One of the Securities and Exchange Commission (SEC)’s most publicly pro-crypto members spoke on Monday about whether her agency is finally ready to approve a spot Bitcoin ETF in the United States.

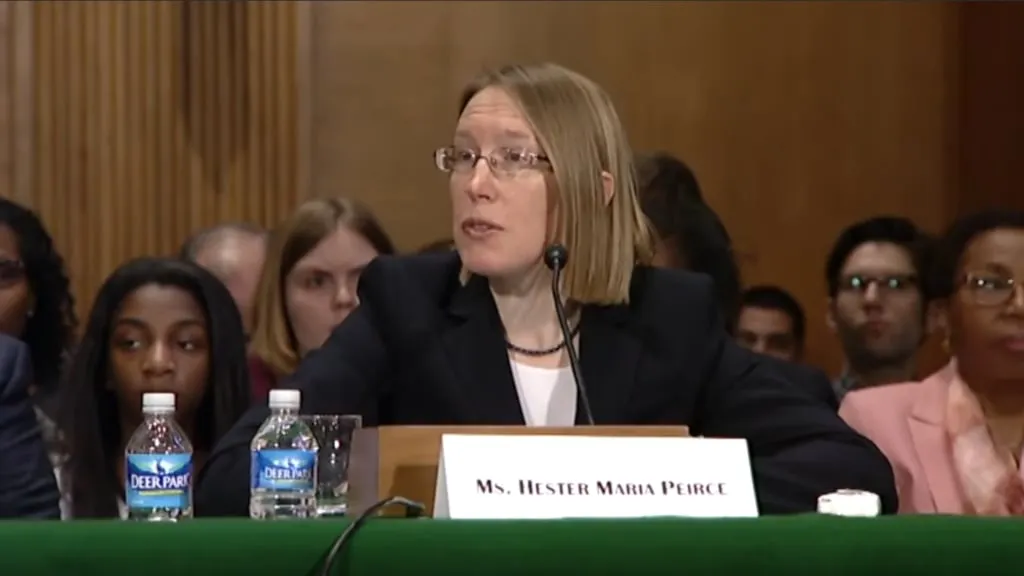

While not offering specifics about her agency’s game plan, Hester Peirce—fondly known as “Crypto Mom” throughout the industry—said the regulator’s court loss to Grayscale is “obviously an important factor.”

“I've been thinking we should approve one for the last five years,” Peirce told CNBC’s Squawk Box on Monday. “The logic for why we haven’t has always mystified me.”

"Will the SEC approve a #Bitcoin ETF?" @andrewrsorkin asks @SECGov Commissioner @HesterPeirce: pic.twitter.com/ps11zgoeLk

— Squawk Box (@SquawkCNBC) October 23, 2023

Grayscale, the owner of the world’s largest Bitcoin fund, sued the SEC in June 2022 for unfairly rejecting its application to convert its Grayscale Bitcoin Trust (GBTC) into a spot ETF, given that the agency had already approved similar futures Bitcoin ETFs for trading.

The court of appeals sided unanimously with Grayscle in August, agreeing that the SEC’s treatment of the firm was “arbitrary and capricious.” After 45 days, the SEC remained silent as it ultimately ran out of time to appeal the case.

The following week, the agency also abandoned its court fight with Ripple, dropping prior charges against the firm alleging debatable securities law violations.

“Generally, the agency has not been very good when it comes to anything related to Bitcoin or other crypto assets,” said Peirce. “Every day I wake up and hope that they’ll take a more productive approach - that hasn’t happened yet.”

Other fund managers applying for a spot ETF including Mike Novogratz and Cathie Wood have attested to a “change in behavior” from the SEC since its court loss, engaging in constructive private conversations on how each applicant can meet the agency’s standards to trade on public markets.

Major members of the ETF race including Fidelity and BlackRock revised their applications this month to address such concerns with more risk disclosures. Formerly a Bitcoin skeptic, BlackRock CEO Larry Fink has now repeatedly attested to investors’ strong demand for Bitcoin.

“I hear a lot of interest from investors in these kinds of products as well,” Peirce added.

Edited by Stacy Elliott.