In brief

- Catch-all blockchains have been hugely popular, but aren't suitable for all use cases.

- That's led to a rise in use-case-specific projects to serve different business needs.

When blockchains were first devised by the mysterious coder Satoshi Nakamoto in 2008, the design and purpose of these were simple: create a secure public ledger of all transactions on one network.

Some 13 years later, the success of Nakamoto's invention is clear: Bitcoin has a market capitalization of more than $1 trillion, and hundreds of billions of dollars are traded and recorded on the ledger every day.

Since that eponymous moment, blockchains have been rolled out and used in a variety of different ways. From other cryptocurrencies - Bitcoin’s source code alone has been cloned 105 times - to nation-states borrowing the technology to create their own digital currencies or CBDCs, to shipping giants like Maersk using it to help track items as they move along supply chains.

But while this technology has been revolutionary, as it has become more successful, so have the number of challenges it faces. The first of which is speed.

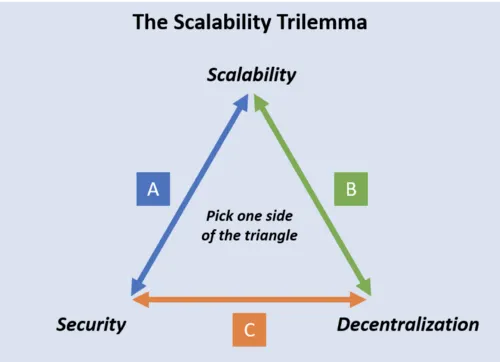

The holy grail for blockchain projects is to create a network that can process thousands of transactions per second, is secure, and adheres to the ethos of being decentralized, i.e. run without the need for centralized control.

This trinity of features, referred to as the “scalability trilemma” by Ethereum co-founder Vitalik Buterin is an idea imported from computer science to describe how realistically, a network can only ever focus on two of these principles, often at the expense of the third.

In the case of Bitcoin, its network has a high degree of security and is decentralized - there is an ongoing debate about the increased centralization in the mining community of Bitcoin but as a rule, it's considered decentralized.

That’s led to problems around the network’s scalability. The Bitcoin network can only process 7 transactions per second, thanks to the constraints placed upon it by its anonymous creator.

By comparison, Visa processes somewhere in the region of 65,000 transactions per second. Ethereum suffers from a similar problem. It’s considered decentralized, and secure, but can only process (in its current form) 25 transactions per second.

Catch all blockchains

As both networks become busier, the cost per transaction goes up. Thanks to the recent NFT craze on Ethereum, the cost to send a transaction has been skyrocketing, irrespective of what’s being sent.

As a result, Bitcoin and Ethereum are considered “catch-all” currencies, good for building most things, but not particularly great at serving specific needs.

Take Ethereum. Its smart contract infrastructure allows for a vast array of different use-cases: digital identity, data recording, supply chain management, insurance, even mortgages can be built on top of smart contracts on the network. But there are limits.

If any of those use cases require speed, for example, it might not be suitable. On Bitcoin, transactions take minutes, or hours, depending on how busy the network is to complete. Ethereum has a similar issue - not to mention fluctuations in the price of gas.

These blockchains can be best thought of as single-lane highways - all traffic has to move along the same road. The more traffic, the slower the network becomes. In addition, as more and more data is added to the network, more space is required to keep a full log of all transactions.

Storing a copy of either Bitcoin or Ethereum’s networks requires more than 300GB of hard drive storage.

Computational access

The second challenge with catch-all blockchains is access to dedicated computational resources. If you need something in a hurry, there is little you can do beyond paying higher fees. Lastly, the architecture of a blockchain like Ethereum isn’t customizable, meaning a business has to operate within the confines of the network.

These issues have led to a flurry of projects embarking on building distributed ledgers that target specific use cases.

Solana was created to more easily track historical events or transactions in a specific sequence. Algorand too has focused on building a highly scalable network targeted at event tracking for the financial services industry.

The Flow network meanwhile, is designed to handle NFTs at scale by splitting the validation tasks into four separate types: consensus, verification, execution, and collection.

Another network built with a specific use-case in mind is Taraxa, a public ledger platform designed to capture informal transactions and agreements in a fast, verifiable way, to ultimately build a tamper-proof audit log of transactional data.

The vast majority of the world's transactions are informal, and are often un-verified. Blockchain networks like Bitcoin and Ethereum are too slow and too expensive for the vast majority of smaller-scale, everyday agreements. Even away from the world of web3, this problem persists in industries as diverse as peer-to-peer lending and construction.

Purpose-built Blockchains

Taraxa aims to solve this by building a network specifically for the task. It tracks off-chain and off-line transactional agreements using audit logs to hold stakeholders in informal, unstructured agreements accountable, making the agreements themselves trustworthy.

In a broader sense, informal transactions in large quantities can reveal a great deal about the person or entity that's committing them on-chain—which promises to introduce new ways to track and verify reputation online.

"This kind of data creates signals for a wide range of use cases: user social profiles, trading tokens and NFTs, non-collateralized finance and DeFi, and a basis for a whole new class of crypto assets," Olga Grinina, Taraxa's head of marketing, told Decrypt.

Taraxa’s network is also designed to complete transactions as fast and securely as possible, without penalizing users with high fees.

As we mentioned earlier, catch-all blockchains like Bitcoin and Ethereum are single-lane highways. A network like Taraxa uses a graph instead of a single chain of blocks, known as a DAG or Directed Acyclic Graph to create a multiple-lane highway.

To reach consensus, instead of proof of work, the nodes on the network follow an innovative and rapidly convergent ordering mechanism to reproduce PoW's security without the carbon footprint.

Taraxa's consensus mechanism is also capable of accommodating multiple block proposals instead of having to discard all but one like in traditional single-chain networks such as Bitcoin or Ethereum.

This system is better suited to capture high-volume transactions quickly and simply. Taraxa’s network can handle 5,000 transactions per second, with a latency of less than a second and a settlement time of fewer than four seconds. For comparison, Ethereum can only handle 15 transactions per second, with a latency of 20 seconds and a settlement time of around 6 minutes.

It’s also explicitly designed to handle a variety of different transactions and data recording events including audit logging, identity, and key management as well as data classification and visualization - none of which traditional blockchains are capable of doing.

The result is a network with a specific audience and user base in mind, rather than a blockchain that’s trying to push different industries, processes, and protocols through the same shaped hole.

Sponsored post by Taraxa

Learn More about partnering with Decrypt.