some of the projects.

Despite the hefty fees, in several cases, sources say McAfee did little or no promotion. With scam prevention platform Cpollo, after tweeting a few times, he suddenly stopped without explanation. This led to several of the projects, including Simmitri and Cpollo, begging for their tokens back.

“The McAfee alliance has been almost nonexistent,” Cpollo lead project analyst Cody Madison said, in a public statement. “Their continued silence and inability to provide what was promised in the contract has forced us to end the partnership.”

Rewards platform Simmitri had a similar experience. McAfee tweeted just three times in support of the project, even though it had given him 70 million tokens, 20 percent of its total supply. In this case, however, the Simmitri team threatened legal action unless the coins were returned. Team McAfee subsequently returned 48 million tokens.

In other cases, even despite scant promotion, some projects were afraid to speak up. The very reason that they signed up with McAfee in the first place—his vast marketing influence—caused them to fear his Twitter-y retaliation, according to interviews.

I'll keep it as a reminder that no matter how old I get, I still get scammed by unscrupulous people with pie in the sky plans. They almost drove me to violence.

— John McAfee (@officialmcafee) March 20, 2019

“With a million followers on Twitter, one negative tweet from him would be enough to take down a whole project, especially those that are new and not well established yet,” said one partner, who asked to remain anonymous. “We would be equally worried if we got on his shit list. Because he was the biggest supporter of [our project], if he turns against us, he can cause serious harm.”

McAfee has also used this influence as a bargaining chip. According to New York Magazine, he promoted the privacy coin Verge in December, 2017, then threatened to crash its price unless its founders paid him $1.1 million worth of Ethereum.

It appears this hasn’t changed. In the case of Eristica, he was paid millions of tokens, started then stopped promoting the project before asking for a further $100,000 to advertise it, according to messages obtained by Decrypt. The team refused.

You know my methods, Watson

Jimmy Watson worked for McAfee for a year, starting in November 2017; he was named CEO in May, 2018, and last 7 months. He denied that he left the company due to “medical reasons”—as claimed by McAfee—but declined to publicly state the reason why.

McAfee claims that documents Decrypt was provided regarding the contracts are fake: “I have already sued Jimmy for $10,000,0000 in damages for his lies. Please GOD, republish his lies. Not only will that prove damages, it will allow me to add you as defendant. If you want to republish this as a threat to you (the point you are trying to make) please do so.”

McAfee added that from April to mid December of 2018, Watson was running the show: “I had nothing to do with […] the operation of Team McAfee. Jimmy was CEO and I was running the McAfee Talent Team - our think tank. My entire staff can verify that. All contracts, etc. were done by Jimmy. That's why I fired him. When I finalky [sic] checked in and saw what he had done he was gone. Again -- 23 people can verify what I'm telling you.”

Watson told Decrypt, “Now he’s going to try to spin this and say the contracts were ridiculous, way overboard, I never signed this—well, yes he did. I would have never done anything contrary to what he said, I was scared of the man.”

Camelius “Blaze” Ubah, lead engineer at ecommerce network Bezop, defended McAfee and said that he did indeed deliver all that was promised. “John McAfee isn't the villain nor is he an angel...he is a soldier. He provided a platform using his Twitter [account] to bring as many projects to light which may not have stood a real chance in the highly competitive funding space.”

In addition to ICO-based crypto projects, McAfee works with crypto hardware wallet makers Bitfi. He kicked up a storm in August last year, claiming the Bitfi wallet was unhackable—despite previously saying nothing was unhackable—and offering a bounty to back it up. This was proven false by researchers but the bounty was never paid.

Eventually McAfee admitted the whole thing was a marketing stunt.

It turns out he had reason to make such a fuss: According to the Bitfi contract obtained by Decrypt, McAfee receives 12.5 percent of every Bitfi wallet sold, with an additional 5 percent if it was through his own marketing link. At a retail price of $120, that’s as much as $21 per wallet.

It appears McAfee is also a fan of making cash deals. When McAfee was at the Malta Blockchain Summit as a guest speaker in November, 2018, he allegedly sent an email to Watson, which the ex-CEO recently forwarded to Decrypt. According to the email, McAfee wrote: “So far I have got us $700,000 in cash from three deals. I am turning down coin offers because we need cash. I am also working on a Russian deal that will give us another $800,000 in cash. I think we will be in good shape as far as expenses are cincerned. [sic]”

McAfee denied this was true, telling Decrypt, “As to Jimmy's email claim: you damn well better get an experts ooinion in [sic] the validity of that fake.”

Action, which is a rewards platform, also entered into an agreement with McAfee, but never sent over the money because the deal fell flat. CEO Nick Morley explained that it may have been a good thing. “We signed the agreement, then everything went to hell within about a month of that,” he said, adding, “It was disappointing in some respects but on the same token, McAfee is a bit controversial at times and maybe it was a blessing in disguise.”

In January, McAfee got on his yacht and sailed away, claiming the Internal Revenue Service was investigating him due to his refusal to pay taxes for the last eight years. No charges have been filed. He is currently docked in the Bahamas, where he is running his campaign to be the President of the United States, and frequently tweeting.