HongKong, 中国, October 29th, 2024, Chainwire

In collaboration with Blocktempo, a leading Taiwan-based crypto media outlet, ChainCatcher has published the "2024 Asia-Pacific Crypto VC Research Report," offering key insights into the decision-making patterns and market sentiments of early-stage cryptocurrency investors across the Asia-Pacific region. The report, based on a comprehensive survey of over 1,000 investors, details how these investors navigate a rapidly evolving landscape while balancing innovation-driven opportunities with market risks.

Key Data Summary:

- Data Sources: RootData leads as the preferred data query and tracking platform, used by 85% of investors, followed by Cryptorank.io (43%) and Crunchbase (32%).

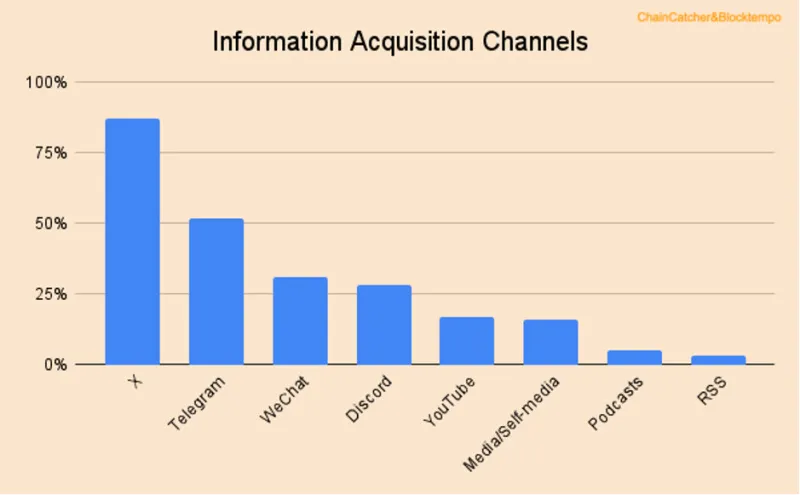

- Information Channels: 87% of investors rely on X (formerly Twitter) for industry information, with additional use of Telegram (52%), WeChat (31%), and Discord (28%).

- Investment Focus: Team background and experience are top priorities for 75% of investors when evaluating projects.

- Perceived Valuations: DeFi is considered the most undervalued category by 41% of respondents, while Layer1/Layer2 is seen as overvalued by 48%.

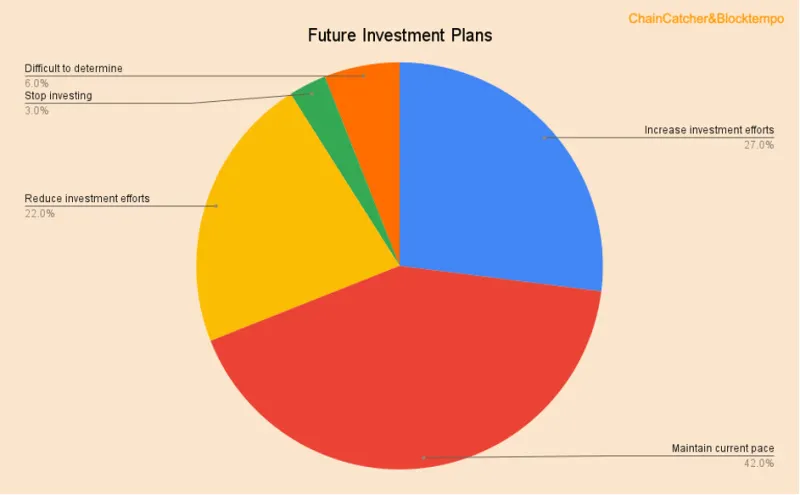

- Investment Pace: 42% of investors plan to maintain their current investment pace over the next four months, with 27% expecting to increase their activity.

Current State of Crypto VCs - Asia-Pacific Edition

As the Crypto industry enters a new development cycle, the Asia-Pacific market is rapidly becoming an important component of the global Crypto ecosystem, leveraging its rich resources of developers and investors. To gain a deeper understanding of the dynamics in this key market, ChainCatcher, in collaboration with Taiwan's leading crypto media platform Blocktempo, conducted a comprehensive survey on the research methods of Asia-Pacific Crypto VCs. Ultimately, 1,084 questionnaires were collected, providing valuable first-hand data for understanding the Crypto VC community.

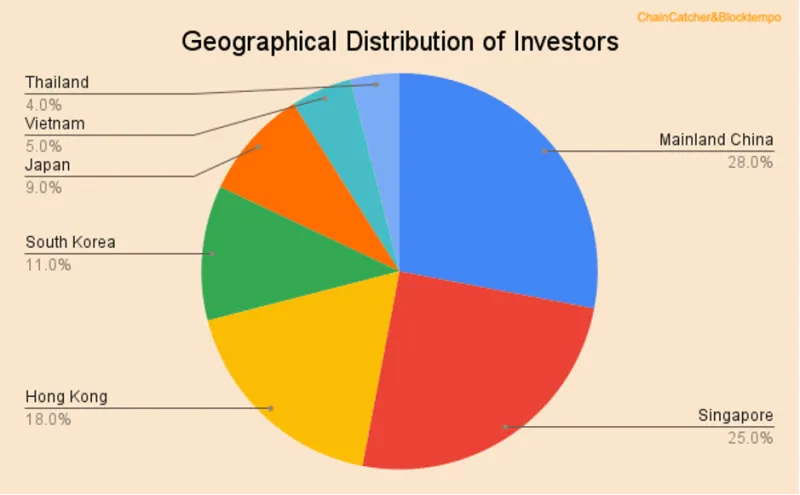

Geographical Distribution

The survey shows that 28% of respondents are from mainland China, followed by Singapore (25%), Hong Kong (18%), and South Korea (11%), with coverage extending to several Southeast Asian countries.

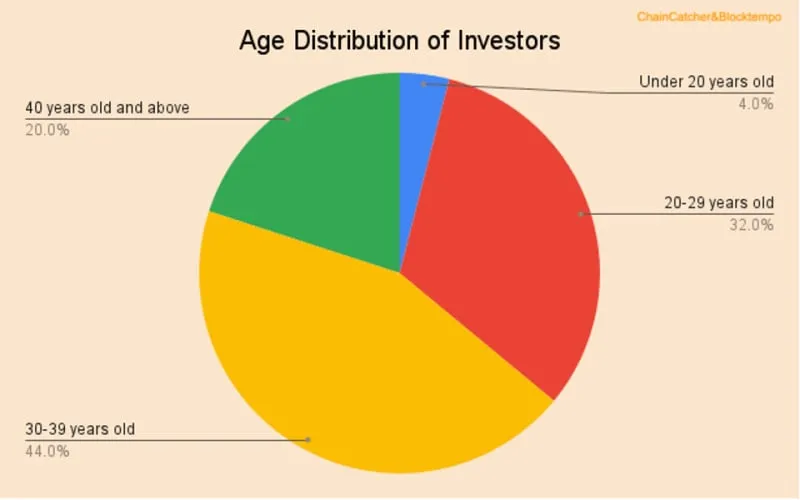

Age and Position Distribution

Respondents aged 30-39 account for the highest proportion at 44%, followed by 20-29 (32%) and 40+ (20%).

Among the surveyed group, investment managers/researchers make up the largest proportion at 27%, followed by partners (20%), founders (15%), investment directors (10%), executive directors (4%), and others (24%).

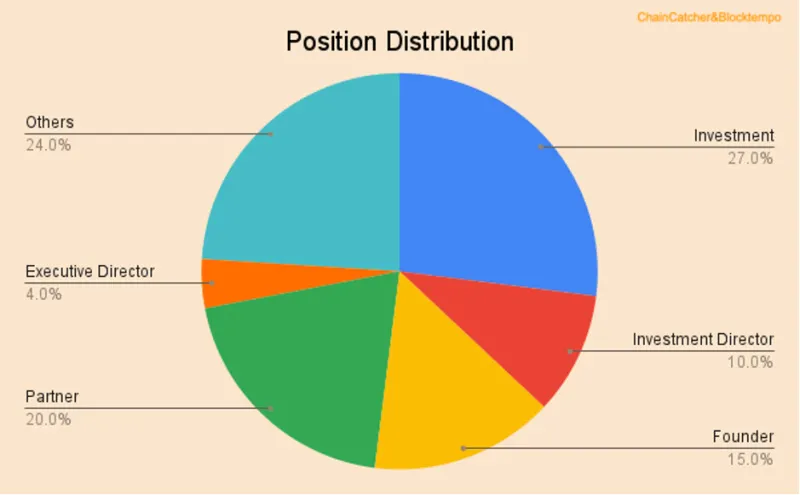

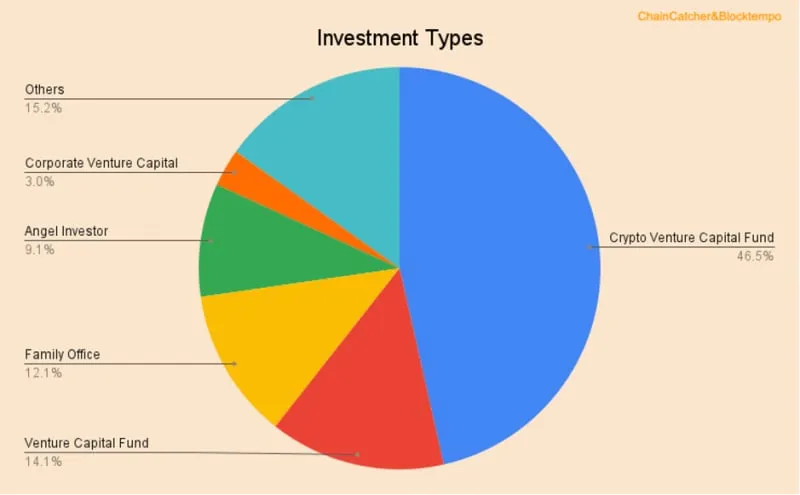

Types of Investors

46% of respondents are from Crypto Venture Capital Funds, 14% from traditional Venture Capital Funds, 12% from Family Offices, 9% from Angel Investors, 3% from Corporate Venture Capital, and 15% from other types.

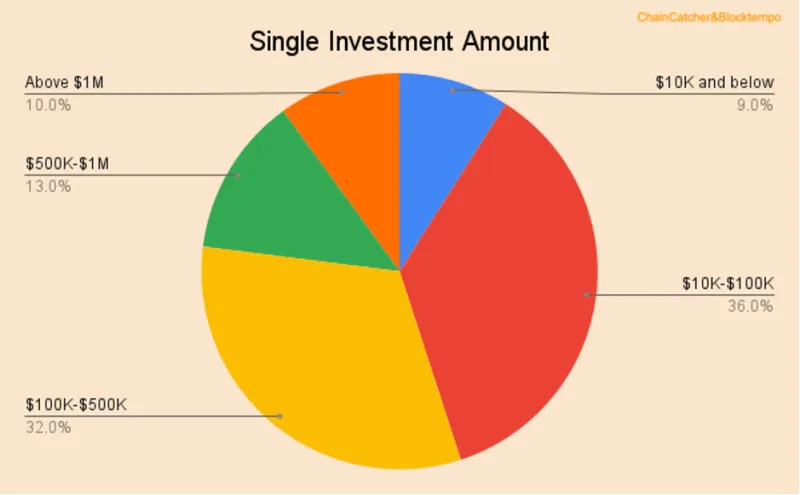

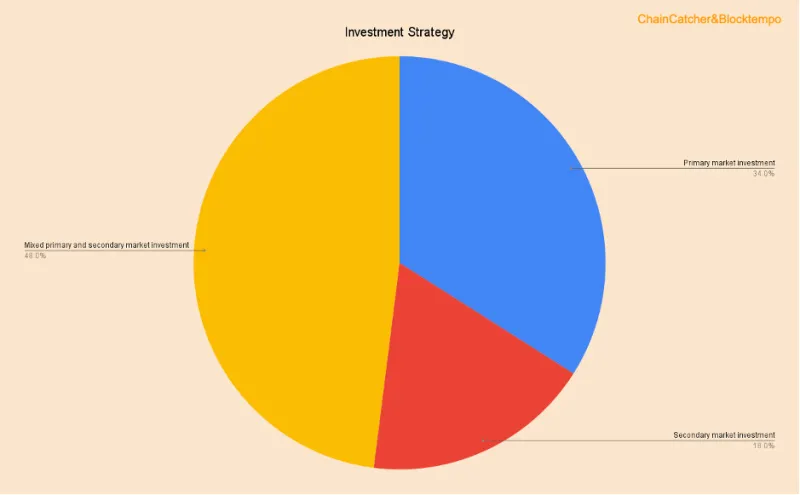

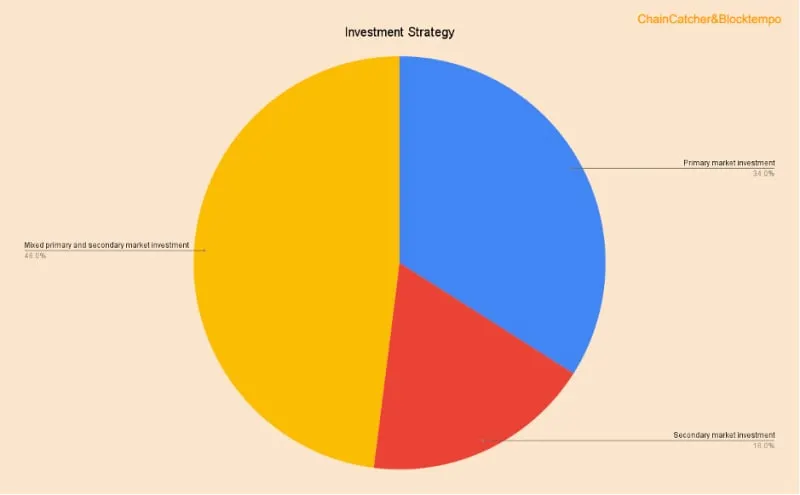

Investment Ranges and Strategies

36% of investors make single investments in the $10K-100K range, 32% in the $100K-500K range, 13% in the $500K-1M range, 10% above $1M, and 9% below $10K.

48% of investors adopt a mixed primary and secondary market investment strategy, 34% focus on primary market investments, and 18% focus on secondary market investments.

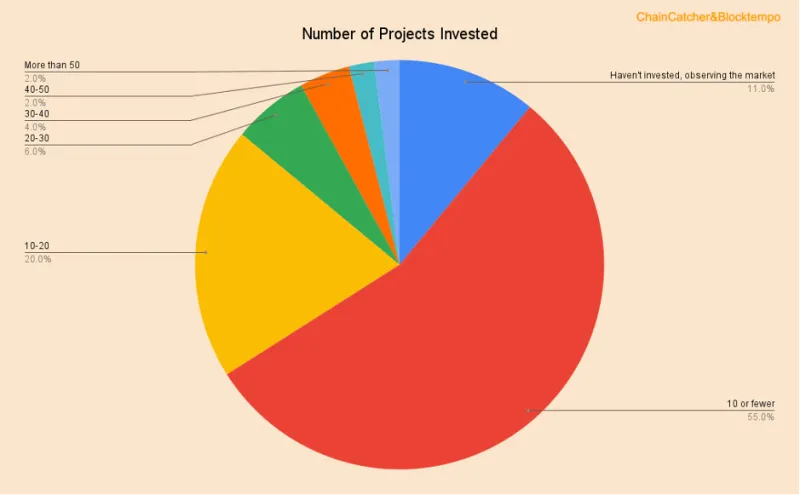

Number of Projects Invested

55% of investors invested in 10 or fewer projects this year, 20% invested in 10-20 projects, 11% are observing without investing, 6% invested in 20-30 projects, 4% in 30-40 projects, 2% in 40-50 projects, and 2% in more than 50 projects.

Information Acquisition Channels

X (formerly Twitter) is the most popular information channel, chosen by 87% of respondents. This is followed by Telegram (52%), WeChat (31%), Discord (28%), YouTube (17%), media/self-media (16%), podcasts (5%), and RSS (3%).

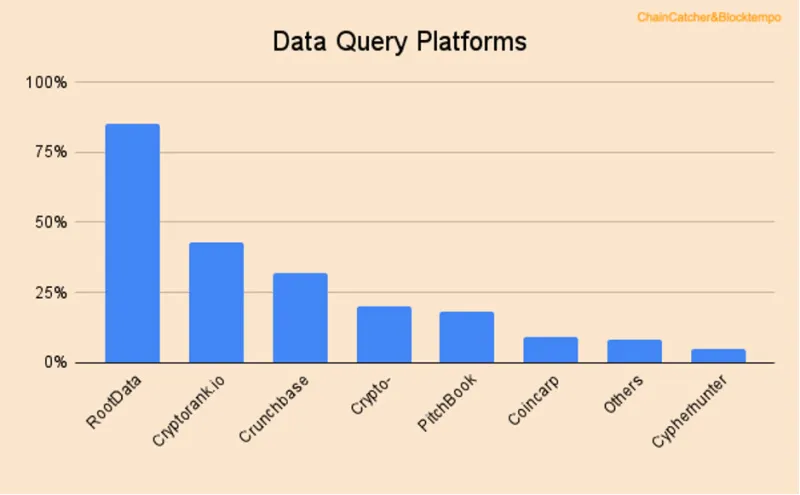

Data Query Platforms

The survey shows that RootData is the most popular investment data query platform with an 85% usage rate, followed by Cryptorank.io (43%) and Crunchbase (32%).

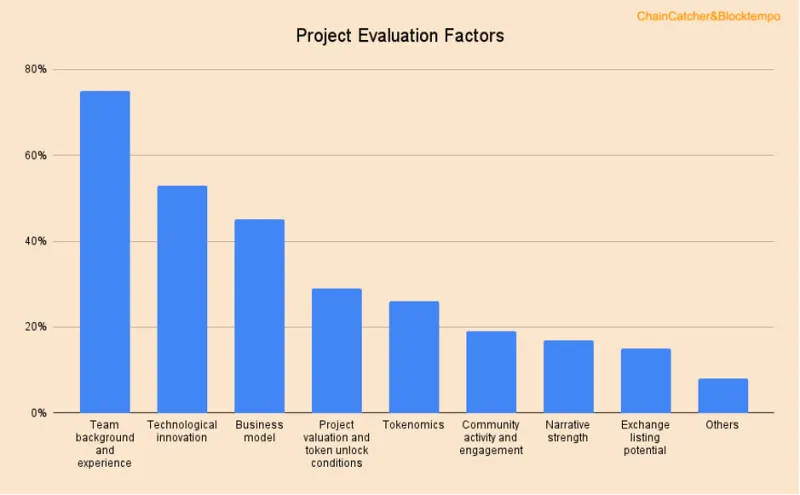

Project Evaluation Factors

Team background and experience (75%), technological innovation (53%), and business model (45%) are the three most valued factors for investors in evaluating projects.

Investment Research Challenges

Lack of project transparency (61%) and rapid industry changes (43%) are the main research challenges.

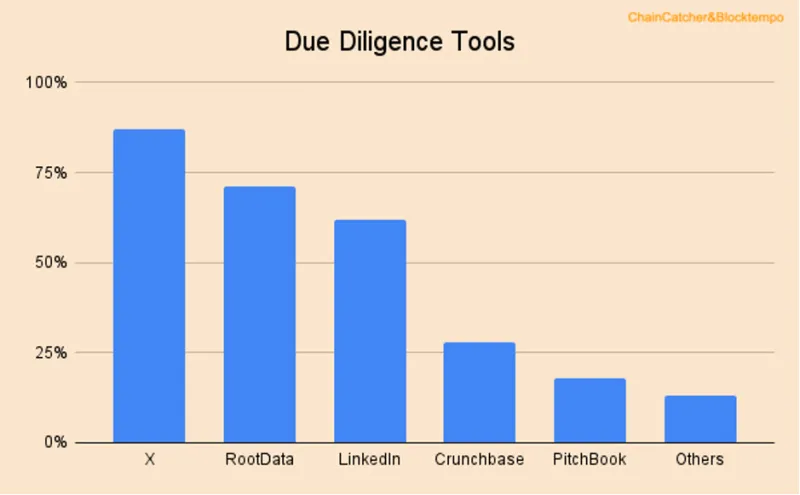

Due Diligence Tools

X platform (87%), RootData (71%), and LinkedIn (62%) are the most commonly used due diligence tools.

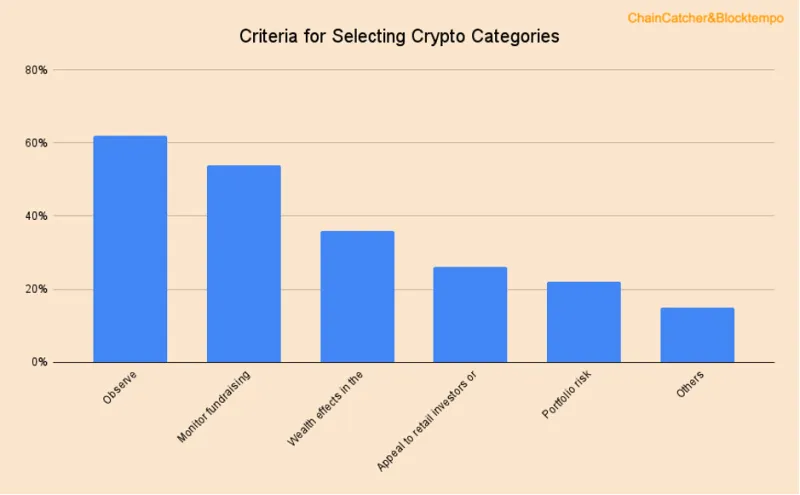

Criteria for Selecting Crypto Categories

62% of investors choose categories by observing narrative/category innovation, 54% focus on funding situations, 36% consider secondary market wealth effects, 26% focus on attractiveness to retail investors or exchanges, and 22% consider portfolio risk resistance/synergy needs.

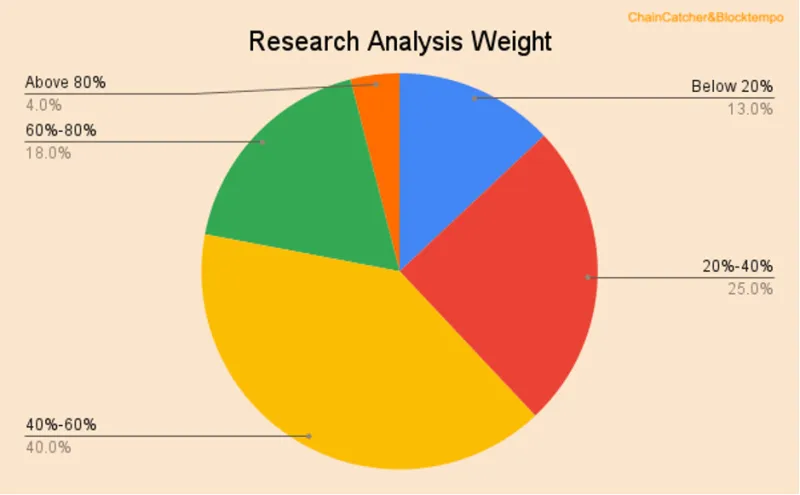

Research Analysis Weight

40% of investors believe that research analysis accounts for 40%-60% of the decision-making weight, while only 13% of investors believe that research analysis accounts for less than 20% of the decision-making weight.

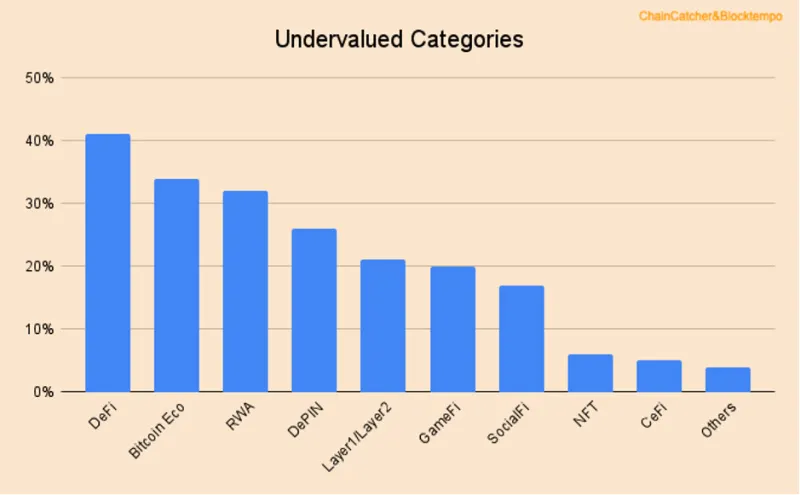

Undervalued Categories

DeFi (41%), Bitcoin ecosystem (34%), and RWA (32%) are considered the most undervalued categories.

Overvalued Categories

Layer1/Layer2 (48%), GameFi (28%), and NFT (25%) are considered overvalued categories, which may be significantly related to the innovation stagnation these categories are facing.

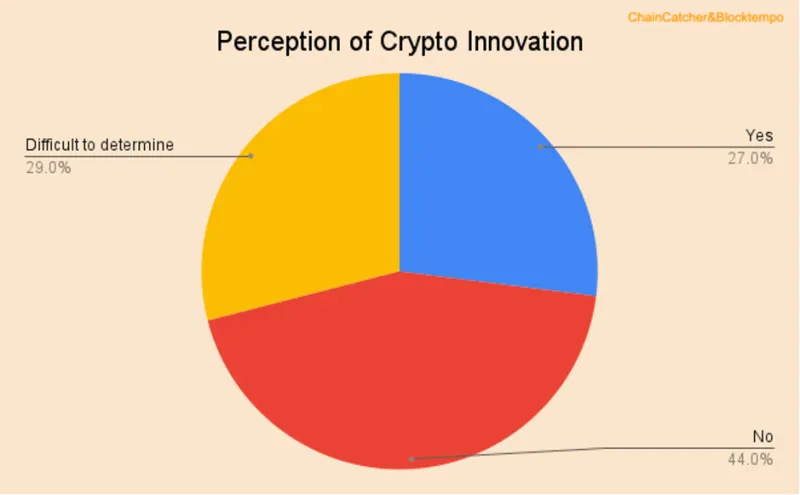

Perception of Crypto Innovation

44% of investors believe they haven't seen significant innovations in the Crypto industry this year, 29% find it difficult to describe, and 27% believe they have seen significant innovations.

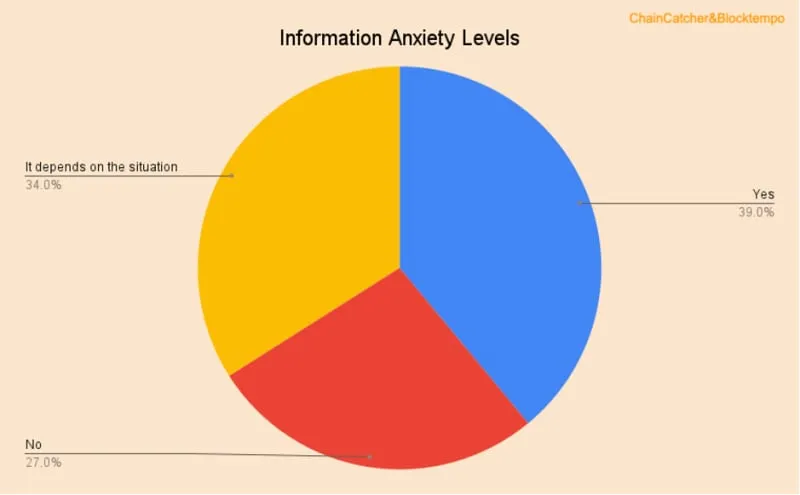

Information Anxiety Levels

39% of investors report significant information anxiety, 34% say their level of information anxiety varies depending on the situation, and 27% report no significant information anxiety. Nearly 40% of investors experiencing significant information anxiety also indicates that the Crypto market is still in a period of rapid development, with many unrefuted innovations still existing in the market.

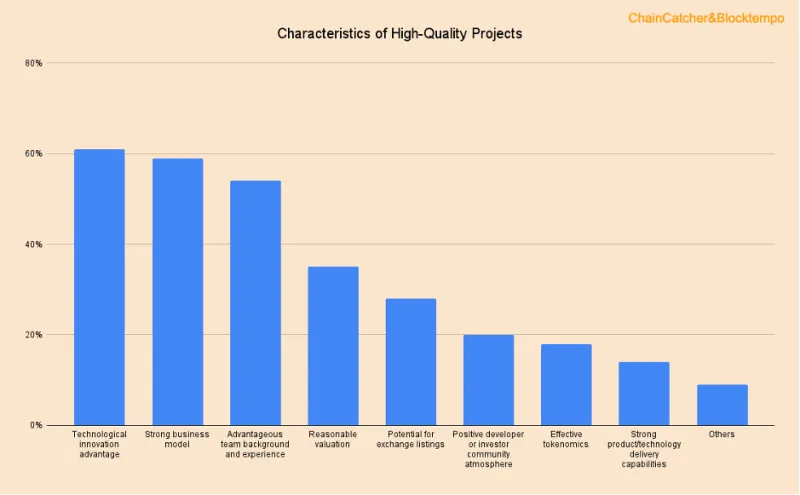

Characteristics of High-Quality Projects

Technological innovation (61%), business model advantages (59%), and team background (54%) are key characteristics of quality projects.

Future Investment Plans

42% of investors plan to maintain their current investment pace over the next 4 months, 27% plan to increase investments, 22% plan to decrease investments, and the remaining few investors (9%) are cautious or uncertain about market prospects, choosing to either find it difficult to judge or stop investing. It's worth noting that only 31% of investors explicitly express caution or reduced investment attitudes, while more early-stage investors still express optimism, which may drive a cyclical recovery and prosperity in the Crypto primary market in Q4.

Summary of Investor Outlook and Market Dynamics

The findings illustrate a cautious but optimistic sentiment among Asia-Pacific early-stage investors. While 42% aim to maintain their current investment pace, 27% intend to increase their activity in the near future, indicating a steady outlook despite market volatility. Only 31% of investors explicitly express caution or reduced investment activity, suggesting that many still see potential for a market recovery.

Combined with RootData’s Q3 2024 report, which noted a 25.69% quarter-over-quarter decline in funding events and a 15.04% drop in funding totals to $2.406 billion, these insights underscore a period of strategic restraint amid macroeconomic uncertainties, regulatory shifts, and fluctuating listing channels. Despite these conditions, optimism around sectors like DeFi and the Bitcoin ecosystem demonstrates a continued interest in innovative areas within the crypto space.

About ChainCatcher

ChainCatcher is a prominent cryptocurrency media and research organization focused on delivering timely, in-depth analysis and insights into blockchain technology and crypto market trends. By partnering with key industry stakeholders, ChainCatcher provides research reports, news, and educational content designed to equip investors and industry participants with reliable information for decision-making.

About Blocktempo

Blocktempo is Taiwan’s leading cryptocurrency media platform, dedicated to providing up-to-date news, insights, and educational resources on blockchain and digital assets. Through its in-depth content and active community engagement, Blocktempo has established itself as a trusted source for crypto enthusiasts and investors in the Asia-Pacific region.

Disclaimer: The data for this survey was collected from August 26 to September 26, 2024. All data is for research purposes only and does not constitute any investment advice. Investors should bear their own investment risks. ChainCatcher reserves the final right of interpretation for this report.

Contact

Disclaimer: Press release sponsored by our commercial partners.