In many respects, 2021 was a huge year for crypto—and it was underpinned by growth in the NFT space, according to research from crypto analytics platform Nansen.

According to Nansen's State of Crypto Industry Report 2021, by the end of the last year total sales volume in the NFT space surpassed a staggering 4.6 million ETH, or estimated $17 billion, with two major spikes occurring in May and August.

The August surge was particularly strong, sparked by the fervor surrounding Bored Ape Yacht Club spin-off Mutant Ape Yacht Club. It resulted in an unprecedented peak above 132,000 ETH (over $422 million) in combined trading volumes in one single day on August 29.

It formed just one of the drivers for growth in the NFT space over the year, Nansen CEO Alex Svanevik told Decrypt.

"It’s hard to point to one individual event that created the NFT wave,” Svanevik said. "Was it Axie Infinity pioneering play-to-earn? Or OpenSea becoming a behemoth marketplace for trading jpegs? Or perhaps Bored Apes making celebrities ape into the trend? This was truly a movement with plenty of projects playing an important role."

“Instead of convincing people to buy Bitcoin based on Austrian economics, we figured out that flipping JPEGs of cartoon animals might be a better strategy,” claims the report.

Ethereum faces more competition

The explosive growth of NFTs over the past year is illustrated by the surge in gas use for the leading NFT marketplace, OpenSea; according to Nansen, in September and October, it became the only project to exceed gas usage for the market’s leading decentralized exchange (DEX) Uniswap.

The process of creating, or minting, NFTs, is still largely happening on the Ethereum blockchain, meaning that NFT creators bear the associated costs.

As the report notes, Ethereum still remains the biggest smart contract platform in terms of market cap and total value locked (TVL) across decentralized applications (dapps). However, high gas prices, which skyrocketed over the course of the last year, opened up “opportunities for Layer 1 and L2 solutions to flourish as the much needed scalable solution.”

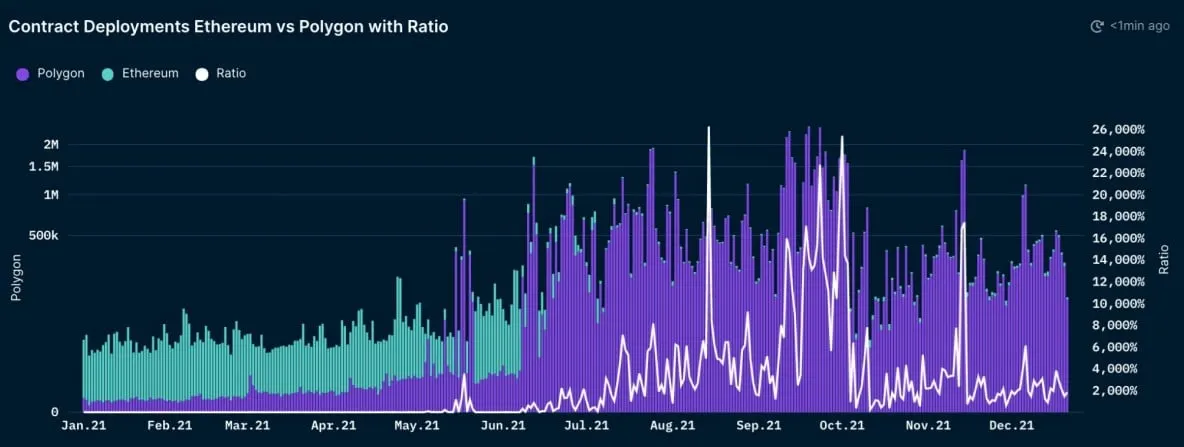

With other chains offering cheaper alternatives, as well as EVM compatibility, contract deployment on the Ethereum blockchain plummeted in the second half of 2021—from 2.7 million contract deployments in June to only 300,000 in October.

At the same time, smart contracts deployed on Polygon, an interoperability and scaling protocol for creating Ethereum-compatible blockchains and Layer 2 scaling solutions, surpassed Ethereum by up to 26,000%.

Ethereum’s other notable competitors include Binance Smart Chain, which over the course of the year boasted the highest number of daily active addresses among all L1 chains, and Fantom, a proof-of-stake blockchain seeking to solve such scalability issues as the cost of transactions, throughput, and time to finality.

Celebrity NFTs

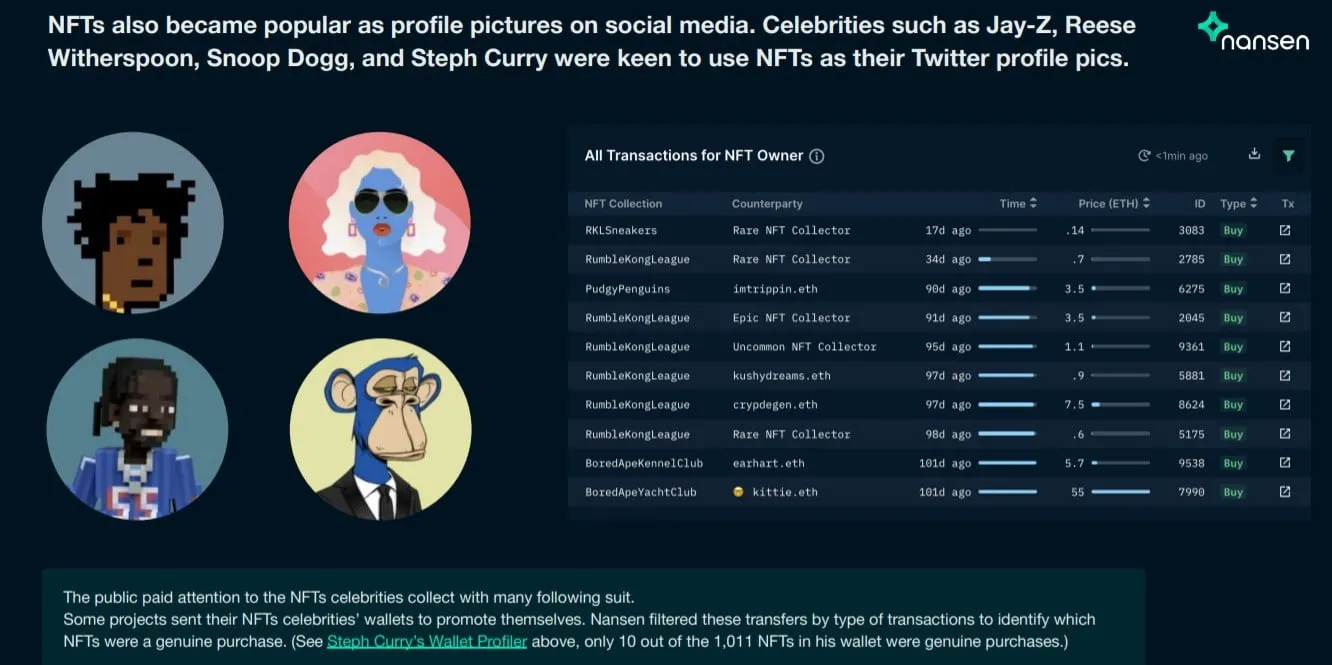

While NFTs became hugely popular among celebrities, with many of them using digital art for their profile pics on social media, Nansen claims that not all of their purchases were in fact genuine—with many projects sending NFTs to celebrities' wallets in order to promote themselves.

For example, after filtering transactions to the wallet of NBA star Stephen Curry, Nansen found that only 10 out of the 1,011 NFTs in the wallet associated with the NBA star were genuine purchases.

Still, as the market matured, reputable NFT projects with high liquidity became valuable commodities, something that led Nansen to introduce the NFT Bluechip Index, a basket of 20 most valuable and liquid NFT collections, including the likes of iconic CryptoPunks and the Bored Ape Yacht Club.

Metaverse growth

According to Nansen, themes that were big in 2021 will strengthen further this year, however, “winners will emerge based on the quality and number of dapps,” with low fees and little withdrawal delays to play a crucial role on the road to success.

The firm added that while NFTs “achieved a mainstream breakthrough” in 2021, early indicators also show a growing trend of investment in metaverse and gaming utility.

“Multi-chain, DeFi, and NFTs are here to stay. In particular, NFTs have already started the year strong, and we’ve only scratched the surface of their potential in gaming, art, and social networks," Svanevik told Decrypt.

Singapore-based Nansen offers investors and traders a network of real-time dashboards and alerts focused on such areas as decentralized finance (DeFi) and non-fungible tokens (NFT). Through its Smart Money platform, Nansen enables customers to perform due diligence, discover new opportunities, and make strategic portfolio decisions.

Currently, Nansen covers Ethereum (ETH), Polygon (MATIC), Binance Smart Chain (BSC), Fantom, Avalanche, Arbitrum, and Celo, while Solana integration is expected to go live in the coming weeks.