Galaxy Digital is raising fresh funds to continue the firm’s expansion and to keep pace with the crypto industry’s continued growth.

The firm is looking to raise $500 million through the sale of five-year convertible bonds in exchange for stock in the company. These notes would earn holders 3% interest and are set to mature in 2026, according to the firm.

Galaxy Digital is a registered crypto broker-dealer that offers financial services for professional investors looking to enter the cryptocurrency market. As of October 31, 2021, the firm managed over $3.1 billion in assets, the most notable of which have been Galaxy’s suite of crypto exchange-traded funds (ETFs) in Canada.

The latest sale will be executed in a private placement, with reported buyers including the Senator Investment Group, NZ Funds, and Arca.

These funds will be used to continue expanding the firm’s asset management business as well as lunch a new fund and hire more talent. Galaxy Digital does not have plans to roll out services for the retail market, instead preferring to continue catering to institutional investors.

The fundraising announcement has also been coupled with news that the Cayman Islands-based company will move its headquarters to New York.

Galaxy Digital continues growth

Last month, Galaxy Digital raised another $325 million for its Galaxy Interactive Fund, which is focused on the fast-growing crypto games and arts space.

Sam Englebardt, a general partner at Galaxy, told Decrypt at that time that the move aimed to cater to “young people moving en masse to digital.” The fund has already deployed $150 million in Mythical Games and the fractionalized art project Master Works.

Galaxy Digital launched another fund this summer focused on the decentralized finance (DeFi) sector too. Called the Bloomberg Galaxy DeFi Index, the fund offers professional investors exposure to blue-chip DeFi tokens like SushiSwap, Aave, Maker, Yearn, Uniswap, Compound, and others.

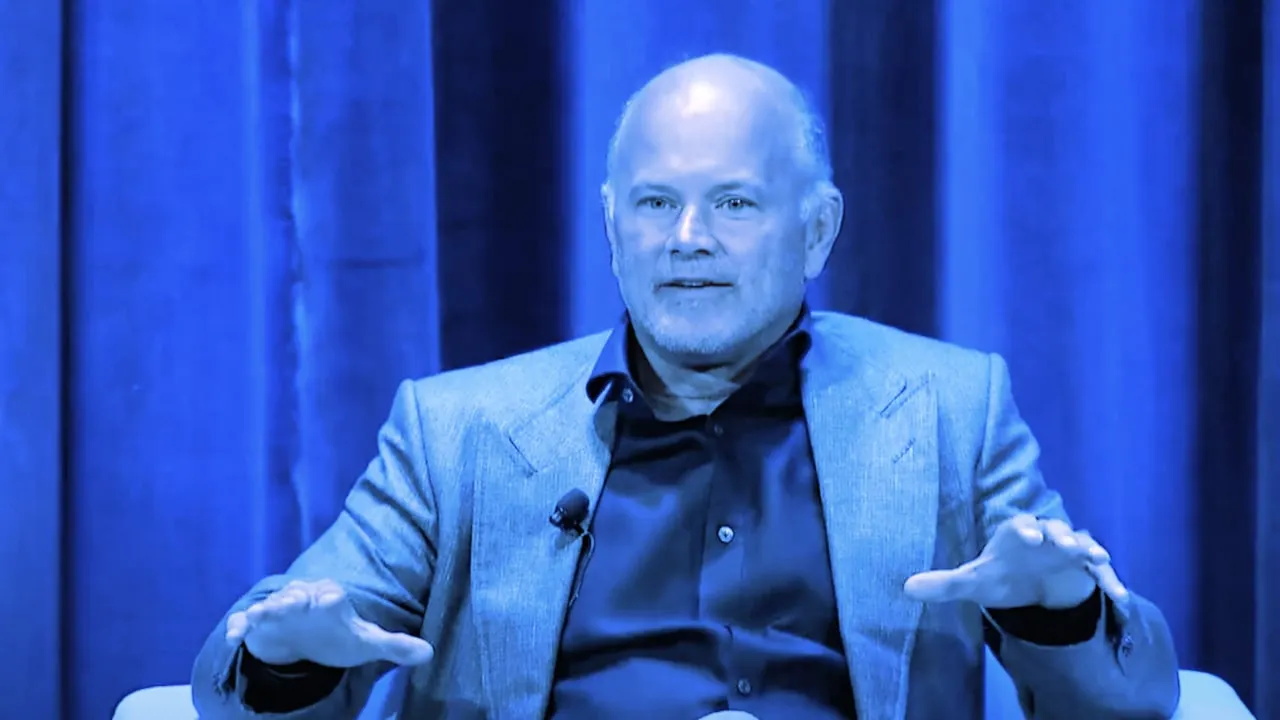

The speed at which Mike Novogratz’s firm is raising and deploying capital is yet more evidence that the crypto industry, and institutional interest in it, is hotter than ever.