Smart contract blockchain Tron saw its usage surge in the last quarter of 2022, according to a new report from market intelligence firm Messari.

The State of Tron report, commissioned by Tron, showed double-digit quarter-on-quarter growth across key metrics in Q4 2022. Average active daily addresses increased by 17.9%, with 1.3 million new accounts added on December 10 alone. Average daily transactions increased by 22.4%, while total quarterly revenue grew by 25.3%.

Smart contract execution and transfers of Tron's native cryptocurrency, TRX, accounted for 90% of total transactions over the quarter, while the amount of TRX staked remained statistically even.

State of @trondao Q4 2022 is LIVE.

Link to the FREE Tron quarterly report from @JamesTrautman_ in the tweet below ⬇️ pic.twitter.com/rcqFxpXAHe

— Messari (@MessariCrypto) February 8, 2023

Messari identified several possible reasons behind the spike in activity during December, including a delayed reaction among users to the collapse of FTX, with previously-dormant users “moving assets on TRON and seeking refuge in USDT.” Other possible catalysts include the launch of TCNH, an Offshore Chinese Yuan-pegged stablecoin, on the Tron network, and the passing of a proposal to adjust the native token TRX’s staking rate and burn volume.

As a result, 38% more TRX was burned in December than in October, with Messari reporting that as a result, “TRX continues to be deflationary.”

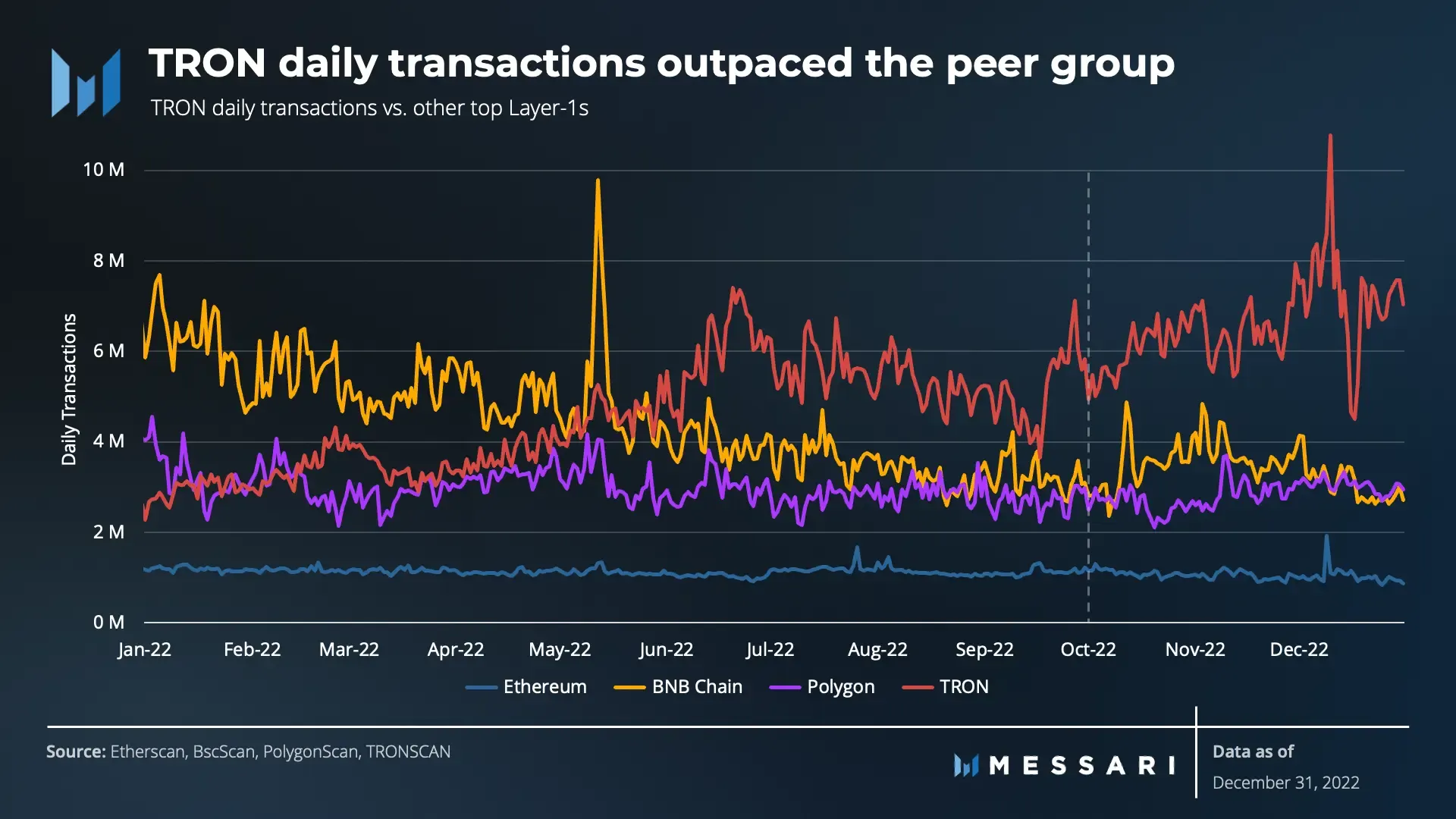

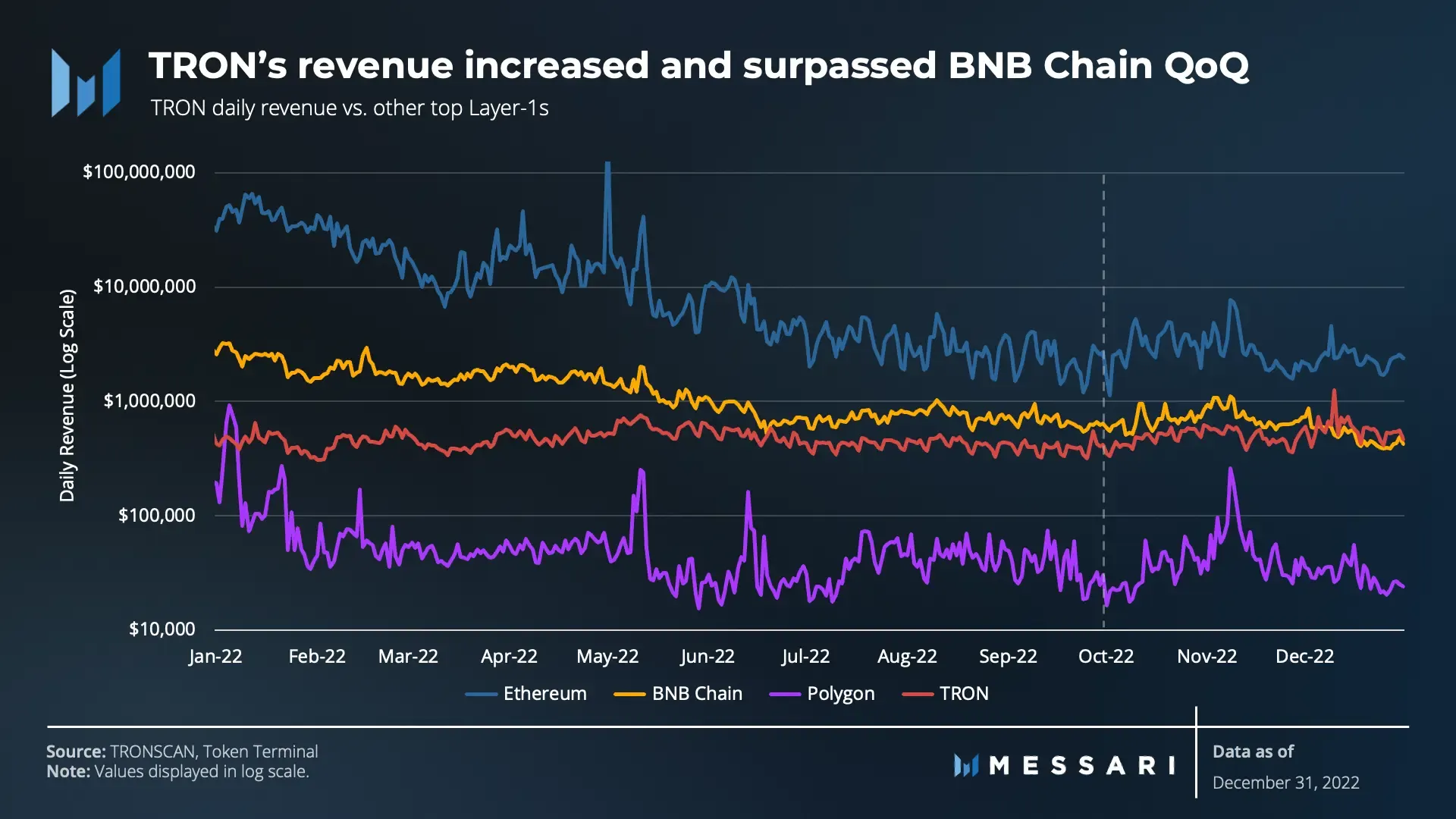

Relative to its “peer group” of layer 1 smart contract blockchains, Tron saw six times the number of daily transactions compared to Ethereum, twice that of Polygon, and nearly twice that of BNB Chain. Tron also led the way in terms of percentage of total revenue increase in Q4, and gained 2% of the peer group’s stablecoin market share.

However, Tron continues to lag behind its three rivals in the number of protocols using its network. Along with a number of its peers, Tron’s valuation declined over the quarter, ending Q4 down 11%; Messari attributes this to the impact of the FTX collapse on crypto prices.

Other key developments in Q4 flagged by Messari include the launch of the GreatVoyage-V4.6.0 (Socrates) client to improve network functionality, the integration of the TronLink wallet with Android and iOS and the launch of staking features, and Dominica’s designation of Tron as its national blockchain–along with its adoption of seven Tron-based cryptocurrencies as legal tender in the country.

Developer activity on the network remained healthy in Q4, with over 1,100 participants across 270 teams participating in the third season of its Grand Hackathon. Winners shared a $1.2 million prize pot. The fourth season of the hackathon kicked off on February 1. Tron also launched the Tron Academy with blockchain-club partnerships across seven leading universities, including the first ever “Hacker House” on the Harvard University campus.

Application usage on the Tron network increased in Q4, and smart contract triggers were up by around 45% QoQ. Q4 also saw the $1 billion TRON DAO Ecosystem Fund launch the TRON DAO Ventures (TDV) accelerator, in hopes of attracting more developers into the Tron ecosystem.

The state of USDD

Tron’s overcollateralized dollar-pegged stablecoin came under the microscope in a second Tron-commissioned Messari report, The State of USDD Q4 2022. The market intelligence firm found that the number of USDD holders increased 8% in Q4; an expected slowdown in growth from the previous quarter, which saw USDD holders surge 480.4%.

State of @usddio Q4 2022 is LIVE.

Link to the FREE $USDD quarterly report from @john_tv_locke in the tweet below ⬇️ pic.twitter.com/FCbtyrtL3B

— Messari (@MessariCrypto) February 1, 2023

Circulating volume of USDD increased by 27.3% QoQ, while the volume of USDD per transaction increased by 27.3% in the same period, averaging 210,000 USDD. USDD’s supply remained the same between Q3 and Q4. Messari identified a pattern of large USDD transactions occurring at the beginning of the month, which could be attributed to a lending strategy rebalancing or capital infusion activity.

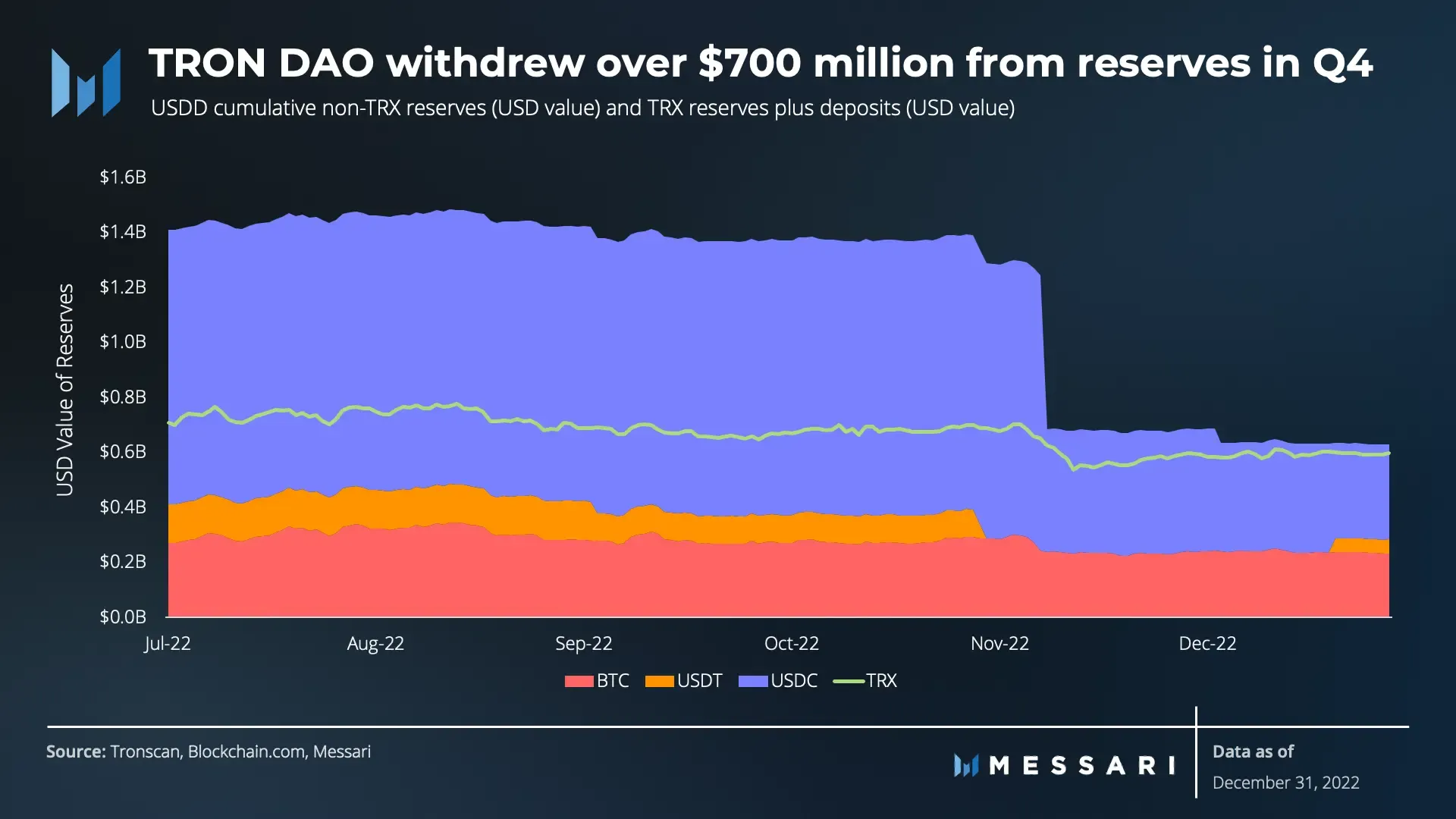

Messari noted that throughout Q4, USDD has traded below its dollar peg. USDD’s value is backed by the over-collateralization of crypto assets under the Tron DAO Reserve, including Bitcoin, USDT, USDC, and TRX. Messari found that TRX balances in the TRON DAO Reserve remained the same from Q3 to Q4. Excluding TRX, the collateral ratio for USDD is below 1 at 0.87; with TRX included in the reserve wallets and deposited in the burn account, the collateral ratio is 1.7.

Source: MessariAmid November’s market volatility around the collapse of FTX, the Tron DAO Reserve announced buybacks of 300 million and then 1 billion USDT. Messari reported that these changes removed 653 million USDC and 100 million USDT from the reserve wallets, while 50 million USDT was added back in December.

Meanwhile, adoption of the stablecoin across commerce platforms continues to grow, with USDD added as a payment option by travel firm Travala in October (note: USDD is not currently accessible via a U.S. based exchange).

Taken together, the reports “indicate steady strength, ongoing growth, and a bright future both for the Tron network and the USDD stablecoin,” a spokesperson for Tron told Decrypt. They added that, “Tron is resolved to build the future of commerce and community for every human on the planet.”

Brought to you by Tron

Learn More about partnering with Decrypt.