Several decentralized finance (DeFi) cryptocurrencies including Uniswap (UNI), Sushiswap (SUSHI), Chainlink (LINK) and 1inch Network (1inch) have suffered heavy losses over the past 24 hours.

UNI, the native token of the popular decentralized exchange (DEX) Uniswap, has dropped over 8.7% over the past day and is currently trading at just over $5, according to data from CoinMarketCap. The token is the 22nd-largest cryptocurrency with a market capitalization of $3.7 billion. UNI has dropped over 88% from its all-time high of $44.97, recorded in May 2021.

Decentralized oracle platform Chainlink's LINK token is also treading water, down over 8.3% over the past 24 hours. LINK is the currency used by users to run oracles on the Chainlink platform. Oracles for important data bridge between off-chain and on-chain events. LINK is currently changing hands at $6.54, down over 87% from its all-time high of $52.88 recorded in May 2021.

Elsewhere, SUSHI, the token powering the Sushiswap DEX, shed over 7.8% of its value over the past 24 hours. The token currently trades at $1.50, down over 90% from its all-time high of $23.38 in March 2021.

1inch, the 98th-largest cryptocurrency with a market capitalization of $377 million, has also shed over 6.8% over the past 24 hours, and is currently trading at $0.91. 1inch is the native token of the decentralized exchange aggregator platform 1inch exchange.

What’s driving the DeFi token crash?

The primary driver behind today’s bearish price action is likely the sudden drop in total value locked (TVL) across different DeFi protocols fueled by Ethereum's recent price slump. The second-largest cryptocurrency by market cap, which underpins much of the DeFi ecosystem, Ethereum is down over 6% on the day and nearly 5% in the last seven days.

According to DefiLlama, the total value locked across all DeFi protocols currently stands at $139.59 billion, compared to $249.13 billion on May 1, 2022.

Despite Uniswap reaching a total lifetime volume of more than $1 trillion yesterday, the UNI token is in a downtrend.

According to Dune Analytics, weekly trading volume at Uniswap dropped to $3.9 billion last week, down from $10 billion in the previous week. The volumes plummeted to levels last seen in December 2020, indicating a reduced interest in DeFi.

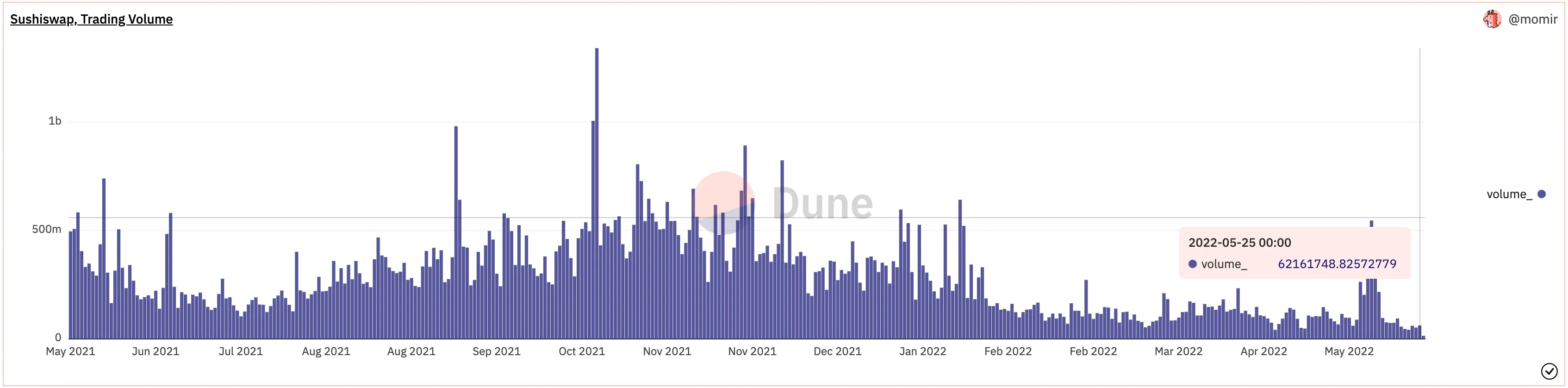

Sushiswap's monthly active users (MAU) dropped slightly from 70,000 in April to 60,000 in May. Its MAU hit an all-time high of 170,000 recorded in November 2021, according to Dune Analytics. Trading volume on the DEX also dropped to just $6 million yesterday, from an all-time high of $1.34 billion last November.

LINK, the native token of the Chainlink platform, is used for multiple purposes across the crypto ecosystem. The majority of the usage is attracted by the keeper network. Chainlink keepers is a smart contract automation service that helps to update off-chain information to smart contracts.

To run a keeper on Chainlink, the primary requirement is to hold a LINK token. Data from Dune Analytics shows a steady decline in the use of the keeper network, resulting in less usage of LINK tokens.

Despite steady growth in the number of transactions and trading volume on 1inch, the DEX aggregator platform's native token 1inch is in a downtrend, correlating with major assets like Bitcoin & Ethereum.

Bitcoin is down 2.3% over the past 24 hours and is currently trading at around $29,100. Ethereum is currently changing hands at $1.845, a drop of over 6.4% over the past 24 hours.