In 2021, Bitcoin more than doubled its previous all-time high price, the Ethereum ecosystem surged, institutional investors jumped into crypto, and Dogecoin somehow became a mainstream buzzword.

But the one thing everyone couldn’t stop talking about, amazingly, was JPEGs.

This time last year, NFTs were niche. Now they’re a mainstream phenomenon. Over the span of 12 months, not only has the term permeated the broader culture and made digital asset ownership a more widely-known concept, but the industry has also surged to billions of dollars in monthly trades.

Many people feel very strongly about NFTs, and it goes both ways. Whether it’s delight, disgust, or a bit of FOMO, NFTs are both intensely loved and loathed. Depending on whom you ask, they’re either the future of ownership or just one big cynical and environmentally disastrous scam.

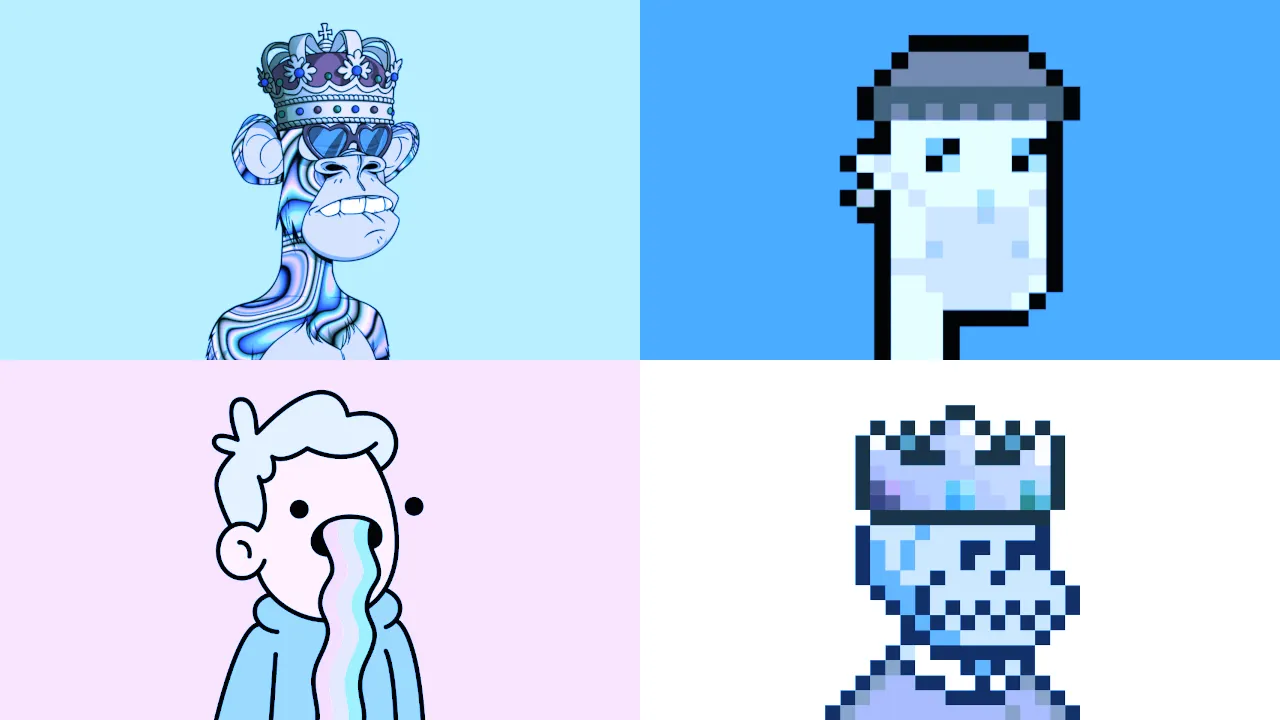

What ultimately is an NFT, or non-fungible token? Contrary to popular belief, an NFT isn’t a JPEG. It’s not a profile picture of a disinterested ape or a pixelated face, a sports highlight turned into a digital collectible, or a cartoonish monster that battles on your behalf in a video game. Those are all things that an NFT can represent.

The NFT, itself, is essentially a blockchain-based token that proves that you are the sole holder of that one-of-a-kind digital item—whatever it might be. Smart contracts, or the code that powers NFTs, make it possible to sell or transfer an NFT, set perpetual royalties for artists, use assets within games and metaverse worlds, and more.

Gradually, then suddenly

Early in 2021, it was sports and celebrities that helped push NFTs from a niche market into a true phenomenon. Dapper Labs’ NBA Top Shot alone put up more than $200 million per month in trading volume in both February and March—more than the entire NFT market produced over the course of 2020.

Celebrities and artists also made waves in the NFT space early this year, whether it was Grimes or Rob Gronkowski, or crypto-centric creators like Pak and 3LAU. But it was digital artist Beeple who put an exclamation mark on the early-year NFT boom with his $69.3 million sale of a single NFT at a Christie’s auction in early March—the third-largest single sale by any living artist.

In hindsight, that may have been the top for the initial NFT boom: a sign that the frenzy had surpassed the true appetite in the market. Top Shot sales began tapering off, and more and more prominent celebrity drops failed to generate significant returns. Many wondered whether the NFT boom had merely been a short-lived fad.

All told, the market generated $2.5 billion worth of trades in the first half of 2021, split almost evenly between quarters—but the Q1 buzz gave way to a muted late spring and early summer. The crypto market’s own freefall didn’t help. But as crypto prices perked up in July, the NFT market was doused with rocket fuel and blasted off to startling new heights in August.

OpenSea, now the leading NFT marketplace, jumped from $150 million worth of Ethereum trading volume in June to $329 million in July—and then $3.4 billion in August. And this time around, it was more original, fully crypto-native projects that drove the surge, showcasing the potential for creativity, community, and functional utility with digital assets.

The Bored Ape Yacht Club picked up the baton from the O.G. CryptoPunks, treating its NFT profile pictures as an all-access pass to an exclusive club packed with perks—and giving holders the right to commercialize the images. Art Blocks used Ethereum’s own blockchain to yield algorithmically generated artwork, much as EulerBeats did with music.

Axie Infinity, meanwhile, showed the enormous potential for NFTs in video games, quickly becoming the largest NFT project to date as millions of players bought and battled with cartoonish, Pokémon-like monsters. Some even made a living from it. Another project, Loot, began with NFT lists of fantasy items. Now the decentralized community that sprung up is collectively developing game experiences around the NFTs.

And as the metaverse takes shape, immersive worlds like The Sandbox and Decentraland represent the expanding digital frontier, offering ownership of virtual land that can be customized, shared, and even monetized. It’s an NFT world, and if ambitious metaverse plans from Facebook and others play out, we may all be living in it before too long.

Buzz and backlash

With $10.67 billion in Q3 trading volume and an estimated $22 billion now year-to-date, per data from DappRadar, the NFT market is thriving. It appears to be maturing, too, as additional use cases take hold amid a wider shift towards NFTs with utility. NFTs are considered an important building block for Web3—the keys to the metaverse, in other words.

All the while, NFTs have helped introduce people to cryptocurrency and blockchain technology. Many are colorful and alluring, and tie into the artwork and culture that people already love. Even if onboarding and usability are very much works in progress, NFTs have made crypto more approachable. As Nansen CEO Alex Svanevik told Decrypt in September, “DeFi has brought the capital into crypto, and NFTs are bringing the people into crypto.”

But NFTs have a perception problem. Sure, it’s perplexing to most of us to see anyone spend millions of dollars on a Twitter avatar. But that’s just the tip of the iceberg for obstacles that the market will gradually need to solve to overcome.

The environmental impact of Ethereum continues to dominate the narrative around NFTs, even for collectibles and assets mined on less-energy-intensive blockchain platforms (like Solana), plus scams and exploits continue to flourish across the crypto industry.

Vocal criticism of NFTs is prevalent on social media, and companies and projects that want to explore the space often face backlash. That largely hasn’t stopped major brands from dipping a toe, however, as recent drops from McDonald’s and Budweiser suggest. The Budverse is coming, marketers claim—but so is the Tinderverse, and White Castle’s Sliderverse.

Even the earliest, most bullish NFT advocates probably couldn’t have anticipated such an explosive year for tokenized digital collectibles. Will the frenzy last, however?

Some in the space believe that the bulk of NFTs won’t be able to sustain such value long-term. Even Gary Vaynerchuk, a noted NFT collector and creator, has warned of an “NFT winter” market pullback, telling Decrypt that he believes only select “blue chip” projects will thrive.

If NFTs really are the building blocks of the next-generation internet, then they may eventually become utterly mundane. Much to the chagrin of current skeptics, NFTs could be everywhere before long, representing ownership of every last thing in our digital lives.

We might not even call them NFTs in time. We might not even think about it. They won’t be special anymore. They’ll just be. After all, when’s the last time you referred to your digital music stash as your MP3 collection?

But in 2021, NFTs were wild, new, perplexing, and captivating. Going into 2022, we’re still in the thick of the craze.