Investment firm Digital Currency Group (DCG) plans to buy up to $250 million of shares in the Grayscale Bitcoin Trust (GBTC), according to a press release. The trust is run by digital asset manager Grayscale Investments, which is itself owned by DCG.

DCG will be using its own cash to purchase the shares, gaining indirect exposure to the price of Bitcoin. Each GBTC share corresponds to a small amount of Bitcoin, but the shares can trade above or below the value of the underlying asset.

DCG has a long track record of investing in companies across the cryptocurrency space, including Bitcoin firm Blockstream, blockchain analytics company Chainalysis and crypto exchange Coinbase. It has not previously announced any direct investments in cryptocurrencies or funds tracking crypto prices.

To a degree, DCG is jumping on a trend of companies investing their cash holdings into Bitcoin—although it's not holding Bitcoin directly. Cloud service provider MicroStrategy kicked off this trend last year and now owns 91,064 Bitcoin, worth $5 billion. Payments company Square and car maker Tesla have also followed suit, buying $120 million and $1.5 billion of Bitcoin respectively.

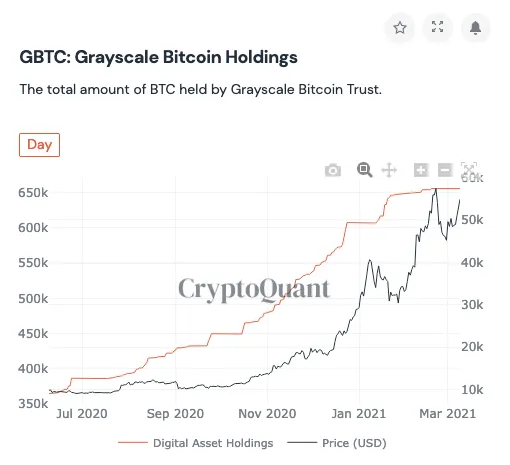

The boost to Grayscale's Bitcoin Trust comes at an opportune time. With the recent addition of alternative Bitcoin investment vehicles, new investment in GBTC has largely slowed to a halt since late January, according to crypto data provider CryptoQuant. At the same time, Grayscale's premium—the difference between the price of GBTC shares and the underlying Bitcoin value, known as the NAV—has turned negative. It's currently at -8%.

The negative premium may have an impact on the crypto investment market. The premium led to an arbitrage opportunity between the value of buying GBTC shares and selling them (six months later, after the lock-up period expires) at a premium.

This was commonly done by hedge funds, according to investor Raoul Pal, and Bitcoin lending firm BlockFi. The lack of arbitrage will see crypto investment firms looking for alternative ways to secure returns on their investments.