In brief

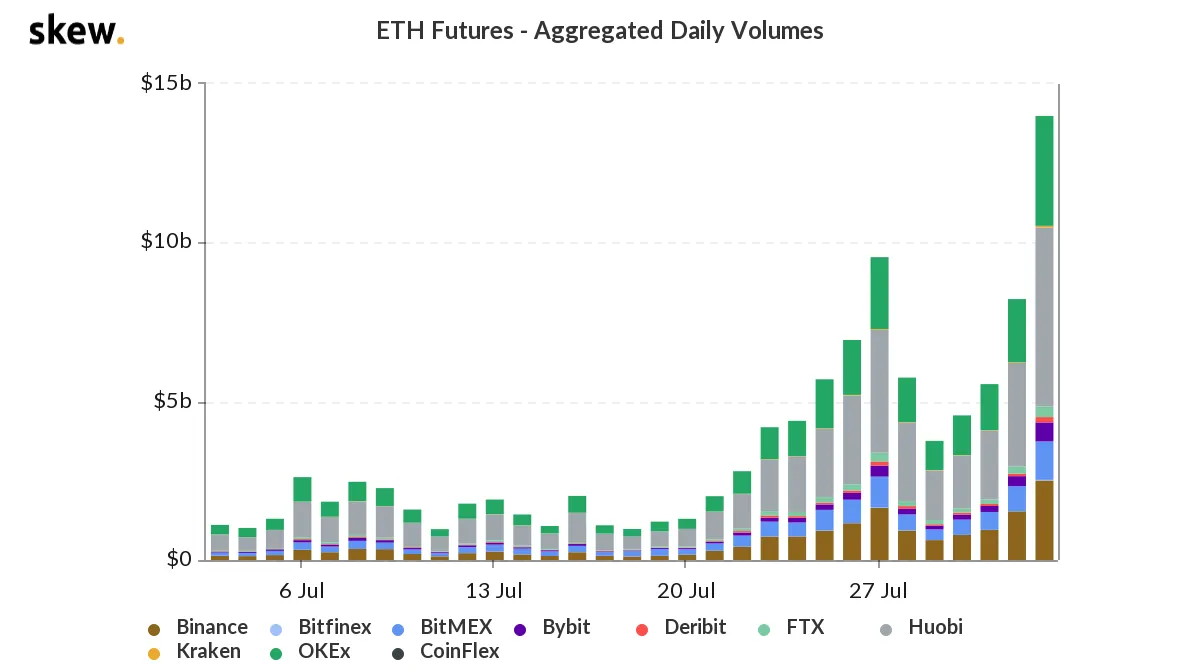

- ETH futures daily volume hit a new all-time high on Sunday of nearly $14 billion.

- Binance, Huobi, and OKEx saw the greatest futures volume.

- Futures contracts give a hint about how traders are thinking about asset prices in the future. And the outlook for Ethereum is bullish.

Ethereum futures are more popular than ever as volume spikes alongside the increasing price of ETH.

Trading volume for Ethereum futures, a type of derivative product that allows traders to bet on the future price of ETH, reached a new all-time high of just under $14 billion yesterday, according to data from Skew Analytics. That’s an increase of more than 45% compared to the previous high of $9.6 billion set July 27.

The surge comes as ETH prices flirt with $400, a milestone that would represent a gain of more than 160% since the beginning of 2020. As DeFi metrics continue to grow, it’s becoming more difficult every day to deny Ethereum is in the midst of a new bull run.

Futures contracts are an agreement between two parties to buy or sell a given asset at a predetermined point in the future. Contract buyers expect the future market price to be greater than the contract price, allowing them to immediately sell the asset at the higher market price. Contract issuers profit by charging a fee when selling the contract, hoping the fee is greater than the gain from selling at the future market price.

Futures contracts, like options contracts, can be traded like other financial assets. Growing futures volume indicates more traders want to make bets about what will happen to an asset’s price in the future, in this case ETH. Panama-based exchange Deribit provides the longest futures contract period, with execution set for March 25, 2021, and a price of $413 at time of writing. BitMEX provides the shortest duration with an expiration set from September 24 and a price of $403.

Futures trading volumes were greatest on the Binance, Huobi, and OKEx exchanges, making up close to 80% of total volume. Of that group, OKEx saw the greatest increase in volume compared to previous all-time highs, rising more than 50% since July 27.

While trading volume is way up, futures open interest—the actual value of all futures contracts in circulation—that recently passed the $1 billion mark are down slightly from an August 1 high of nearly $1.4 billion to about $1.2 billion on Sunday.

In equity markets, futures are often used to get a rough idea of which direction the price of an asset or commodity is headed. If crypto follows a similar pattern, ETH above $400 seems like a distinct possibility.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.