The state of NFTs isn’t all doom and gloom amid the bear market.

The total volume of Ethereum NFT trades has declined by 55% in the past month, from 1.3 million ETH to just 584,000 ETH, according to Nansen data. That’s a drop from just under $2.6 billion to about $672 million, which is roughly a 70% decrease when valued in USD.

Ethereum’s price has fallen about 43% in the past month. “Blue chip” NFT prices haven’t risen to compensate, however, meaning less money is changing hands overall.

Among the top five ranked NFT collections on OpenSea, average prices in ETH have remained more or less stagnant, with Bored Ape Yacht Club NFT prices still hovering around 100 ETH. CryptoPunks are an exception, which saw buy-in floor prices increase 48% in part due to Christie's head of digital sales becoming the Punks’ new brand lead this month.

NFT traders are still buying and selling these unique blockchain tokens that signify ownership over digital art—they’re just buying cheaper ones and “apeing” into free mints like Goblintown, which started a wave of free-to-mint NFT collections centered around bodily waste, nihilism, and memes.

Per CryptoSlam data, the average sale price for an Ethereum NFT went from $2,463 in May to just $703, a 71% decrease. So as the crypto bear market continues, NFTs are being purchased for less overall.

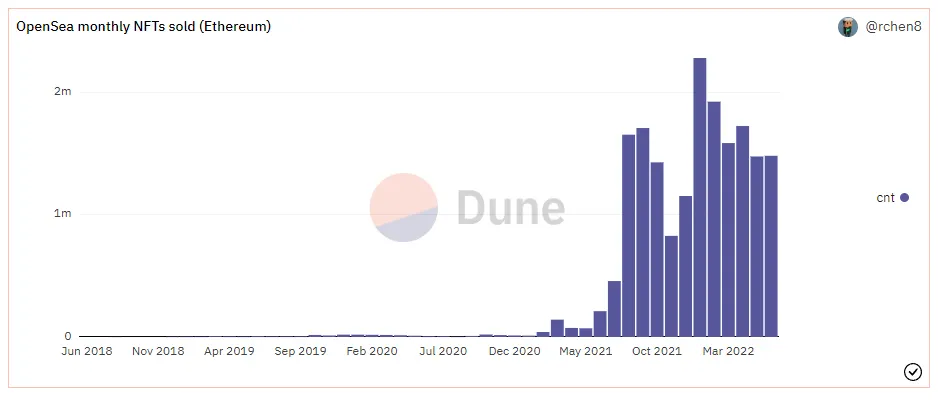

In May, OpenSea saw 1.478 million NFTs sold on its platform. In June, 1.476 million were sold as of Wednesday, meaning it’s quite possible more NFTs will actually be sold this month compared to the month of May. May’s numbers were also heavily propped up by Yuga Labs’ Otherside NFTs, which saw $561 million traded within 24 hours.

When it comes to the total number of traders, OpenSea saw a modest 6.5% increase in registered users who have made at least one transaction on its marketplace, according to Dune data. The number of active traders for Ethereum NFTs has only declined slightly, a 16% decrease from about 422,000 to 354,000.

The number of weekly active NFT projects seeing sales hasn’t declined much either, according to Nansen data. Compared to last month, the same number of NFT collections—three—are seeing more than 10,000 sales. The number of collections seeing more than a thousand sales is only down 30% this month, from 109 to 76. This means NFT creators, especially in collections with the highest market caps, are still seeing sales.

So while overall volume might be down 55% to 70% in ETH and USD, respectively, traders are still making moves. For now, it looks like NFT enthusiasts haven’t yet lost hope, even though they’re now buying and selling for less.