This is exactly what decentralization advocates warn about: CENTRE, the issuer of USDC, has blacklisted an Ethereum address holding $100k of the tokens.

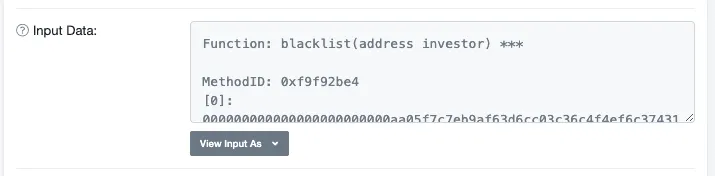

Centre called a “blacklist(address investor)” function on an Ethereum address holding USDC, effectively freezing the money in the address. The entity, which is a joint venture between Coinbase and Circle, said it was complying with law enforcement.

“Centre can confirm it blacklisted an address in response to a request from law enforcement. While we cannot comment on the specifics of law enforcement requests, Centre complies with binding court orders that have appropriate jurisdiction over the organization,” according to a company statement cited by CoinDesk.

USDC is backed at 1-to-1 with US dollars held in banks, and issuing and redeeming the token for dollars requires complying with know-your-customer procedures. Advocates of alternatives that don’t rely as much on third parties have long criticized USDC and others like it, for being susceptible to censorship and interference. The blacklisted Ethereum address, whose owner is unknown, is an example of that.

Questions on Dai

The blocked address also raises questions about the most popular decentralized stablecoin Dai, as USDC is used as collateral to issue it. This means law enforcement could potentially interfere with USDC held in MakerDAO. Still, the stablecoin is just under 12% of total ETH collateral, which means Dai would likely survive the shock.

DTC Capital’s Spencer Noon made the point that only 31 addresses have ever been frozen for holding USDT out of 1.47 million (0.002%), and only 1 address has ever been frozen for holding USDC out of 182k (0.0005%).

Still, the fact that it can be frozen undermines the very point of cryptocurrencies: To provide a censorless financial system, that’s a viable alternative to the incumbent one.

[This story was written and edited by our friends at The Defiant, and also appeared in its daily email. The content platform focuses on decentralized finance and the open economy and is sharing stories we think will interest our readers. You can subscribe to it here.]