This article was updated after it was published with comments from Eric Conner, an Ethereum advocate who works at prediction market Gnosis.

Ethereum mining isn't what it used to be.

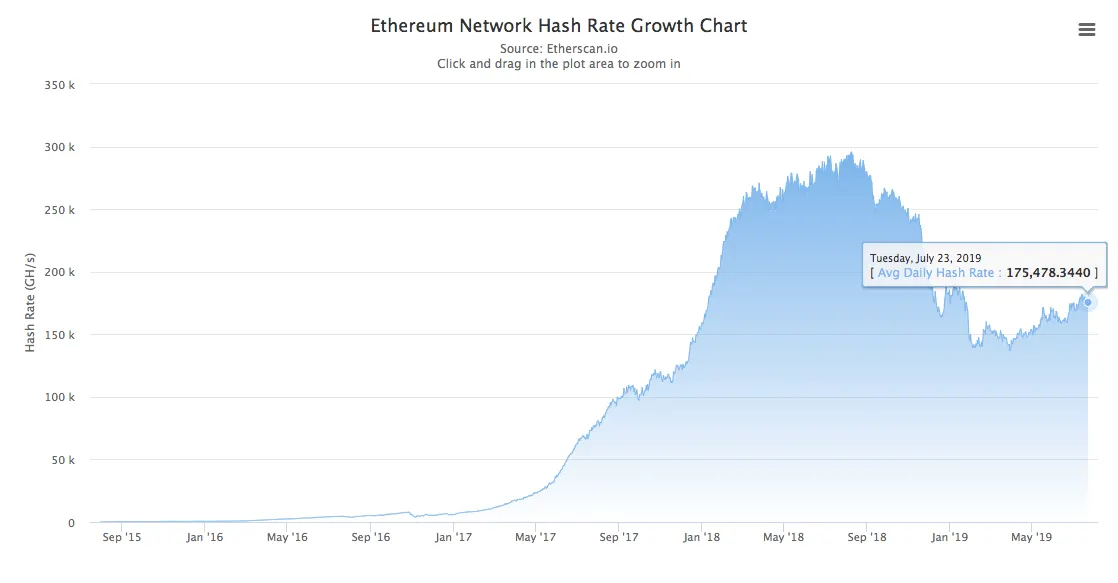

The second-largest cryptocurrency by market cap has struggled with its mining hashrate in 2019, according to hash analytics site, Long Hash. The hashrate remains 42 percent below what was seen during Ethereum’s high of 295 GH/s back in August 2018. It now hovers at around 175 GH/s.

Mining hashrate for proof-of-work coins like Ethereum is an indicator of a coin's security. The higher the hash number, the more difficult it becomes to sabotage the network using a 51 percent attack. It's also a figure used to measure the general health of the network–the higher the hashrate, the more miners there are and ultimately, the more interest there is.

That said, Eric Conner, an Ethereum advocate and who researches product at Gnosis, said that the findings were very misleading. "Comparing hash rates across chain is a generally poor metric due to different algos and equipment that can be used on each," he tweeted, after this article was published. "Ethereum's hash is something like 4x higher than the first time it passed 200."

Moreover, Conner said the proof is in the pudding: "The Ethereum community decided to cut the block reward 33%. A drop in hash with that, and price down 80%, is expected. It’s still extremely costly to attack, and hasn’t happened. [This] article makes it sound like an easy thing to do."

Still, others believe that Ethereum is suffering due to bitcoin’s increased market dominance, which now hovers at 65 percent. Altcoins have struggled to capture the attention of miners. Ethereum's hashrate isn't the only project that's suffered in this bitcoin bull market. Bitcoin Cash and Bitcoin SV's hashrates are all substantially below previous highs.

By comparison, bitcoin’s hashrate recently cracked a new all-time high - 79.7 TH/s - beating its 2018’s best by a substantial 22 percent.

What does this all mean for the network's security? It comes down to how much computer power, and cash, a bad actor needs to burn in order to take control of a network.

With bitcoin's hashrate soaring, it would cost $850,000 per hour to attack the network and take control of transactions. Ethereum, meanwhile, supposedly costs $100,000 to achieve a 51% attack. The bitcoin forks even less.

Some say it's a tough time to be an E-maximalist, with Ethereum currently bogged down by in-fighting. That's totally untrue, said Conner: "We aren’t bogged down by in-fighting. That’s sensationalist BS."