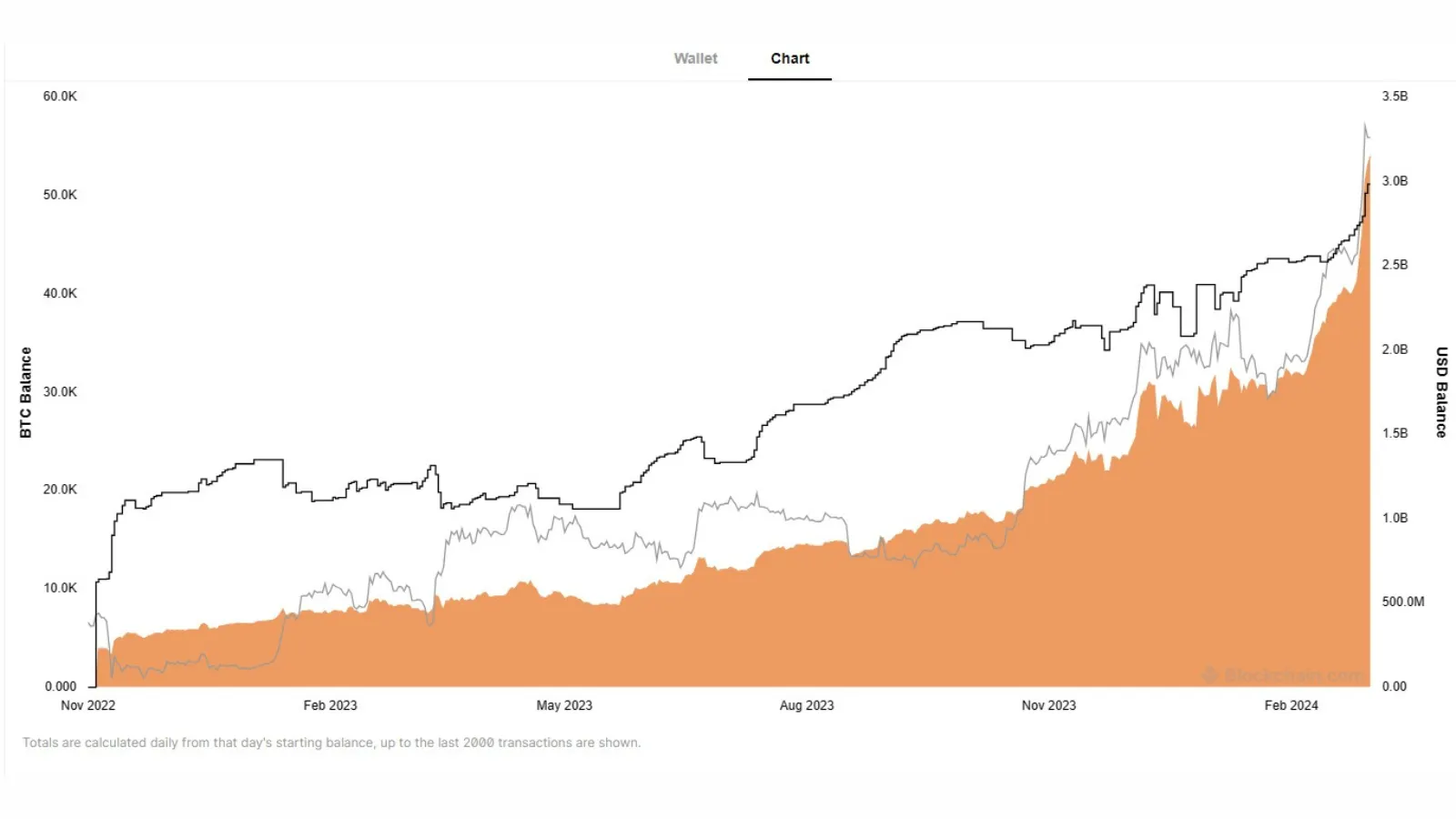

A mysterious Bitcoin address is amassing BTC as the race to a new all-time high continues. According to data from Bitinfocharts, the whale’s wallet now holds over 54,164 BTC–worth around $3.2 billion.

A “whale” is an investor who hoards large amounts of cryptocurrency. Because of the size of their Bitcoin holdings, a whale's moves garner a lot of attention among blockchain sleuths, especially on crypto Twitter.

In April, a wallet from the early days of Bitcoin moved over $11 million in BTC after being dormant for 12 years. That same week, another Bitcoin wallet moved $8 million in BTC after ten years of inactivity. In November, another Bitcoin whale made waves after analysts discovered wallet holding $450 million in Bitccoin.

This whale, dubbed “Mr. 100,” may not be a single investor—it could belong to an investment fund or one of the big banks behind one of the several spot Bitcoin ETFs now available.

“It's definitely possible, but I would say unlikely,” Amberdata Director of Research Chris Martin told Decrypt. “All of the ETFs have publically shared their addresses, so it would be strange to me if they didn't share this one.”

According to Amberdata, the wallet has been accumulating Bitcoin since November 2022, using Binance and KuCoin.

While the US Government has also accumulated an immense treasury of Bitcoin—estimated to now be worth over $12 billion—Martin doesn’t see the Biden Administration being behind the address. One tell: the digital assets are coming from Binance and KuCoin,

“It might be safe to rule out a U.S. entity or bank,” Martin said. “I wouldn’t be surprised if it's a fund of some kind.”

Hong Kong is said to be mulling 31 applications for crypto custodians, he noted.

Martin also said he does not believe the wallet is someone loading up in preparation for the upcoming Bitcoin halving in April.

“I would say not—they could just be supporting the price run-up rather than accumulating tokens for a specific event,” he said.

“I think it's interesting that they've generally received the same amount on every transaction—about 100 BTC—throughout their existence,” Martin added. “Why they chose 100 BTC is beyond me... possibly a limitation of their funding source.”

While speculation around the identity of “Mr. 100” whale remains, sentiment in the cryptocurrency market is riding high, and the countless entities loading up on Bitcoin point to signs that the bull market is indeed back and running.

Edited by Ryan Ozawa.