The market capitalization of the entire crypto industry has plummeted in the past 24 hours, falling from $2.8 trillion to roughly $2.5 trillion. And though leading cryptocurrencies like Bitcoin and Ethereum have both seen their prices tumble, one token is showing surprising resilience: BAT.

Basic Attention Token (BAT) is currently up 9.9%, at press time, after hitting an all-time high of $1.81 earlier this morning. The cryptocurrency is currently trading at $1.52, according to CoinGecko.

BAT is the native cryptocurrency for the privacy-centric web browser Brave. Instead of tracking users’ behavior and showing advertisements based on that behavior, Brave allows users to earn BAT for voluntarily viewing advertisements. They can also block all advertisements, but won’t earn any rewards for doing so. The coin was launched in 2017 via an initial coin offering (ICO), earning the firm $35 million.

The token’s latest rise is, however, difficult to pin on any one event—but recent announcements and updates from Brave do offer some justification.

Earlier this month, for example, the browser expanded beyond the Ethereum network and launched an integration with the Solana network.

Like Ethereum, Solana is a smart contract-enabled crypto network, but boasts higher throughput and lower fees. It is for these advantages that Brave turned to Solana. The firm added that they would also roll out a Solana wallet integration at the beginning of 2022.

Still, the Solana integration has been the only large piece of news around Brave and BAT.

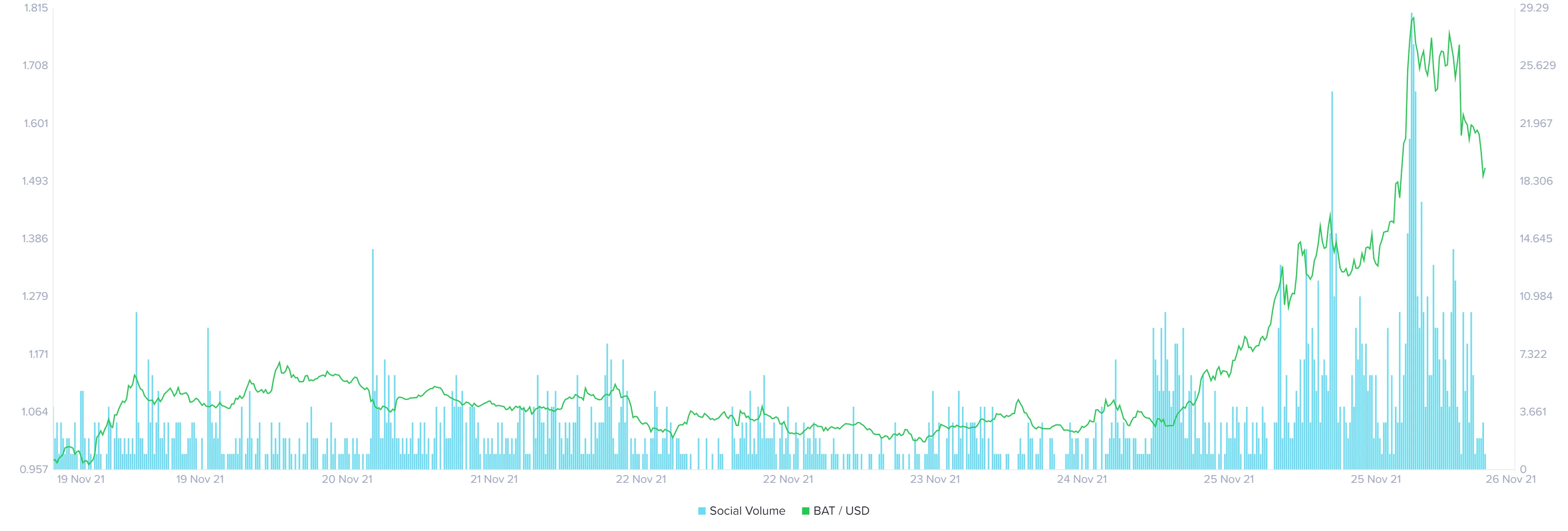

Pulling data from Santiment, specifically social trends around the keyword “BAT,” provides further insight. The chart below indicates that a lot of chatter on Twitter, Reddit, and Telegram for this term began picking up on November 24.

This metric exploded on November 25 and November 26 alongside the price of the cryptocurrency.

But while BAT and Brave appear to be the topic of discussion this Thanksgiving, the broader crypto market did not enjoy the same kind of bullish attention.

BAT flies high while Bitcoin, Ethereum falter

The leading cryptocurrencies, Bitcoin and Ethereum, have dropped 6.7% and 8.1% over the last 24 hours, respectively. Their downward trend has extended to other top coins, with Binance Coin (BNB) falling 9.9%, Solana (SOL) dropping by 10.2%, and Cardano crashing 8.8%.

Cardado’s rout appears to be closely related to news that the trading platform eToro is restricting U.S. users from buying the coin after Christmas. ADA is down 15.0% over the past week.

Popular metaverse and NFT-related cryptocurrencies like Immutable X (IMX), Enjin Coin (ENJ), and Decentraland (MANA) have all fallen hard too. Just two days ago, MANA hit an all-time high of $5.30 but now trades at $4.57 at press time.

The market dip has also shed roughly $3 billion from the industry’s entire market capitalization. It is currently hovering around $2.5 trillion at press time.

It should also be noted that the crypto sector’s market cap on Thanksgiving last year was barely $550 billion, a fraction of today’s sum even amid such bearish conditions.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.