In brief

- SushiSwap is a popular Ethereum-based decentralized exchange (DEX) that allows users to swap tokens, earn rewards via yield farming, and more.

- It was forked from leading DEX Uniswap, which it initially drained liquidity from via a process called “vampire mining.”

Decentralized exchanges (DEXs) enable users to trade directly with one another, without going through a centralized intermediary, such as Coinbase and Binance. That means they can offer access to a wider variety of cryptocurrency tokens and financial services than you’ll find at popular centralized exchanges, plus they allow for trading without an intermediary or a need to provide identifying information.

SushiSwap has emerged as a popular rival to the leading DEX, Uniswap, which makes sense: it’s actually based on Uniswap’s code!

Although SushiSwap had a controversial and drama-filled launch, it has since stabilized and now sports a polished design, plus a growing array of decentralized finance (DeFi) products and services such as yield farming, SUSHI token staking, lending, and new token offerings. Here’s how to become a “DeFi chef” with SushiSwap, plus a look at its volatile history and the SUSHI token.

What is SushiSwap?

SushiSwap is an Ethereum-based decentralized exchange that lets you swap a vast array of tokens, as well as engage in other finance services. It has no centralized authority or middlemen. Instead, it relies on smart contracts—or code that automates processes—and liquidity provided by other users to complete trades. SushiSwap is similar to Uniswap, which also runs on Ethereum, as well as the Binance Smart Chain-based PancakeSwap.

The history of SushiSwap

SushiSwap launched in August 2020 and quickly ran into controversy. The pseudonymous creator Chef Nomi and his collaborators copied (or forked) the open-source code from Uniswap, but made a key change: the addition of a governance token, SUSHI, which users could buy and earn to have a say in the future of the DEX.

Along with that notable change, SushiSwap wanted to crush Uniswap and take its throne as the most popular Ethereum DEX. The creators devised a “vampire mining” scheme to drain liquidity out of Uniswap via incentives: by providing SUSHI in exchange for users’ Uniswap liquidity pool (LP) tokens. Those LP tokens would then be exchanged for the original assets put into the Uniswap liquidity pools, thus creating liquidity for SushiSwap instead.

I have returned all the $14M worth of ETH back to the treasury. And I will let the community decide how much I deserve as the original creator of SushiSwap. In any currency (ETH/SUSHI/etc). With any lockup schedule you wish.https://t.co/QwFj5SeeuQ

— Chef Nomi #SushiSwap (@NomiChef) September 11, 2020

If that wasn’t bold and controversial enough, a fresh twist came before the vampire mining campaign could be completed: Chef Nomi cashed out about $14 million worth of SUSHI from the DEX’s developer funds for Ethereum—on Uniswap, no less. SUSHI’s price sank and Nomi was assailed by users who thought that they had just scammed or “rug pulled” the newly-formed SushiSwap community.

Nomi reversed course and returned the funds, and ultimately decided to withdraw from SushiSwap. Control over the project was handed over to Sam Bankman-Fried, head of Alameda Research and centralized derivatives trading platform FTX, who oversaw the successful completion of the vampire mining campaign. He then passed control on to numerous trusted community members, ensuring SushiSwap’s decentralized future. To the relief of users, SushiSwap has experienced a much less tumultuous run since then.

How does SushiSwap work?

Like Uniswap, SushiSwap is built on an automated market maker (AMM) system that uses the aforementioned smart contracts to complete transactions. Tokens are provided by other users via liquidity pools. Other SushiSwap users lock up their funds in token pairs to these pools, which provides the funds needed to complete swaps. Those users are then rewarded with a small percentage of fees generated by trades, a process called yield farming.

Beyond token swaps, SushiSwap offers other DeFi features, such as the ability to stake SUSHI coins in the network and earn rewards, as well as participate in lending services and purchase newly-offered tokens DeFi startups via its MISO service.

Did you know?

SushiSwap’s community provides an enormous amount of liquidity: more than $3 billion across 1,300+ token pairs as of this writing.

What’s so special about it?

Even if it started with Uniswap’s code base, SushiSwap has made significant changes to differentiate itself from its inspiration (and rival). The SUSHI token was a DeFi innovation that ultimately led to Uniswap adopting a similar approach, providing users not only with an additional means of generating rewards but also a say in the future of the DEX.

Also, while Uniswap has raised venture capital funding and has a core, centralized development team, SushiSwap’s decentralized, community-centric ethos extends beyond the DEX itself.

How to make your first trade on SushiSwap

As with other DEXs, you will need a crypto wallet such as MetaMask, WalletConnect, or Lattice to use SushiSwap. It also works with Coinbase Wallet, which does not require an account with the centralized Coinbase exchange. Unlike centralized exchanges, SushiSwap does not make you register an account or provide identifying information—you just need a wallet. However, you cannot use a debit card or bank account to buy crypto with fiat currency at SushiSwap.

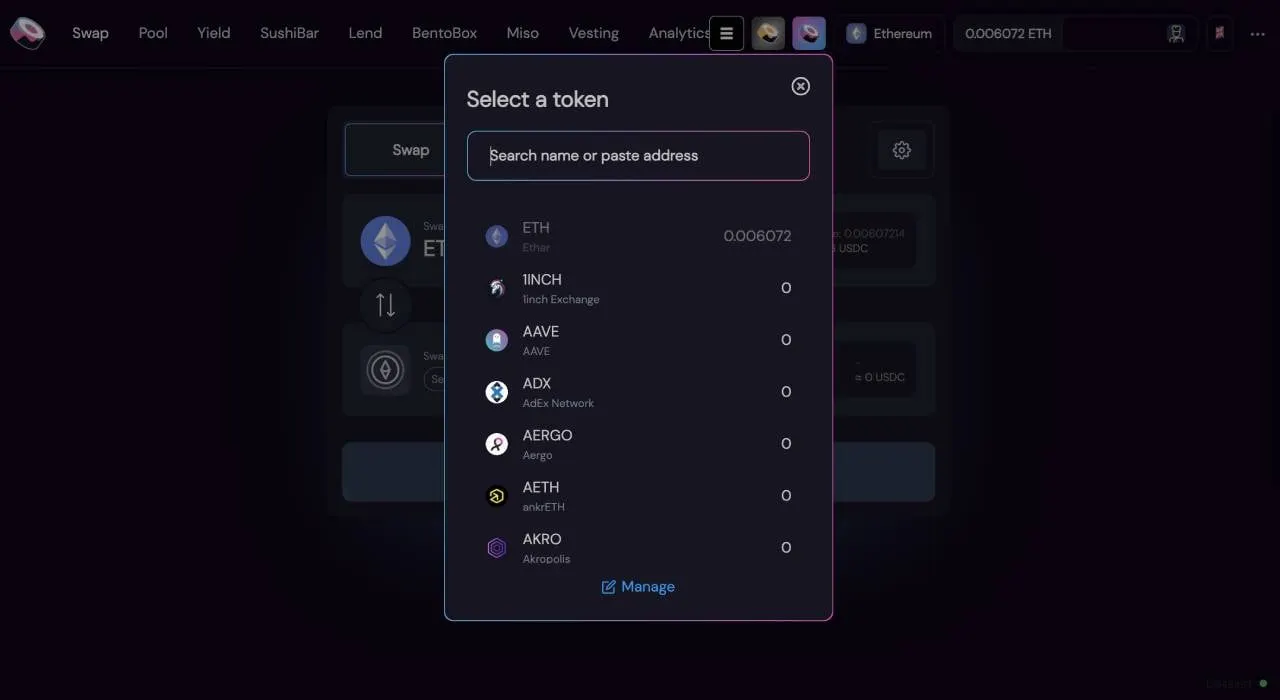

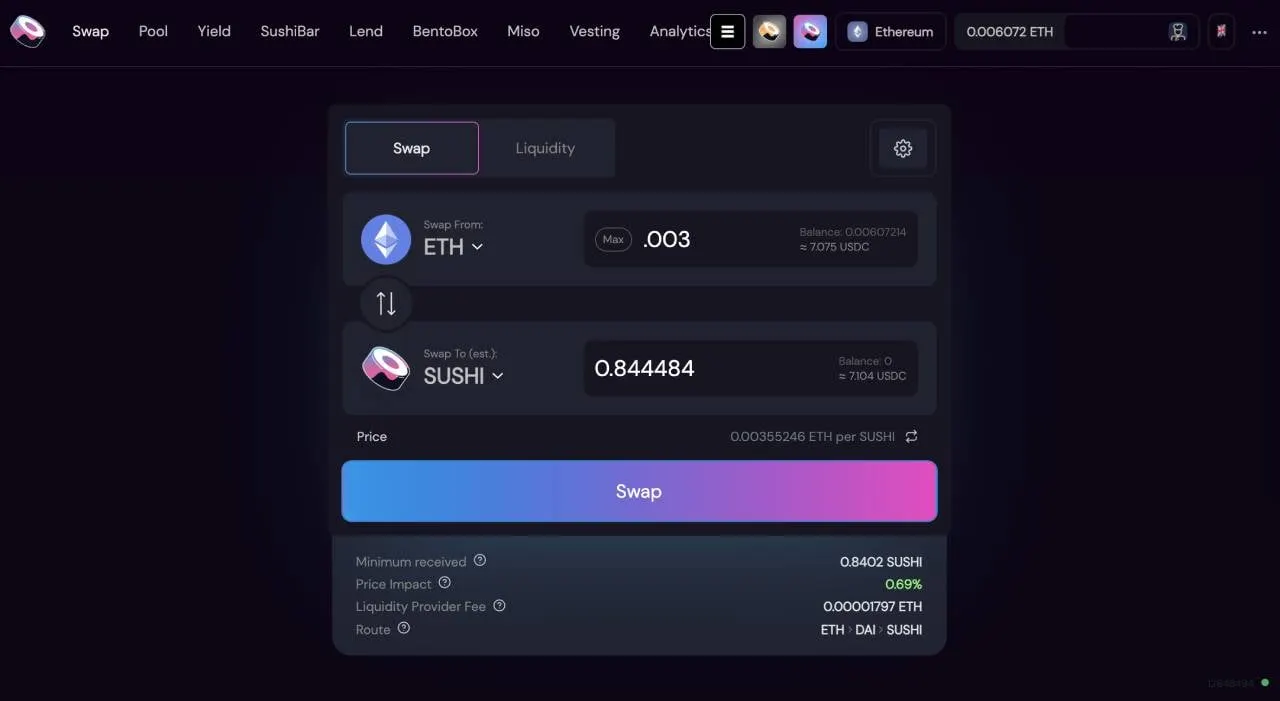

Once logged in with a wallet, head to the “Swap” feature at SushiSwap and choose which cryptocurrency in your wallet (such as Ethereum) you want to trade, and which token you want to trade for. SushiSwap allows anyone to create a trading pair and establish a liquidity pool, so it supports a very wide array of Ethereum-based tokens as well as other coins wrapped for use in Ethereum.

Once you choose which tokens to swap, enter the amount of your token that you want to exchange and SushiSwap will tell you how much of the other token you’ll get in return. If you are satisfied with the exchange rate, click the rainbow-colored Swap button to execute the transaction. It may take a few minutes to complete the trade, but if it successfully goes through, then the new tokens will appear in your wallet.

Where and how to buy SUSHI

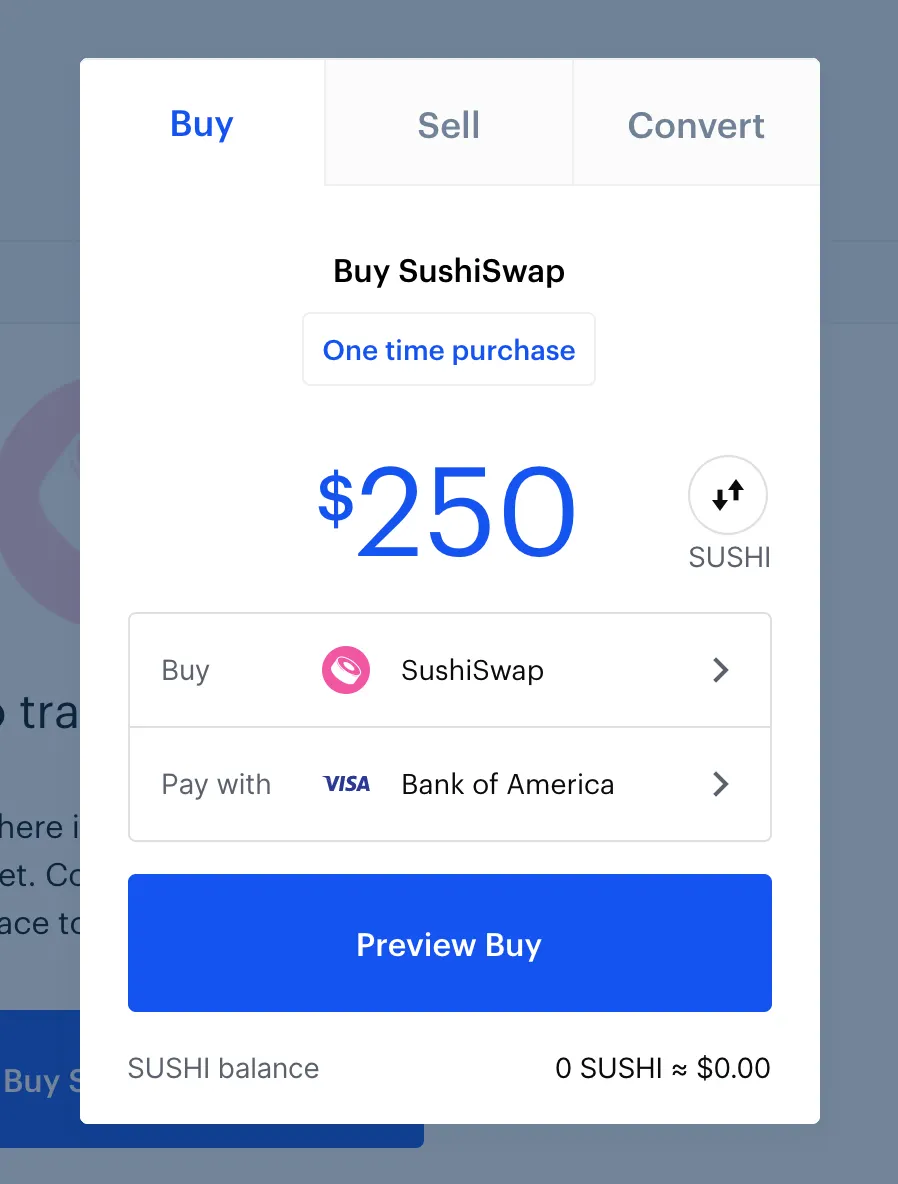

You can swap for SUSHI at SushiSwap, of course, or even at Uniswap. If you prefer to buy SUSHI tokens elsewhere, however, and then bring them into SushiSwap, you can also do that. SUSHI tokens are available for purchase from a wide array of exchanges, including Coinbase, Binance, FTX, and Huobi Global.

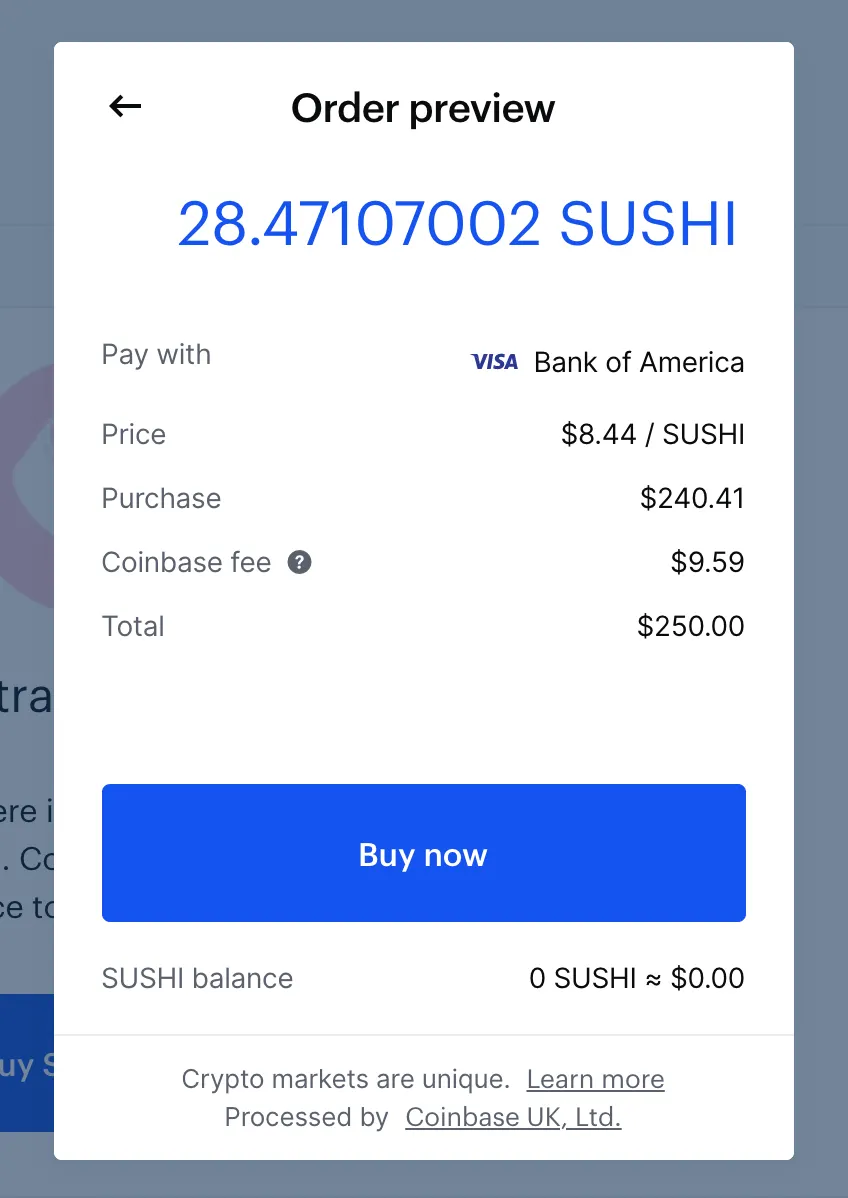

Here’s a look at how you can purchase SUSHI at Coinbase. In this example, we're looking to buy $250 worth of SUSHI using a linked bank account, and then after taking its transaction fee, Coinbase offered to send back 28.47 SUSHI in return. If the terms are agreeable on your own transaction, click “Buy now” and the SUSHI will soon appear in your Coinbase account.

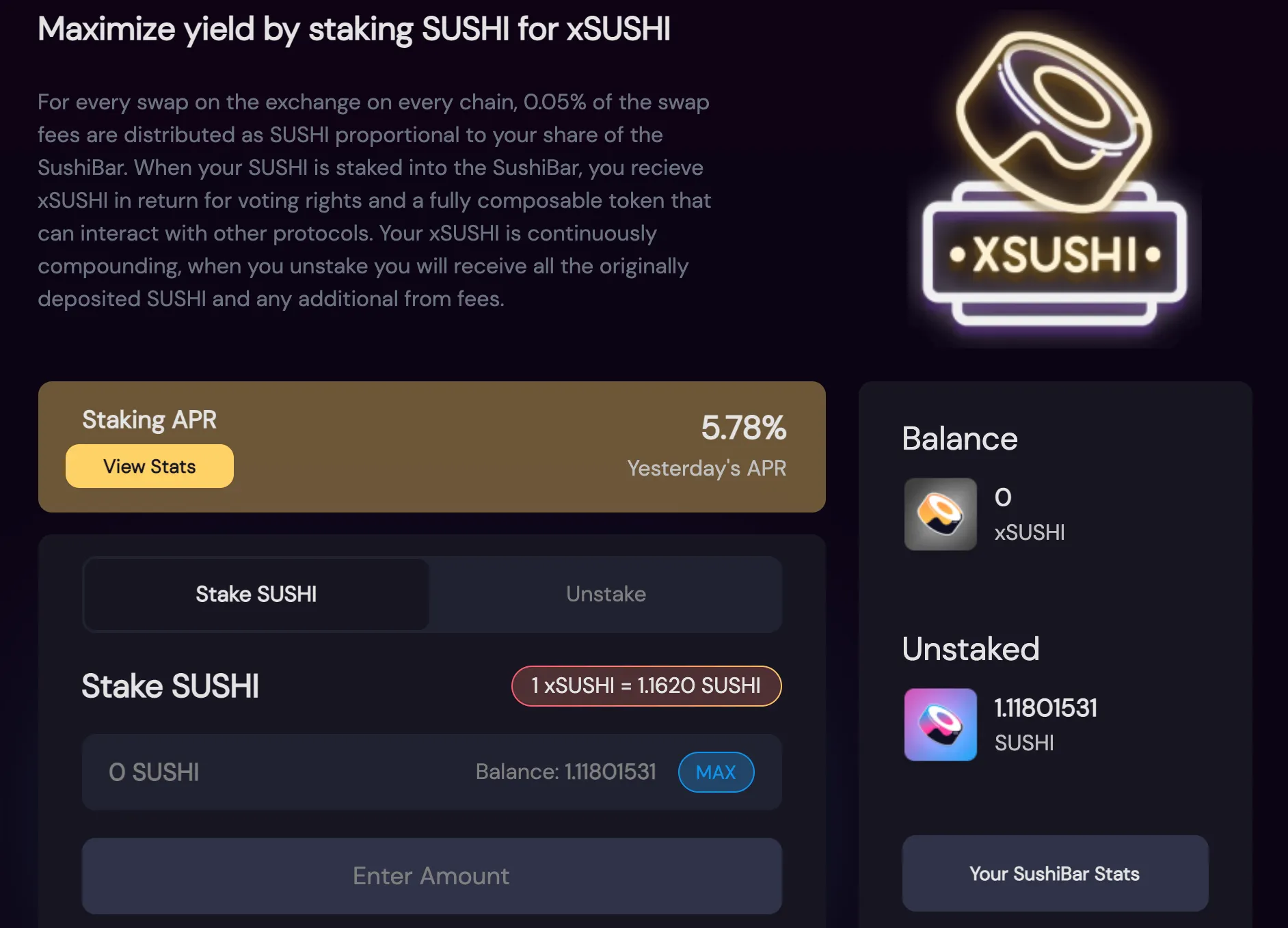

How does staking work? What is xSUSHI?

SushiSwap allows you to stake (or lock up) your SUSHI tokens into the network to earn gradual rewards over time. According to the DEX, 0.05% of the total swap fees are redistributed to users proportional to the amount of SUSHI they have staked. When you stake your SUSHI, you will receive xSUSHI to hold onto. xSUSHI grants you voting rights and compounds your rewards over time. When you unstake your funds, you will gain back your original SUSHI amount plus however much extra you earned in rewards, minus fees.

The future

Much as SushiSwap emerged out of nowhere to challenge the dominant Uniswap, the DEX market isn’t static. Uniswap, for example, continues iterating upon its concept and launched its v3 DEX in May 2021. Furthermore, DEXs are starting to gain traction on other blockchains besides Ethereum, most notably PancakeSwap and BurgerSwap on Binance Smart Chain.

SushiSwap has already expanded considerably since its contentious launch and transfer of power, rolling out new features like BentoBox, a platform that additional DeFi services can be built upon. The app has also seen a significant visual and interface overhaul that is much more polished and easier to understand, and moved to the simpler sushi.com URL.

The Sushi Anons are really liking $SUSHI on Polygon, huh?

In less than one month you did it...

Welcome to the $1 Billion TVL Club !! https://t.co/4dqdGycqCg pic.twitter.com/d1RmwYEf4v— SushiChef (@SushiSwap) June 3, 2021

Like other Ethereum-based apps and platforms, SushiSwap has seen rising gas and transaction fees due to high network congestion. Given that, SushiSwap is now expanding out to other blockchains and embracing layer-2 scaling solutions to minimize fees and speed up transaction confirmations.

SushiSwap has launched a version of its DEX on the Polygon (ex-Matic) blockchain, and has created a bridge that lets users move Ethereum assets back and forth between the two DEXs.

Did you know?

There are many decentralized exchanges out there. Click here to learn about some of the other popular options and how they compare.