In brief

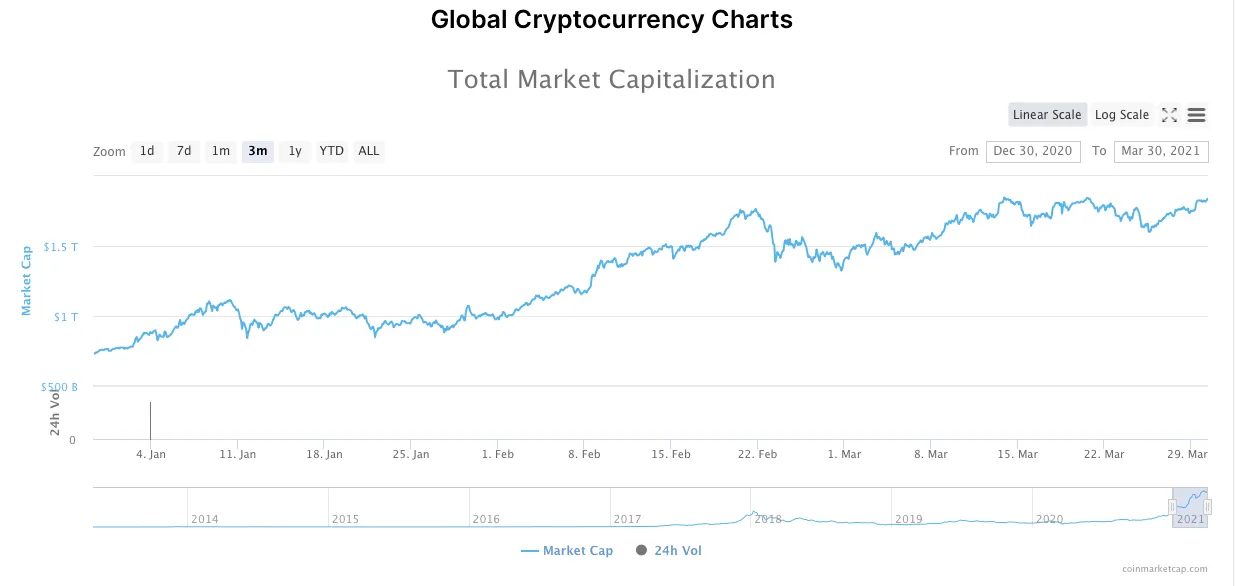

- Crypto markets gained strongly with global market cap approaching $2 trillion.

- Ethereum was buoyed by news Visa is now experimenting with USDC as a settlement option.

- Wall Street continues to be rocked by the Archegos sell off on Friday.

When it comes to price swings, crypto is usually the one making the headlines. But after the Archegos sell-off that rocked global asset markets on Friday, crypto seemed tame in comparison.

Market cap for crypto saw strong gains overnight, rising 3.7% to $1.87 trillion, according to Nomics. This puts crypto close to its all-time high of $1.9 trillion set earlier this month. That surge has been felt across the market.

Bitcoin is up 3.4% to around $58,000 after a choppy weekend. But with its market dominance now trending below 60% - other assets have been helping the markets along.

Chief among them is Ethereum, which enjoyed a 5.8% bump to take its price back into the $1,800s thanks to news that Visa had recently opened the door for transactions to be settled on its network using USD Coin - which is built on Ethereum.

Ripple also saw gains thanks to a spate of positive news. XRP is up 3.5% after the SEC granted a motion to allow an intervention in the ongoing case against the company. While that was happening Ripple acquired a 40% stake in southeast Asian payments company Trango.

Other winners in the crypto top 20 include HEX, up 5.8%, Chainlink up 2.8%, and Algorand up 10%. Why is crypto doing so well? It seems to be linked to what’s been happening on Wall Street.

As we reported yesterday, Archegos Capital Management, the office of billionaire Bill Hwang was forced to sell nearly $30 billion worth of shares after the markets went the wrong way.

Hwang held a significant amount of stock of Viacom and the Discovery Network, meaning their prices collapsed by 27% on Friday. While the markets were closed for the weekend, anticipation was building around who else was likely to take a hit from the Archegos dump. And it turns out it was the banking sector.

Swiss banking giant Credit Suisse had warned investors in the build-up that its position was likely to be affected by the sudden sell-off. By the close of play yesterday the bank was down an eye-watering 11%. Wells Fargo was also caught up in the stock sale losing 3%.

While the financial industry was left licking its wounds, the Dow crept to a fresh closing high, and the S&P 500 was just shy of previous records thanks to rumors the US economy has created 630,000 new jobs in the last quarter - the best performance since October 2019 and the strongest signal yet that the economy is recovering. The jobs report isn’t due till Friday, but markets are pricing in the news early.

With news that Biden is gearing up to unveil his $4 trillion infrastructure plan in the coming weeks, industrials and energy sectors are rubbing their hands. But the plan is likely to lead to a rise in taxes which some sectors are concerned may stifle growth.

What ever side of the fence you’re sitting on, this next quarter is sure to feature fireworks.

Brought to you by AAX

Learn More about partnering with Decrypt.