In the traditional equities market, “blue-chip” stocks are household names that have proven strong financials and steady returns over the long-term, even through downturns. The label is far from technical, and functions more as the financial community’s subjective stamp of approval: These companies are here to stay, and you can’t go wrong investing in them. Think Amazon, Apple, Nike, and Warren Buffett’s Berkshire Hathaway.

In the nascent and rapidly evolving DeFi (decentralized finance) sector, Decrypt has identified eight projects that have achieved something close to blue-chip status with the community—for now. Our criteria include reputation, lack of hacks, price performance, and continued updates and new features.

DeFi is still so new that it might feel crazy to crown any DeFi projects “blue chips” yet.

But investors have locked up more than $65 billion in DeFi protocols, according to DappRadar. Still, not every DeFi project is created equal. Hacks, exploits, and “rug pulls” have dotted the rise of the sector, separating the cash grabs from the blue chips. Investors should proceed with caution, and as with any new and volatile asset, only put in what you could stand to lose. Building the future of finance won’t happen without at least a few hacks, crashes, and scares.

Certainly, none of these projects is as established as a brand like Microsoft or Apple, but each one has earned some level of trust from the DeFi investor community. In crypto, that’s worth its weight in digital gold.

Decrypt will update our list of blue-chip DeFi tokens over time as the space evolves.

1. Aave: The Finnish ghost

Founded: 2017, rebrand to Aave in 2018

Founder(s): Stani Kulechov

Ticker: AAVE (was LEND until 2020)

Price performance in 2021: +104.78%

Decrypt Learn guide here.

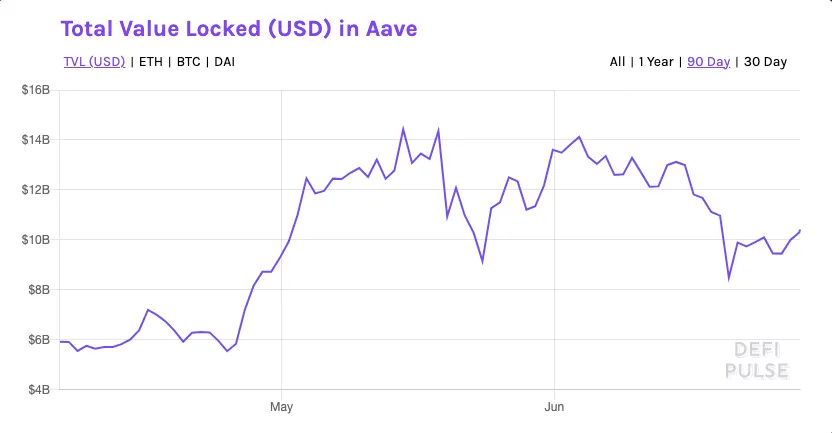

Formerly ETHLend, Aave began by allowing users to earn interest on their idle tokens by lending to borrowers. Unlike Big Bank alternatives, this activity is also entirely transparent on the Ethereum blockchain. Aave has built out this vision over the years, adding new features and even earning a payments license in the UK.

You can earn a variable interest rate on more than 20 different assets, ranging from the common to the exotic. This interest rate changes depending on the market’s demand to borrow said assets. If tons of investors want to borrow DAI, for example, then the protocol incentivizes lenders to lend DAI via attractive rates.

It’s a bit different when borrowing, though, as rates are both variable and stable. Today, it costs users11.8% in stable interest to borrow DAI and 3.61% in variable interest, with the stable rate remaining unchanged over a much longer period. Whether you like it or not, borrowing assets is a key market in DeFi. You might, for instance, be bullish on Ethereum and don't want to sell that Ethereum. At the same time, you may also want to invest in another project or simply wish to pay your bills with crypto dollars or euros.

Taking out a loan like this can be risky, though. If the value of the asset you borrowed against (called your collateral) drops, the protocol can begin to sell this underlying asset to make up your shortfall. This threshold is different for each asset on Aave. Each asset's risk parameters can be viewed here.

2. Uniswap: The decentralized unicorn

Founded: 2018

Creator(s): Hayden Adams

Ticker: UNI

Price performance in 2021: +195.44%

Decrypt Learn guide here.

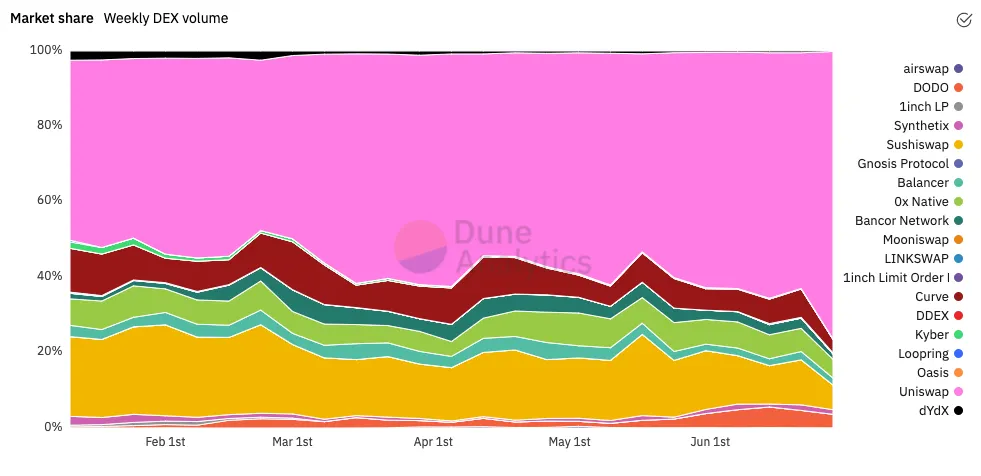

Built in 2018, Uniswap is crypto’s leading decentralized exchange or DEX, commanding more than 64.7%of the market share at press time. (Its closest competitor in this category is Sushiswap, a near-identical fork). Despite the growing number of decentralized exchanges, Uniswap has maintained its dominance for some time. This, as well as the excellent performance of its governance token, UNI, has earned the project its blue-chip status.

The UNI token was distributed in September 2020 via a retroactive airdrop. Anyone who had used Uniswap prior to the airdrop was awarded 400 UNI tokens, at that time worth roughly $1,400. Hayden Adams, the protocol’s creator, used it as a means to thank the community for supporting the exchange in the early days.

You can swap any Ethereum-based token on the market, and if it’s not included on the DEX, it’s simple to add that token by simply copying and pasting the smart contract address. After trading, you can also earn money by putting the assets sitting idle in your wallet into the protocol.

On Uniswap v2, there is a flat fee of .3% on all trades. This means that folks who add their coins to the exchange, called liquidity providers, earn .3% pro rata on every trade made for a specific token pair. Thus the pair with the highest trading volume also accrues the most fees. And the more money you add, the larger the share of those fees you can earn.

The arrangement is slightly more granular on Uniswap’s latest release, v3. Instead, liquidity providers can select a fee tier from .05%, .3%, and 1%. They can also specify a specific price range for which they would like to supply liquidity, meaning they would only earn fees if there are trades made within this price range.

3. SushiSwap: Cooking up dapps

Founded: 2020

Founder(s): “Chef Nomi”

Ticker: SUSHI

Price performance in 2021: +118.39%

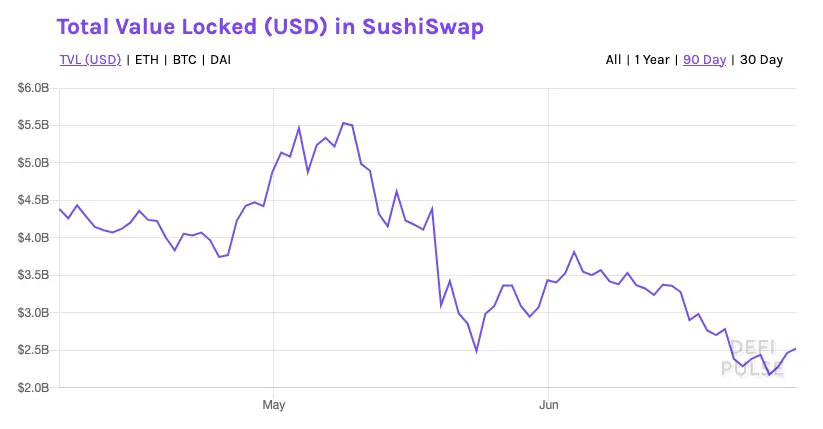

SushiSwap came out in August 2020 as a kind of Uniswap-meets-yield-farming DeFi app. These days, you can do most of the same things as on other super apps like Aave or Compound: there’s a decentralized exchange; lending market; and a mini network of dapps (called “BentoBox” dapps). You can stake its governance token, SUSHI, and vote on upgrades to the platform; and there’s a yield farming dapp called Onsen.

SushiSwap tagged along with the "DeFi summer" trend of naming complicated financial protocols after food, and distinguished itself by being by far the most successful and least scammy. It was created by an anonymous team of developers, led by "Chef Nomi" and stewarded by a community manager called 0xMaxi. Little is known about them, apart from that 0xMaxi is a very smart young man with a French accent.

The project was really started by Chef Nomi, but he did a runner last summer, withdrawing a couple million dollars from the protocol’s treasury with him. After much ado, he came back to the platform, returned all the money, and was swiftly excommunicated from development. 0xMaki became the de facto leader of the decentralized protocol, and the protocol has operated like this ever since.

SushiSwap is the 9th largest decentralized finance protocol, with $2.44 billion of value staked in its smart contracts, and its SUSHI governance token is up 108% in 2021 as more users pull up a seat at the sushi table.

4. Maker: DeFi’s central bank

Founded: 2015

Founder(s): Rune Christensen

Ticker: MKR, DAI (stablecoin), BRK (unit bias token)

Price performance in 2021: +200.93%

Decrypt Learn guide here.

Maker’s claim to fame is that it mints the market’s one of the only successful decentralized stablecoin DAI. Unlike centralized stablecoins like Circle’s USDC or Tether (USDT), DAI is backed by overcollateralized loans. Overcollateralized loans are loans made where the underlying asset exceeds the value of the loan.

A similar principle is at play with Maker. To mint $1 in DAI, users put up $1.5 in ETH. This is because the collateralization ratio on Maker is 150%. If the value of the collateral falls below 150% (i.e. $1.5 in ETH becomes $1.4), the protocol will begin selling the collateral to pay back the borrowed DAI as well as slap an additional fee as a penalty. One of the earliest tactics for speculators was to use Maker and generate leveraged longs on their ETH bids. After borrowing DAI against their ETH, they would then proceed to buy even more ETH using that borrowed DAI, and so on.

These days, the number of assets used for collateral is much higher and the collateralization ratio varies, asset to asset. In April, Maker and Centrifuge expanded beyond crypto, allowing users to mint DAI with physical real estate as collateral. The move offers a glimpse into a world where traditional finance and crypto are seamlessly integrated.

The most valuable aspect of Maker is DAI. But one concern has been the growing percentage of collateral in Circle’s USD Coin (USDC). This is because Circle has ultimate control over the activity of its token. In 2020, the firm even blacklisted an Ethereum address holding $100,000 in USDC. With more than 55.5% of all DAI backed by a centralized company, many DeFi purists have warned that the protocol may be deviating from its original objective.

Seems that @MakerDAO is doubling down on their reliance on $USDC in an effort to hold the dollar peg on the face of expected volatility in the market in the coming days.

That probably means we are going to see >50% $USDC backed $DAI? Its already at ~40%https://t.co/MMbNmy0FsS pic.twitter.com/2kuQacDMjQ

— Lefteris Karapetsas | Hiring for @rotkiapp (@LefterisJP) May 28, 2021

5. Compound: High-tech, high-interest savings

Founded: 2017

Founder(s): Robert Leshner

Ticker: COMP

Price performance in 2021: +60.88%

Decrypt Learn guide here.

Like a high-interest savings account, you can earn interest on various tokens on Compound. The range of tokens is slightly less varied than that of Aave, and it’s also missing some of the unique features that Aave has built out in the past few years.

Compound is credited with inventing yield farming at scale (then called “liquidity mining”) in June 2020. IDEX, a decentralized exchange, was technically the first project to do something like this in 2017, but it was a much smaller experiment. On May 27, 2020, Compound announced the launch of its COMP token. Distribution began on June 15, 2020, following the passing of Compound’s Proposal 007.

If you were lending or borrowing on the platform at that time, you began earning the COMP token as a bonus. You might, for instance, have been earning 2% on your DAI holdings; but during the yield farming event, you earned this 2% plus the COMP token proportional to your contribution within a given market.

The theory was that the event would incentivize new users to participate and earn the governance token, effectively decentralizing control over the protocol. That’s because users who hold the COMP token are also eligible to vote on issues like changing Compound’s logo or adding new assets.

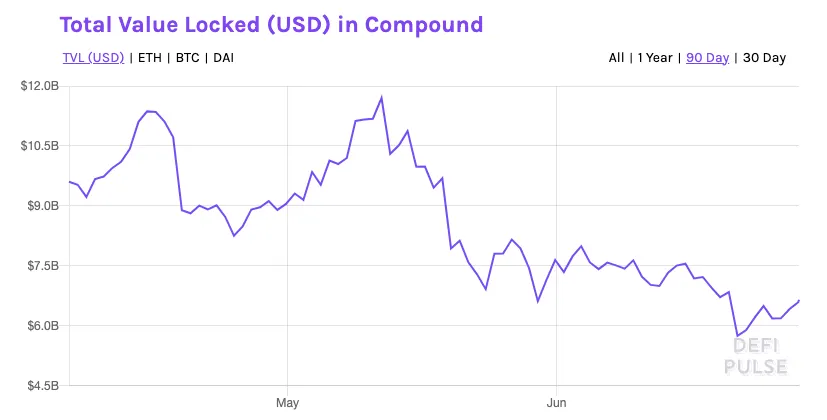

The protocol remains a top-five DeFi protocol in terms of total value locked (TVL). TVL is a general metric for measuring how much money a given project has “locked” in its smart contracts. As for future developments, Compound Labs is currently building Gateway, a multi-chain version of Compound.

6. Curve: Decentralized stablecoin trading

Founded: 2020

Founder(s): Michael Ergorov

Ticker: CRV

Price performance in 2021: +118.39%

For a layperson, you can understand Curve as a decentralized exchange that’s optimized for assets with the same relative value. An example of this kind of asset could be a stablecoin like USDC or Tether. Another example could be the various “wrapped” versions of Bitcoin, including WBTC and renBTC.

It’s also important to remember that though these assets aim to hold the same value, this is not always the case.The discrepancy is usually minimal, though, amounting to cents.

Still, money is money and many investors want to make sure they’re getting the best bang for their buck. This is especially true for large holders of these kinds of assets.

The number naturally increases as the size of this trade increases, with Curve coming out the winner on most occasions. What’s more, trading fees on Curve are much lower than on Uniswap. As mentioned above, Uniswap charges traders 0.3% while Curve charges 0.04%.

This enhanced efficiency is also important for those looking to lend and borrow their idle assets. As mentioned earlier, the rates for lending and borrowing on assets fluctuate based on supply and demand. DAI may be earning 3% on Compound, but USDC could be earning 7% on Aave. Thus swapping the former for the latter makes the most sense when seeking the highest returns. Using Curve means retaining as much value as possible.

Like Uniswap, Curve also allows users to earn interest for providing liquidity. There is also the Curve governance token, called CRV. Holders can propose and vote on various upgrades or changes to the protocol using this token.

7. Synthetix: Tokenized stocks

Founded: 2017

Founder(s): Kain Warwick

Ticker: SNX

Price performance in 2021: -37.68%

Decrypt Learn guide here.

Synthetix lets users create synthetic versions of traditional assets (like stocks and commodities) on the Ethereum blockchain. The platform calls them "synths."

These synthetic assets track the price of the mirrored asset through the use of data oracles, specifically Chainlink’s. As the price of gold (XAU), for example, rises, the price of synthetic gold (sXAU) follows in lockstep. Likewise, as the price of Tesla stock (TSLA) sinks, so too does the synthetic Tesla stock (sTSLA).

Synthetix also lets you create unique types of assets that may not exist in traditional finance. A user could create a synthetic asset that rises or falls in line with a country’s gross domestic product (GDP), for example. Similarly, you could create an instrument that tracks the popularity of top crypto influencers, rising as each influencer accumulates more followers.

Though neither of these examples exists at press time, Synthetix offers a platform to create such assets. To create them, holders of the native token, SNX, must make a Synthetix Improvement Proposal (SIP) and let the community vote on the proposal’s execution.

Like all the DeFi blue chips on this list, Synthetix’s token is also a governance token. But, beyond just voting on SIPs, the SNX token also plays a fundamental role in the stability of the protocol and the health of these synthetic assets.

This is because the synthetic Apple stocks, oil, and global currencies are difficult to trade outside of the Synthetix ecosystem. For instance, sOIL, an asset that tracks the price of oil, is not listed on Coinbase. And though the contract address can be added manually on Uniswap and on DEX aggregator 1inch, there isn’t enough liquidity to efficiently execute the trade. To buy them, users must mint the protocol’s native stablecoin, sUSD. And to do that, users must first stake their SNX. This is a similar mechanism as Maker’s DAI minting process.

Staking SNX does bring with it a host of incentives. Users who stake their tokens are also eligible to earn fees generated anytime a synthetic asset is traded throughout the entire platform. This fee is 0.3% at press time. Stakers also enjoy handouts as part of the protocol’s inflationary rewards on a regular basis.

You'll notice that the SNX token has vastly underperformed its blue-chip peers this year. Some likely reasons for this are the complexity of the protocol, and mounting competition (Solana, for example, is now listing tokenized stocks on its blockchain). Still, Synthetix is one of the original DeFi protocols in the space, with many projects taking ideas from it for their own approaches.

8. Yearn: Yield farming for dummies

Founded: 2020, Formerly iEarn Finance

Founder(s): Andre Cronje

Ticker: YFI, WOOFY (unit bias token)

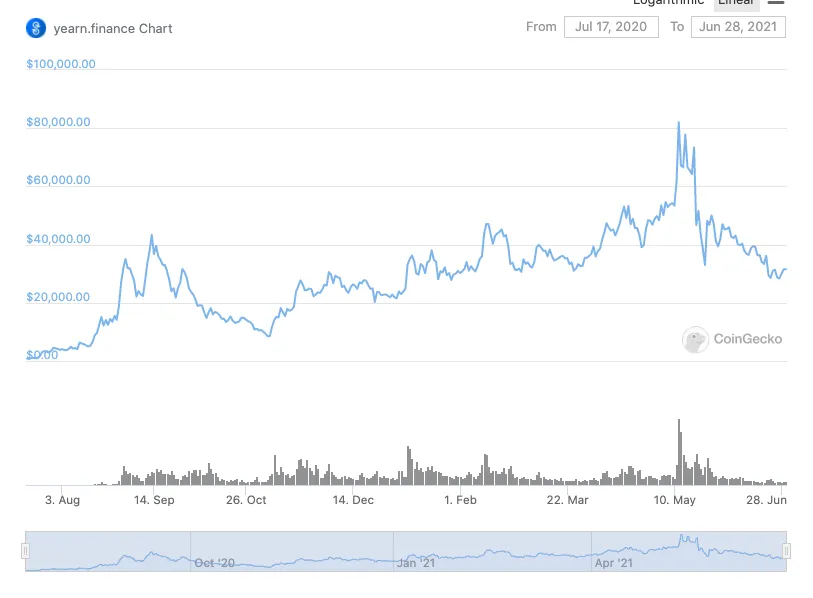

Price performance in 2021: +19.87%

Yearn Finance launched in 2020 as an aggregator of DeFi interest-earning services that found users the best rates without needing to constantly move funds and rack up gas costs. It’s the equivalent of going to Bankrate to find out which bank offers the highest rate for a savings account. But instead of having to pick only one account, you just deposit your funds to Bankrate and the company automatically selects the highest rates even as those rates change.

The biggest difference, of course, is that Yearn (like all of DeFi) is made up of lines of code available to anyone with an Internet connection rather than a centralized bank or equivalent. This specific service from Yearn is called “Earn” and is just one of a handful that the project offers.

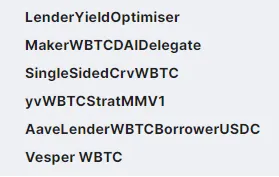

Instead of aggregating interest rates, Yearn’s “Vaults” have more flexibility in how they generate returns. If, for example, you deposit some of your Wrapped Bitcoin (WBTC), an ERC-20 token that tracks the price of Bitcoin, the Vault will execute a variety of operations to yield users a current return of 0.57%.

Let’s unpack one of these strategies. The “MakerWBTCDAIDelegate” strategy takes your deposited WBTC, deposits this into Maker to mint DAI, then takes this newly-minted DAI and re-deposits it into another Vault called the “DAI Vault.” The DAI Vault then executes a variety of additional operations to earn yield. Once earned, the DAI is then converted back into the original asset deposited, in this case, WBTC, as interest earned.

For finance junkies, Yearn’s Vaults are not dissimilar from how a hedge fund operates. Users put money in, pay a fee (currently there is a 20% performance fee and a 2% management fee), and earn returns. Hedge funds are, however, renowned for being black boxes. Yearn Vaults are all fully visible on sites like Etherscan.

After Earn and Vaults, there’s also the Yearn token, YFI. This token was distributed via a yield farming mechanism, with only 30,000 tokens total. It, like every other DeFi blue-chip token, is a governance token that lets users vote on various issues for the protocol. None of this allocation was set aside for the project’s creator, Andre Cronje. Unlike other blue chips, however, YFI is also one of the most expensive tokens, worth just less than one Bitcoin at press time.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.