The U.S. Securities and Exchange Commission (SEC) has internally considered Ethereum to be a security for over a year, according to previously redacted portions of a lawsuit filed by software giant Consensys against the SEC that were revealed this morning.

Per Consensys’ complaint, Gurbir Grewal, the Commission’s Director of the Division of Enforcement, issued an internal Formal Order on March 28, 2023, announcing an investigation into “Ethereum 2.0,” authorizing employees of the regulator to investigate and subpoena parties involved in the buying and selling of ETH.

The order, which Consensys says was approved by the Commission on April 13, 2023, explicitly refers to Ethereum as a security in and of itself, as it authorizes the investigation of “certain securities, including, but not limited to ETH, as to which no registration statement was or is in effect… and for which no exemption was or is available.”

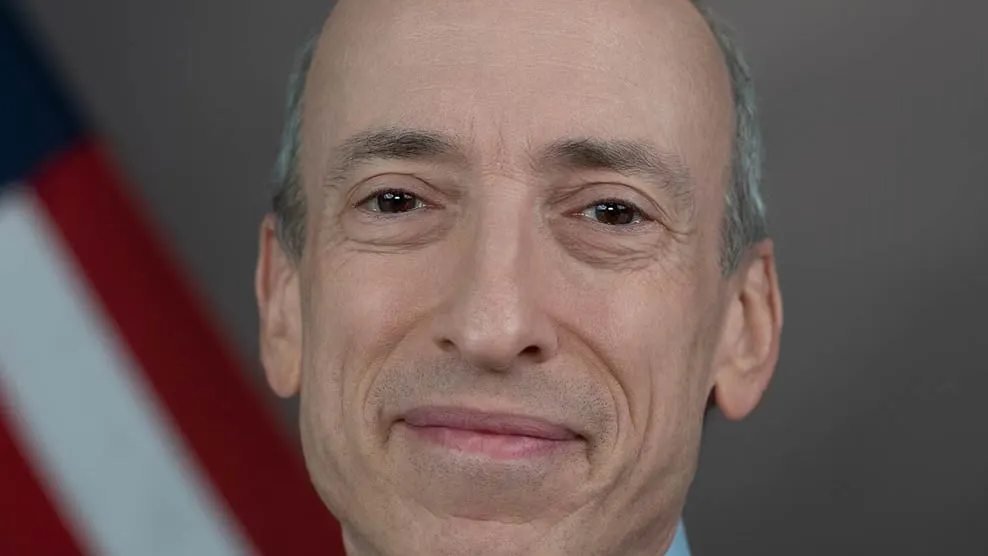

The revelation that the SEC has officially considered ETH to be a security for over a year is a remarkable one. SEC Chair Gary Gensler has repeatedly deferred when asked explicitly regarding the agency’s stance on the matter. As recently as last month, Gensler refused to state the SEC’s position when it comes to ETH.

An SEC spokesperson told Decrypt that the regulator declines to comment on the matter.

Ethereum, which had already been sagging with the rest of the market on Monday, was trading for $3,143.69 at the time of writing—marking a 5% slip from this time yesterday, but only 1.5% lower than this time last week, according to CoinGecko data.

For years, the crypto industry has held out hope that Ethereum—the second largest cryptocurrency in the world after Bitcoin, and the foundation of the massive Ethereum ecosystem—might be considered a commodity in the American government’s eyes, paving the way for ETH’s integration into the American economy on a trajectory similar to Bitcoin.

The head of the Commodity Futures Trading Commission (CFTC) has explicitly declared Ethereum to be a commodity in the past.

It would appear that the SEC’s scrutiny of Ethereum escalated after the blockchain’s September 2022 merge event, which transitioned it to an energy-efficient proof of stake consensus mechanism. That new structure now allows users to stake ETH with the network to help it function—and accrue rewards in the process—a financial incentive the SEC clearly takes issue with.

In the year following the SEC’s reported internal Formal Order regarding Ethereum, the agency has steadily ratcheted up its offensive against entities involved with the cryptocurrency. In February, the Ethereum Foundation, the Swiss non-profit that supports the Ethereum ecosystem, was subpoenaed by an unnamed “state authority.” Several American crypto companies have received subpoenas related to their dealings with the Ethereum Foundation.

And last week, Consensys, perhaps the largest Ethereum-focused American company, filed a preemptive lawsuit against the SEC, arguing that it does not have the grounds to regulate Ethereum, as the asset should not be classified as a security.

Editor's note: This story was updated to reflect the SEC's decision not to comment on the unredacted lawsuit and to clarify the process of ETH staking.

Edited by Stacy Elliott.