In brief

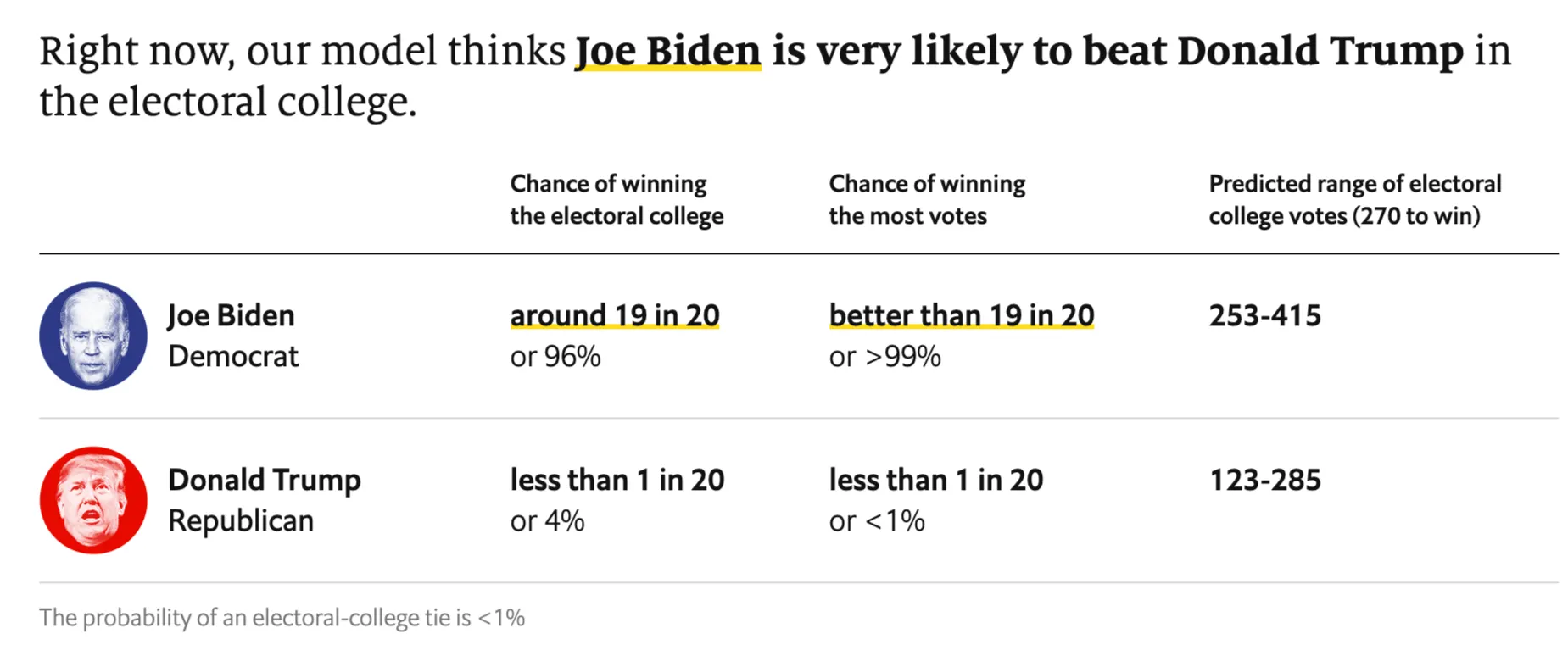

- Major poll-based forecasting models put Donald Trump's probability of reelection between 4% and 14%.

- Polymarket and FTX markets show a tighter race, putting Trump's chances at 38%.

- Scholars disagree about the merits of polls and prediction markets.

According to The Economist’s election forecasting model, President Trump has just a 4% chance of being re-elected. But on the Ethereum-based prediction platform Polymarket, it’ll cost you $0.38 to bet on him (equating to a 38% probability) versus $0.62 for Joe Biden.

What gives?

Betting markets—decentralized or otherwise—have consistently given Donald Trump better odds than polls, let alone forecasting models that also take into account the economic, historical, and demographic context of the 2020 election

Ohio State political science professor Thomas Wood, writing in the runup to the 2016 general election, argued that prediction markets rarely deliver. He pointed to the GOP primary that year, when bettors took a long time to cotton on to the fact that Trump could win—switching from Jeb Bush to Marco Rubio, even when Trump had long been ahead in polls.

Of course, the residue from that year’s general election polling seems to be what’s keeping Trump’s price (perhaps artificially) high. The standard refrain is: “Hillary Clinton was up in the polls, just like Joe Biden is, and look what happened.”

However, according to poll aggregator FiveThirtyEight, Clinton had about a 4% national lead come Election Day. Biden’s polling lead is currently 8.4%. Clinton’s lead was vulnerable to a normal margin of error and slimmer advantages in battleground states, which led to a popular vote victory and Electoral College defeat. Trump will have to overcome more to defeat Biden this go-round.

Not everyone agrees with Nate Silver’s methodology. In a 2018 Medium post that pulled from interviews with former FiveThirtyEight writer Mona Chalabi, Applied Mathematics Professor David Sumpter of Sweden’s University of Uppsala took aim at FiveThirtyEight, saying that its statistical model is intentionally colored by its (mostly white, Democrat, male) staff’s intuition: “It is difficult for a bunch of people who all have the same background to identify all of the complex factors involved in predicting the future. Prediction markets do enable people with different backgrounds to contribute to make better forecasts.”

Though good statistics are hard to come by, cryptocurrency-based betting markets—or betting markets period—are similarly dominated by a small subset of people. According to a Coin Dance estimate, just 14% of community engagement within Bitcoin comes from females. Similarly, online betting is dominated by males. That’s important to note when looking at demographic splits in presidential polling, where President Trump generally leads Joe Biden among white male voters.

Ethereum co-creator Vitalik Buterin, a proponent of quadratic voting, has been thinking about this conundrum as well. In a tweet thread featuring a cameo from investor Paul Graham, Buterin noted: "Bets on prediction markets correctly incorporate the possibility of heightened election meddling, voter suppression, etc affecting the outcome, but statistical models just assume the voting process is fair."

There's a big difference between statistical models and prediction markets this US election; and it's a puzzle why this is happening.

Some guesses:

— vitalik.eth (@VitalikButerin) November 3, 2020

On the other hand, he wrote, "Prediction markets are difficult to access for statistical/politics experts, they're too small for hedge funds to hire those experts, and the people (esp wealthy people) with the most access to PMs are more optimistic about Trump."

Still, given that money is on the line, it doesn’t quite make sense that The Economist (96% to 4% in favor of Biden), FiveThirtyEight (90%-10%), and DecisionDeskHQ (86%-14%) would all have the Democratic challenger way out in the lead, while bettors see it as a tighter race.

Ethereum-based Polymarket, which lets winners buy shares for between $0 and $1—with winning shares becoming worth $1 and losing shares become worthless—has seen over $3 million wagered on the campaign. The current price is $0.38 for Trump vs. $0.62 for Biden. The price is the same for crypto exchange FTX’s TRUMPWIN and TRUMPLOSE tokens. And Catnip Exchange, built atop Augur and Balancer, hit $1 million in daily transaction volume, with a YTRUMP token going for $0.41 compared to $0.60 for a NTRUMP token.

It's not necessarily an issue of relatively low liquidity, either. Some non-crypto political betting sites, such as PredictIt are even more bullish about Trump’s chances; though it favors Biden over Trump, the difference in share prices is $0.61 to $0.43. And betting firms have the same general tilt for their payouts—with converted probabilities roughly in the range of 35% to 45%.

While it’s possible that users of these prediction markets have sufficiently factored polls into their thinking, it’s equally possible some are betting with their heart (or fears) instead of with their head (or an algorithm).

But given the rise of decentralized finance and crypto arbitrage, it’s well-established that cryptocurrency users are always looking for an advantage. Now they’ve got 16 hours to craft a winning strategy before results start trickling in from the Eastern seaboard. And another four years of arguing about who got it most wrong.

[Editor's note: This article has been updated to include comments from Vitalik Buterin.]