In brief

- Ethereum futures interest has passed $1 billion as professional traders pile in.

- Futures interest fell below $400 million following the March crypto crash.

- Ethereum futures interest has a long way to go before challenging Bitcoin.

Open bets on the future price of Ethereum have reached a new all-time high.

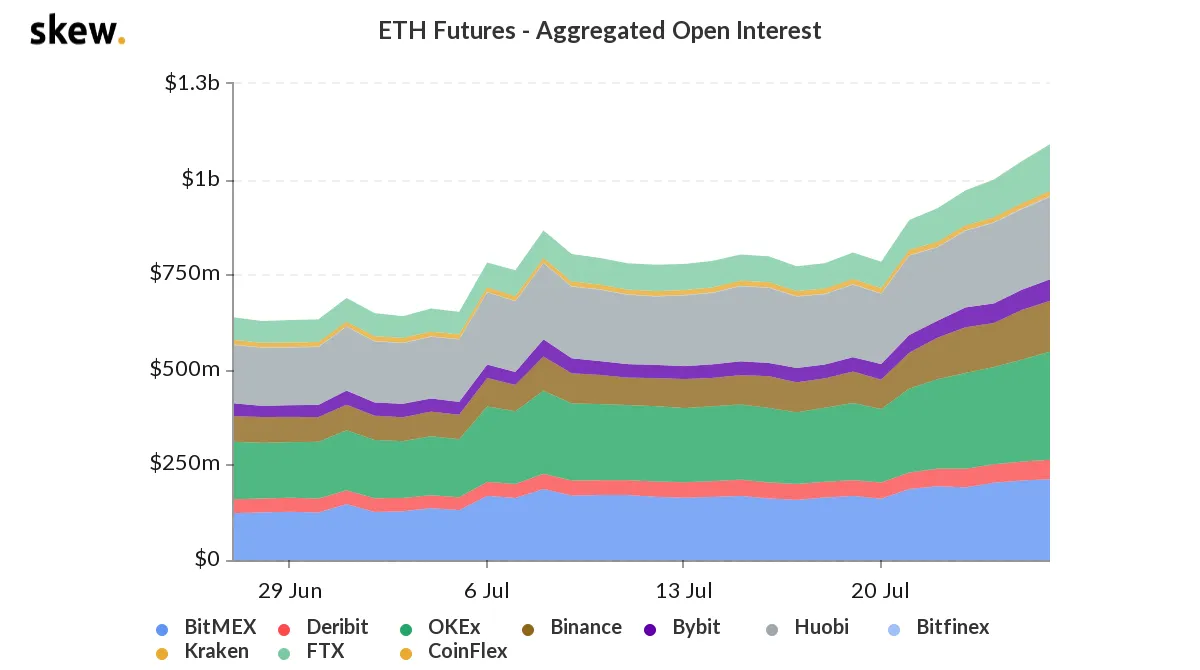

The open interest, or total value of contracts that have not yet been settled, on Ethereum futures has passed the $1 billion mark, according to market analytics firm Skew.

The milestone comes as the price of ETH increases and Ethereum 2.0 progress give investors confidence about the long-term potential of the decentralized protocol. Futures contracts are the domain of more sophisticated traders, indicating that the smart money is feeling good about where Ethereum may be headed next.

Futures contracts are an agreement between two parties to buy or sell a given asset at a set price at a predefined point in the future. Contract buyers expect prices for the asset (in this case ETH) to be different from the contract price at the time of execution, allowing instant profit when filling their obligation. Contract issuers earn a fee, called a premium, on contracts they sell, with the expectation that the fee will be greater than the loss of buying or selling the asset to fulfill their obligation.

Open interest on Ethereum futures has increased almost 30% since June 20, from under $800 million to nearly $1.1 billion at time of writing. Open interest is an important metric because it measures the raw amounts issuers and buyers have at stake in futures contracts with expiration dates still in the future. Futures volume, by contrast, measures the value of existing futures contracts (which can be swapped like any other derivative) being traded in a given period.

Crypto exchange OKEx currently maintains the largest open interest at more than $290 million, with Huobi and BitMEX both also adding more than $200 million to the aggregate total. Huobi recently announced they plan to launch ETH options trading sometime in the third quarter.

ETH futures were on the rise early on in 2020, totaling close to $900 million before coronavirus fears and the subsequent US stock market crash pulled the crypto world down with it. By mid-March, ETH futures open interest had fallen to less than $400 million. Since then, ETH futures open interest has been on an unrelenting march upward, spurred on by the recent price increases.

While ETH futures are on their way up, they have a long way to go before taking on the current crypto financial contracts king, Bitcoin. BTC futures open interest passed the $4 billion mark on July 21, but have increased at just half the rate of Ethereum futures interest since recent price jumps began.

As Ethereum leads the new market cycle, it may not be long before ETH futures interest overtakes BTC as the asset to watch.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.