In brief

- Non-fungible tokens (NFTs) are cryptographically unique tokens that are linked to digital (and sometimes physical) content, providing proof of ownership.

- They have many use cases, including artwork, digital collectibles, music, and items in video games.

Cryptocurrencies, utility tokens, security tokens, privacy tokens… digital assets and their classifications are multiplying and evolving right alongside cryptographic and blockchain technology.

Non-fungible tokens (NFTs) are one of the fastest-growing sectors in the crypto industry. In this guide, we explore what they are, how they work, and how they're being used.

What are non-fungible tokens?

Non-fungible tokens are digital assets that contain identifying information recorded in smart contracts.

It’s this information that makes each NFT unique, and as such, they cannot be directly replaced by another token. They cannot be swapped like for like, as no two NFTs are alike. Banknotes, in contrast, can be simply exchanged one for another; if they hold the same value, there is no difference to the holder between, say, one dollar bill and another.

Bitcoin is a fungible token. You can send someone one Bitcoin and they can send one back, and you still have one Bitcoin. (Of course, the value of Bitcoin might change during the time of exchange.) You can also send or receive smaller amounts of one Bitcoin, measured in satoshis (think of satoshis as cents of a Bitcoin), since fungible tokens are divisible.

Typically, non-fungible tokens are not divisible, in the same way that you cannot send someone part of a concert ticket; part of a concert ticket wouldn’t be worth anything on its own and would not be redeemable. However, in recent months some investors have experimented with the concept of fractionalized NFTs, though they remain a legal grey area and could be seen as securities.

CryptoKitties collectibles were some of the first non-fungible tokens. Each blockchain-based digital kitten is unique; if you send someone a CryptoKitty and receive a CryptoKitty from someone else, the one you receive will be a completely different CryptoKitty from the one you sent. Collecting different digital kittens is the point of the game.

Just now announced in the Telegram group. The very first fancy cat that is extremely rare in the Cativerse, check it: https://t.co/wO2UI87Xgm pic.twitter.com/bYp65BYA3u

— CryptoKitties (@CryptoKitties) November 14, 2017

The unique information of a non-fungible token, like a CryptoKitty, is stored in its smart contract and immutably recorded on that token’s blockchain. CryptoKitties were originally launched as ERC-721 tokens on the Ethereum blockchain, but have since migrated to their own blockchain, Flow, to be easier for crypto newcomers to access.

Did you know?

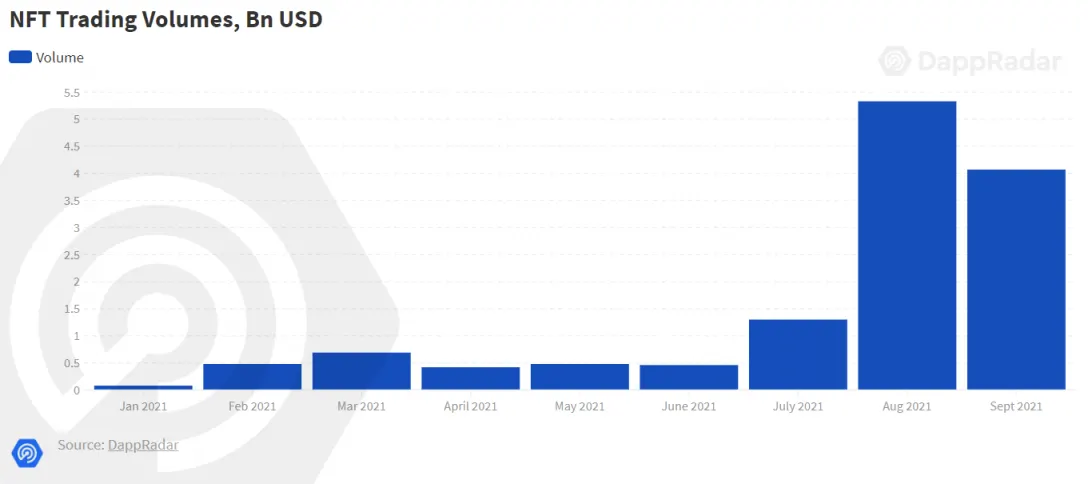

The trading volume for non-fungible tokens hit $10.67 billion in Q3 2021, an increase of 700% from the previous quarter.

What makes NFTs so special?

Non-fungible tokens have unique attributes; they are usually linked to a specific asset. They can be used to prove the ownership of digital items like game skins right through to the ownership of physical assets.

Other tokens are fungible, in the same way as coins or banknotes. Fungible tokens are identical, they have the same attributes and value when exchanged.

Did you know?

In March 2021, digital artist Beeple sold an NFT collage of his work for $69 million, making him the third most expensive living artist at auction, after David Hockney and Jeff Koons.

How are non-fungible tokens used?

As well as representing digital collectibles like CryptoKitties, NBA Top Shot and Sorare, non-fungible tokens can be used for digital assets that need to be differentiated from each other in order to prove their value, or scarcity. They can represent everything from virtual land parcels to artworks, to ownership licenses.

They're bought and sold on NFT marketplaces. While dedicated marketplaces such as OpenSea and Rarible have hitherto dominated the field, recently some of the leading cryptocurrency exchanges have begun to muscle in on the space. In June 2021, crypto exchange Binance launched its own NFT marketplace, while rival Coinbase announced its own plans for a NFT marketplace in October 2021, with over 1.4 million users signing up for the waitlist in the first 48 hours.

How do NFTs work?

Tokens like Bitcoin and Ethereum-based ERC-20 tokens are fungible. Ethereum’s non-fungible token standard, as used by platforms such as CryptoKitties and Decentraland, is ERC-721.

Non-fungible tokens can also be created on other smart-contract-enabled blockchains with non-fungible token tools and support. Though Ethereum was the first to be widely used, the ecosystem is expanding, with blockchains including Solana, NEO, Tezos, EOS, Flow, Secret Network, and TRON supporting NFTs.

Non-fungible tokens and their smart contracts allow for detailed attributes to be added, like the identity of the owner, rich metadata, or secure file links. The potent of non-fungible tokens to immutably prove digital ownership is an important progression for an increasingly digital world. They could see blockchain’s promise of trustless security applied to the ownership or exchange of almost any asset.

As is the challenge of blockchain to date, non-fungible tokens, their protocols and smart contract technology is still being developed. Creating decentralized applications and platforms for the management and creation of non-fungible tokens is still relatively complicated. There is also the challenge of creating a standard. Blockchain development is fragmented, many developers are working on their own projects. To be successful there may need to be unified protocols and interoperability.

How to buy NFT tokens

Non-fungible tokens can be purchased on a huge number of NFT marketplaces, including OpenSea, Rarible, and SuperRare.

Here's how to get your digital hands on some using Rarible:

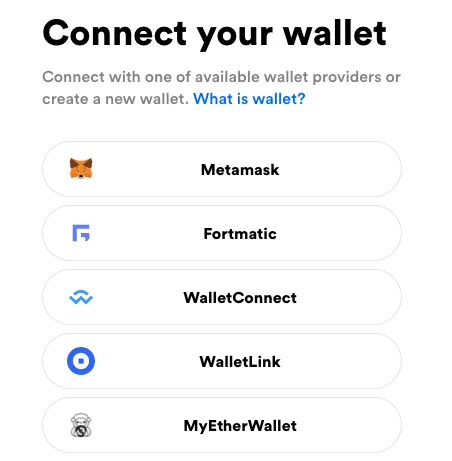

Step 1: Head over to the Rarible website and click the 'Connect' button on the top right. From here, select the wallet you want to connect to the platform and log in.

You'll need to accept the terms of service before you can log in.

In our example, we'll connect using Metamask, a popular web and mobile wallet.

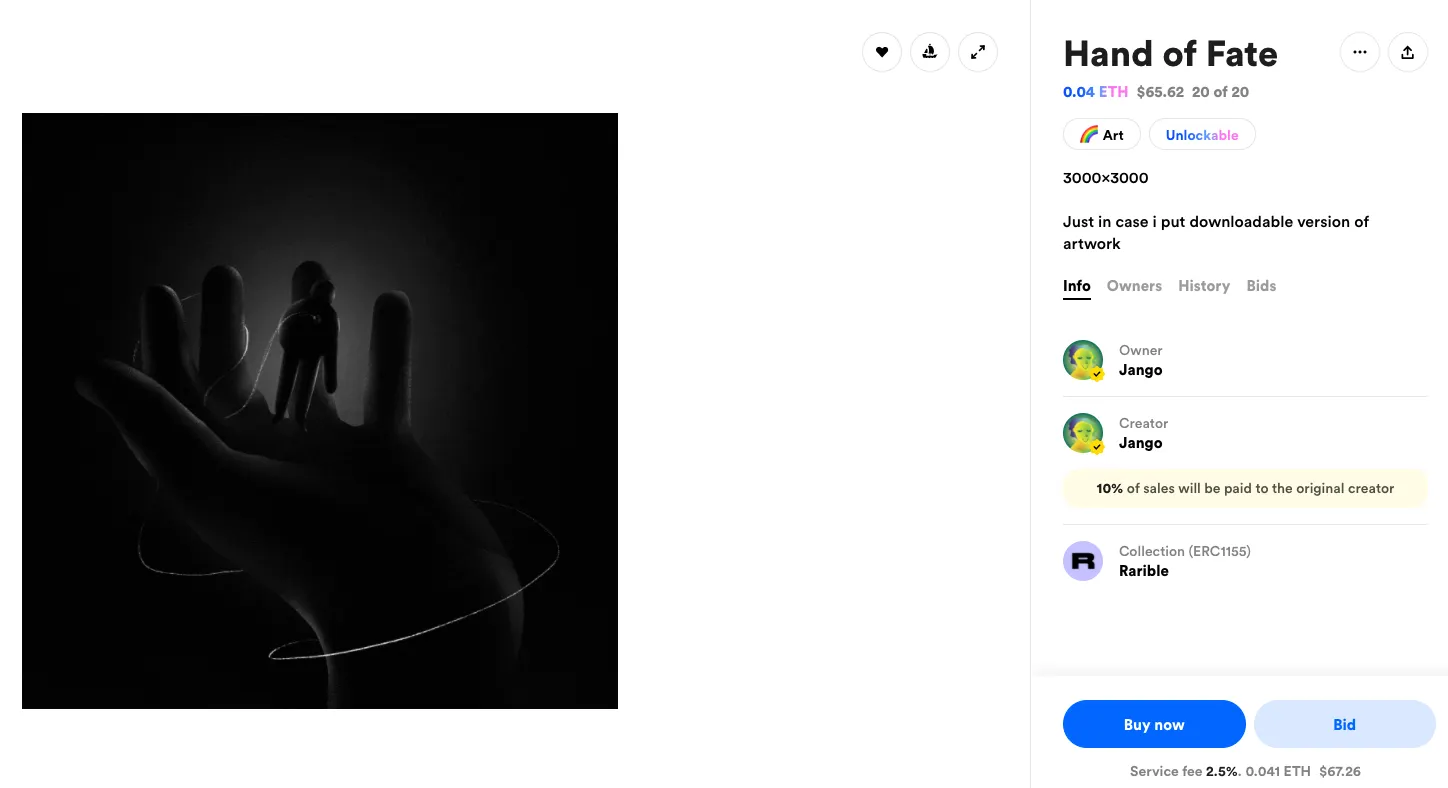

Step 2: Once logged in, search the platform for the NFT you're looking to purchase.

In our example, we'll show how you might purchase 'Hand of Fate' by Jango. The process will be similar regardless of which NFT you wish to purchase (assuming it is available to purchase outright).

Once you've selected the NFT you wish to purchase, click the 'Buy now' button.

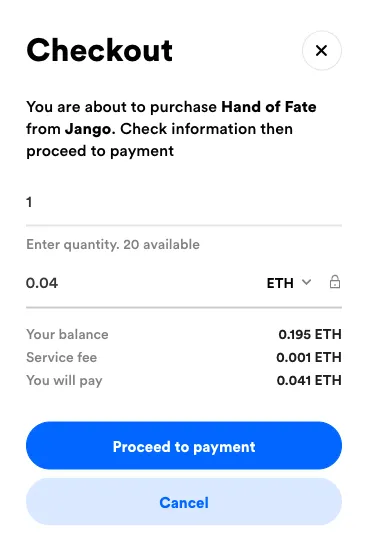

Step 3: A confirmation window will pop up, asking you to double-check the details of the order.

If you're happy to continue, click the 'Proceed to payment' button to move ahead to the final step.

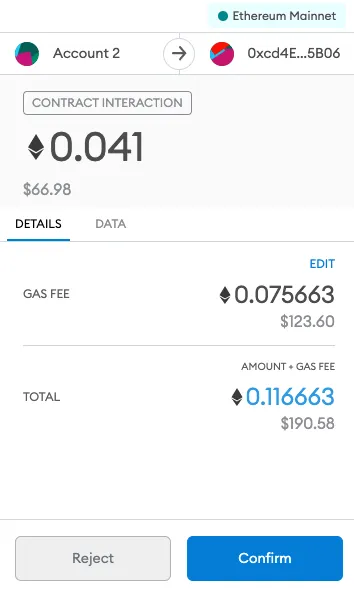

Step 4: Your wallet click will then pop up asking you to confirm the transaction. Again, if you're happy to continue, simply confirm the transaction and it will be processed.

Once it has confirmed, your NFT will be deposited directly to your Ethereum address and will be yours to keep.

Note: you may want to avoid buying your NFTs during peak times—otherwise you may end up with an inordinately high gas fee (as per our example below).

Who's making waves in the NFT space?

CryptoPunks

Dating back to 2017, profile picture (PFP) series CryptoPunks is one of the earliest NFT projects in existence. Created by development studio Larva Labs, CryptoPunks are a series of 10,000 24x24 pixel art images depicting "punks" with randomized attributes, including gender, headgear and eyewear.

Originally released for free, CryptoPunks now command huge sums; at time of writing, the cheapest punks are on offer for six-figure sums, while the rarest punks, including aliens, apes and zombies, sell for millions of dollars. Even payments giant Visa has got in on the action, snapping up CryptoPunk #7610 as part of its collection of "historic commerce artefacts".

Over the last 60 years, Visa has built a collection of historic commerce artifacts - from early paper credit cards to the zip-zap machine. Today, as we enter a new era of NFT-commerce, Visa welcomes CryptoPunk #7610 to our collection. https://t.co/XoPFfwxUiu

— VisaNews (@VisaNews) August 23, 2021

But what can you do with CryptoPunks? They're chiefly used for "flexing"—demonstrating membership of an exclusive fraternity, with owners using them as avatars on social media sites. Indeed, the craze has prompted Twitter to roll out plans for verification of NFT avatars, to prevent people from passing off saved CryptoPunk images as the real deal. And we could be seeing them on the silver screen soon; Larva Labs has signed with United Talent Agency to explore bringing its properties to film, television, video games, and more.

Bored Ape Yacht Club

Like CryptoPunks, Bored Ape Yacht Club is a series of NFT avatars—in this case, taking the form of disinterested-looking apes. And, also like CryptoPunks, there are 10,000 of them, each one has a randomly generated set of attributes, and a thriving community has sprung up around them.

Perhaps most importantly, owning a Bored Ape NFT makes you eligible for drops of additional NFTs, such as Bored Ape Kennel Club (a series of dog NFTs), and Mutant Ape Yacht Club (a series of, er, mutant apes). Think of it as a ticket to an exclusive club that offers perks for members.

That exclusive club has become increasingly exclusive in the past year, with a growing number of celebrities scooping up Bored Apes—including Eminem, Snoop Dogg and Stephen Curry. Like CryptoPunks' Larva Labs, Bored Ape Yacht Club creator Yuga Labs has secured Hollywood representation, with an eye on extending the brand into film, TV and other entertainment formats.

Did you know?

In December 2021, the floor price of Bored Ape NFTs overtook that of CryptoPunks for the first time, a mark of the PFP collection's growing popularity.

Axie Infinity

NFT collectibles like CryptoPunks and Bored Apes are one thing, but non-fungible tokens have a wide variety of applications—one of which is to represent digital objects in video games. And the biggest NFT video game around right now is Axie Infinity, which became the most traded NFT collection ever in Q3 2021, with trading volumes over $2.5 billion.

The game itself is a Pokémon-style affair that sees you collecting cute monsters called Axies, pitting them against each other in battles, and breeding them to create new Axies. The game's "play to earn" mechanic has seen players in countries like the Philippines making a living from breeding and trading Axies. However, the game itself has a steep learning curve, and with individual Axies trading for hundreds of dollars, assembling a team to get started isn't cheap.

NFTs and DeFi

Non-fungible tokens are also making waves in one of cryptocurrency’s most intriguing and innovative spaces, the decentralized finance (DeFi) space.

One example of how NFTs are being used in DeFi is Aavegotchi, an experimental startup funded by DeFi money market Aave. Aavegotchis are NFT crypto-collectibles used in a game universe; every Aavegotchi also has Aave's aTokens staked inside them as collateral, meaning that each one generates yield on Aave. If the owner liquidates their stake, the Aavegotchi disappears.

1/ Play to Earn 🎮💰

The Aavegotchi universe is closed loop, designed to reward active participants.

Buy $GHST to start, then earn it by playing games, voting, and engaging in rarity farming - a novel variant of liquidity mining that rewards the rarest Aavegotchis with $GHST. pic.twitter.com/X5mYRZGqev

— Aavegotchi 👻 💜 (@aavegotchi) September 10, 2020

Another service that's aiming to bridge the DeFi and NFT communites is Rarible, a decentralized app (or dapp) that enables users to sell digital artwork in the Rarible market.

In July 2020, Rarible launched RARI, a governance token that's used to reward creators and collectors; it can only be earned through active participation on the platform, a process Rarible terms "marketplace liquidity mining."

Welcome $RARI: the first governance token in the NFT space, designed to reward active creators and collectors with a voice in Rarible's future. Make proposals, vote, curate, moderate –– the power is in your hands now.

Learn more: https://t.co/LeQUmMvBEn pic.twitter.com/iVxA8aMiVO

— Rarible (@rarible) July 15, 2020

Recent developments

The NFT space grew explosively in 2021, with trading volumes in Q3 hitting $10.67 billion, according to DappRadar—a year-over-year increase of over 38,000%. In August, top NFT marketplace OpenSea recorded trading volume of over $75 million in a single day—more than its entire trading volume in 2020.

Meanwhile, NFTs began to trade hands for eye-watering sums. In March 2021, digital artist Beeple sold a single NFT artwork for $69.3 million at auction, propelling him into the ranks of the top-selling living artists overnight. CryptoPunks, Bored Apes and Art Blocks traded hands for millions of dollars. Scenting a new market, venerable institutions such as auction houses Christie's and Sotheby's have embraced NFTs, hosting sales and (in the latter's case) launching its own NFT platform. Art galleries wrestled with the thorny question of how to display digital artwork.

Big money was accompanied by ever-bigger names, as artists and celebrities rode the wave of enthusiasm for NFTs. Rapper Snoop Dogg outed himself as an NFT collector and released NFT tickets for a party in crypto game The Sandbox; Ashton Kutcher and Mila Kunis launched their Stoner Cats cartoon as an NFT; and NFL star Tom Brady launched his own NFT platform, Autograph.

The future of NFTs

For the time being, much of the attention around non-fungible tokens is focused on artwork, gaming and crypto collectibles. Increasingly, recognizable brands are licensing their content for NFTs; fantasy soccer game Sorare has signed up over 100 football clubs to its platform, while the likes of the Smurfs, Minecraft, and the BBC's Doctor Who have all been rendered as NFTs. Twitter launched its own collection of NFTs in June 2021; months later, it announced plans to verify users' NFT avatars.

For gaming, non-fungible tokens could be used to represent in-game items like skins, potentially allowing them to be ported to new games or traded with other players.

Their potential, however, is much wider; possible applications include copyright and intellectual property rights, ticketing, and the sale and trading of video games, music and movies. In September 2021, thriller film Zero Contact became the first feature-length movie to be released as an NFT; weeks later, pandemic-themed thriller Lockdown followed suit. In October, Tom Brady's NFT platform Autograph launched a music vertical, with The Weeknd as its first signing.

Video game companies have seized on the possibilities of NFTs, with Assassin's Creed publisher Ubisoft becoming the first major gaming company to launch in-game NFTs in late 2021. Other game companies including Konami have experimented with NFTs, but many gamers remain skeptical of the technology; in December 2021, developer GSC Game World abandoned plans to include in-game NFTs in its game S.T.A.L.K.E.R. 2: Heart of Chernobyl, following a widespread backlash among fans.

NFTs are also expected to become a key component of the metaverse, a persistent, shared virtual world where users can interact as 3D avatars. Companies such as Meta (formerly Facebook), Adidas, Nike and Samsung have all ventured into the metaverse, and more brands are expected to follow suit.

Metaverse platforms such as Decentraland and The Sandbox already make use of NFTs to represent plots of virtual land and in-game items such as clothing for avatars. The next step towards a single, persistent metaverse will likely make use of NFTs' interoperability, enabling users to move virtual items between different metaverse platforms.

Non-fungible tokens add potential to the creation of security tokens and the tokenization of both digital and real-world assets. Physical assets like property could be tokenized for fractional, or shared, ownership. If these security tokens are non-fungible, ownership over the asset is completely traceable and clear, even if only tokens representing part ownership are sold.

Further application of non-fungible tokens could include certification for qualifications, software licensing, warranties, and even birth and death certificates. The smart contract of a non-fungible token immutably proves the identity of the recipient or owner and could be stored in a digital wallet for ease of access and representation. One day, our digital wallets could contain proof of every certificate, license, and asset, we own.