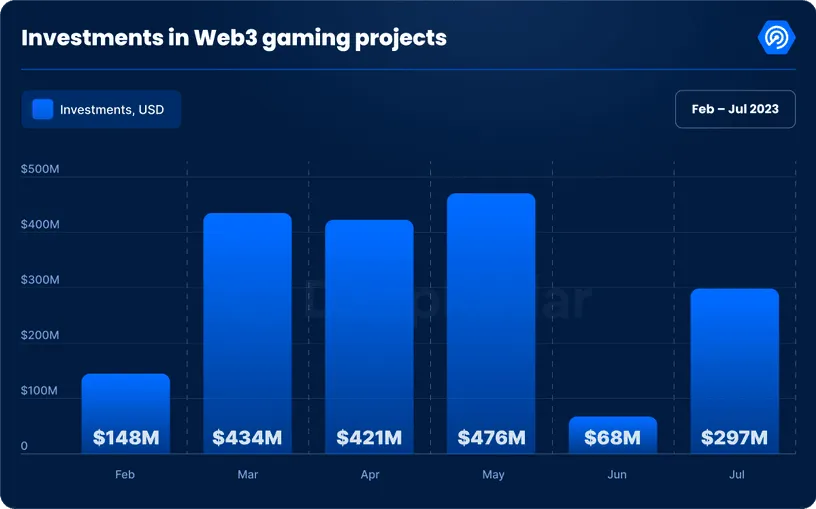

The crypto gaming industry, which spans video games that use blockchain-based tokens or NFTs, collectively received a substantial $297 million in investment funding last month, according to a joint report from DappRadar and the Blockchain Game Alliance.

Some 63% of that July funding was committed to infrastructure development—a detail that suggests the industry is still in its earliest stages. Investors are betting on tools and platforms that will facilitate future crypto and NFT-driven games.

Compared to June, which saw a comparatively meager $68 million in crypto gaming investments, July was an explosive month for the industry.

The report speculated that the low numbers in June could have been partly due to the broader crypto industry reeling from the U.S. Securities and Exchange Commission (SEC) targeting both Binance and Coinbase in June, sowing industry uncertainty.

However, Bitkraft Ventures Partner Carlos Pereira doesn’t believe that much can be deduced from June’s perceived stall and July’s spike.

“I don't think there's any particular reason why one month looked so different than the other,” Pereira told Decrypt in a message.

“It's a concentrated dataset that behaves with higher variance, given sample size. Think that any of those deals that merited $30M+ checks took several weeks to get done, and could have just as easily happened in one month or the other,” Pereira added. “From our side, it certainly didn't feel like anything was different.”

Further fueling the sense that June's investment dip may have been an anomaly is the fact that the sector saw more than $400 million in investment in each of the three previous months, from March through May 2023.

“It can be very hard to glean insights from a month-to-month analysis, especially as many financings don’t get announced, or may see a delay in announcement," Alok Vasudev, co-founder of VC firm Standard Crypto, told Decrypt via email.

"Gaming is especially tricky as games take so long to develop—anything coming to market was probably financed a while ago," Vasudev continued. "But to our way of thinking, we believe that gaming is simply a great use of crypto, and we’d expect to continue to see an upswing of investments in the space in the future."

July saw a number of notable investments, from game publishers Animoca Brands investing $30 million into crypto “super app” Hi to artificial intelligence startup Inworld AI raising over $50 million to power smarter, more dynamic in-game characters.

Valhalla Ventures also established a $66 million venture capital fund for gaming and technology, while Futureverse raised $54 million for its crypto metaverse plans.

While some metaverse-centric firms may still be raising funds, current NFT prices and overall trading volume for existing metaverse games continued to plummet last month.

In July, virtual world games saw a year-low of just $5.6 million in monthly traded volume across 10,796 sales, according to the DappRadar report, with an average sale price of $523 per NFT. That’s a far cry from the heyday of 2021’s metaverse hype, when a plot of virtual land next to Snoop Dogg in The Sandbox once sold for $450,000.

Yuga Labs dominated the metaverse NFT economy again in July, with Otherdeed and Otherdeed Expanded NFT sales making up 72.5% of the volume traded in the virtual world category. The Bored Ape Yacht Club creator’s Otherside metaverse game, which will put those NFT land plots to use, remains in development.