In brief

What drove the surge in adoption?

$65,634.00

-2.36%$1,929.72

-4.53%$611.79

-1.55%$1.35

-2.52%$0.999905

-0.01%$81.64

-4.95%$0.282565

-1.10%$1.046

2.66%$0.093352

-3.38%$48.98

-2.49%$0.277787

-2.41%$0.999742

-0.01%$464.10

-3.32%$8.80

0.31%$27.36

-3.05%$0.169346

-1.84%$8.72

-3.76%$334.40

-2.30%$0.999151

-0.01%$0.157824

-2.04%$0.999967

-0.02%$0.0092988

-1.51%$0.099896

-1.81%$0.998597

-0.15%$54.23

-1.98%$8.93

-3.36%$218.44

-8.34%$0.899261

-2.91%$0.00000578

-2.96%$1.29

0.48%$0.075711

-1.80%$0.111387

-3.71%$5,250.58

1.43%$1.63

4.13%$5,281.21

1.40%$1.43

-0.61%$3.72

-2.57%$0.63174

-0.99%$1.00

0.00%$1.12

-0.12%$0.99993

-0.00%$0.996856

-0.05%$0.693587

-1.07%$112.05

-1.87%$174.94

-3.79%$76.27

-1.68%$0.170519

3.10%$0.00000369

-3.32%$0.067113

-2.66%$2.17

-2.14%$0.999742

0.00%$0.0000016

-1.18%$1.089

-1.76%$2.49

5.11%$8.64

-2.00%$0.999126

-0.02%$0.256836

-2.88%$11.00

0.01%$0.108313

-1.29%$6.95

-2.02%$0.389781

-1.97%$8.34

-2.85%$0.00179101

3.05%$1.83

-2.31%$0.057727

-4.12%$63.80

-0.02%$1.85

-0.45%$0.01619459

-2.87%$0.850902

-0.81%$0.102331

-2.15%$1.00

0.01%$0.02995812

-4.73%$1.24

0.14%$0.00931155

-2.05%$3.38

-2.16%$0.086217

-2.29%$114.42

0.01%$1.00

0.01%$0.992706

-1.95%$0.036099

2.30%$0.940419

-1.59%$1.028

0.01%$1.41

-1.13%$1.11

-0.96%$0.03384118

-3.24%$0.00735661

-2.53%$0.618485

-26.88%$0.081322

1.21%$35.56

9.44%$0.100116

1.57%$1.096

0.01%$0.998077

-0.03%$0.152146

-1.53%$1.00

-0.01%$0.00000595

-1.83%$0.01281046

-0.81%$0.999483

0.05%$0.259342

0.16%$1.089

0.09%$1.18

0.14%$0.068725

-2.02%$1.001

-0.06%$0.677728

2.44%$1.29

-0.86%$0.00677329

-1.52%$33.41

-2.29%$0.04765719

0.03%$0.230553

-10.82%$0.383138

-1.42%$169.36

1.22%$0.999306

-0.09%$0.495182

-2.65%$0.242339

-2.31%$0.157091

-2.29%$0.999705

-0.00%$0.03374659

5.96%$0.079539

-5.12%$0.00000034

-2.43%$1.019

-0.05%$1.35

-5.63%$0.959537

-1.62%$0.00000033

0.15%$1.63

4.05%$3.36

3.35%$123.95

-4.13%$0.055187

-1.72%$15.83

-1.84%$0.338258

-5.96%$3.08

-2.65%$0.01594988

-1.25%$1.43

-22.92%$0.998009

0.35%$0.066855

-3.46%$0.04954333

-4.12%$0.319865

-4.50%$0.02609091

-1.99%$0.298618

-3.99%$0.385048

11.48%$0.00561283

-4.69%$0.00002855

-1.12%$0.989882

-0.10%$0.228917

-4.58%$17.45

-0.71%$0.074633

-3.37%$0.298251

-4.51%$0.119208

0.63%$0.04837773

-2.82%$1.53

-3.36%$1.32

-6.73%$0.00253417

-2.73%$0.00242913

0.46%$0.00004352

19.85%$6.03

-2.72%$1.83

-0.41%$0.999605

-0.00%$0.0206757

-1.85%$0.083582

-0.96%$0.04080416

-4.38%$1.31

-2.29%$0.999923

-0.01%$0.119219

0.22%$0.984022

-0.15%$0.999949

0.01%$11.00

1.36%$1.076

0.01%$0.499332

1.59%$22.79

0.00%$1.25

-3.24%$0.00000098

-0.04%$0.091977

-2.96%$0.204589

-1.57%$4.54

11.82%$0.00201458

-2.70%$0.097433

-0.22%$0.869441

-2.68%$0.053828

0.21%$2.73

-1.58%$1.00

0.00%$5,007.43

-2.52%$0.187543

-2.07%$0.096647

0.87%$0.078752

-3.56%$0.187505

-3.94%$0.00489955

1.78%$1.00

0.00%$18.42

-1.26%$0.01923564

-1.22%$1.00

0.07%$0.00366259

-0.65%$2.15

3.23%$0.167181

20.04%$2.06

1.31%$0.165897

-15.14%$0.02008276

-0.35%$0.02274931

-5.11%$1.79

-0.04%$0.051932

-3.35%$47.99

-0.01%$3.43

1.69%$0.106898

-5.83%$0.591028

-3.11%$0.996402

0.16%$1.72

-0.57%$1.26

-0.05%$0.156078

-5.59%$0.04023575

-0.22%$1.002

0.24%$0.00000738

-5.01%$0.998406

0.02%$0.303879

-1.54%$0.165149

-0.96%$0.395871

-1.91%$0.310377

-1.98%$1.015

0.33%$0.135054

0.33%$0.622859

-4.93%$0.131892

-0.26%$4.47

0.46%$1,096.41

-0.01%$0.074853

3.06%$0.262102

1.60%$0.604476

-1.88%$0.079833

-0.82%$0.09162

-2.93%$1.59

3.65%$0.12895

-1.82%$0.00144975

-1.41%$0.075968

-0.99%$0.275427

-1.36%$0.00393892

-2.88%$0.02114298

1.18%$1.001

0.00%$0.296068

-4.87%$0.241721

-3.32%$0.212378

-3.77%$7.84

8.18%$0.995553

-0.03%$1.08

0.07%$0.115017

1.03%$2.30

-1.15%$0.330699

-3.99%$1.064

0.07%$0.999902

0.02%$0.998465

-0.05%$0.999167

-0.07%$0.999839

0.01%$0.186401

-3.12%$0.321251

-3.14%

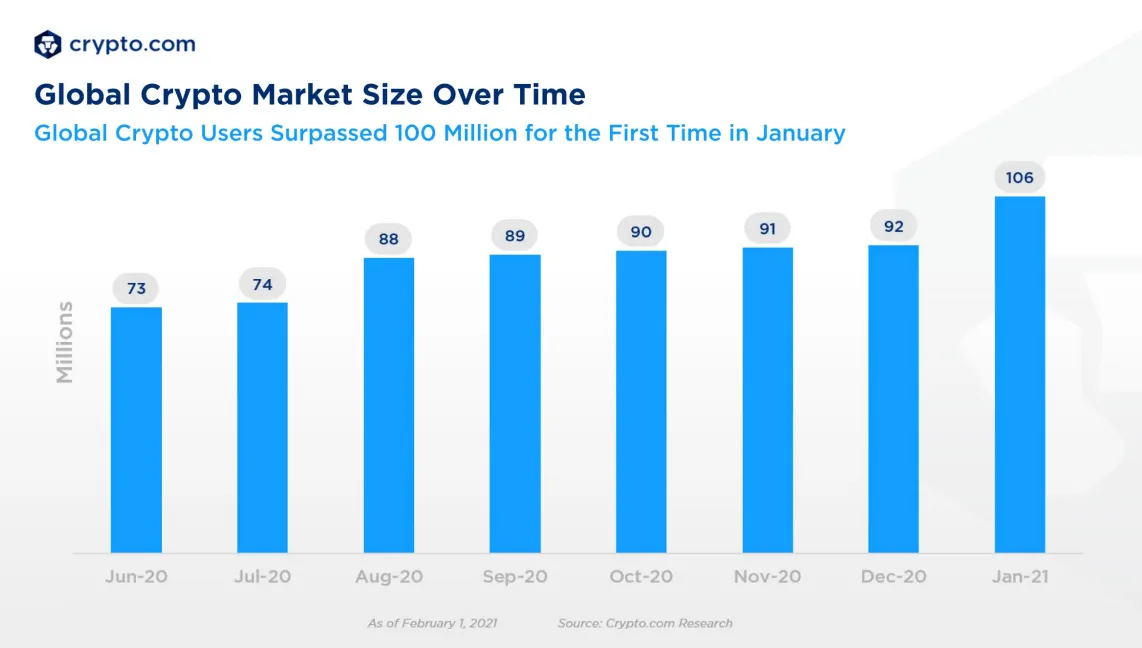

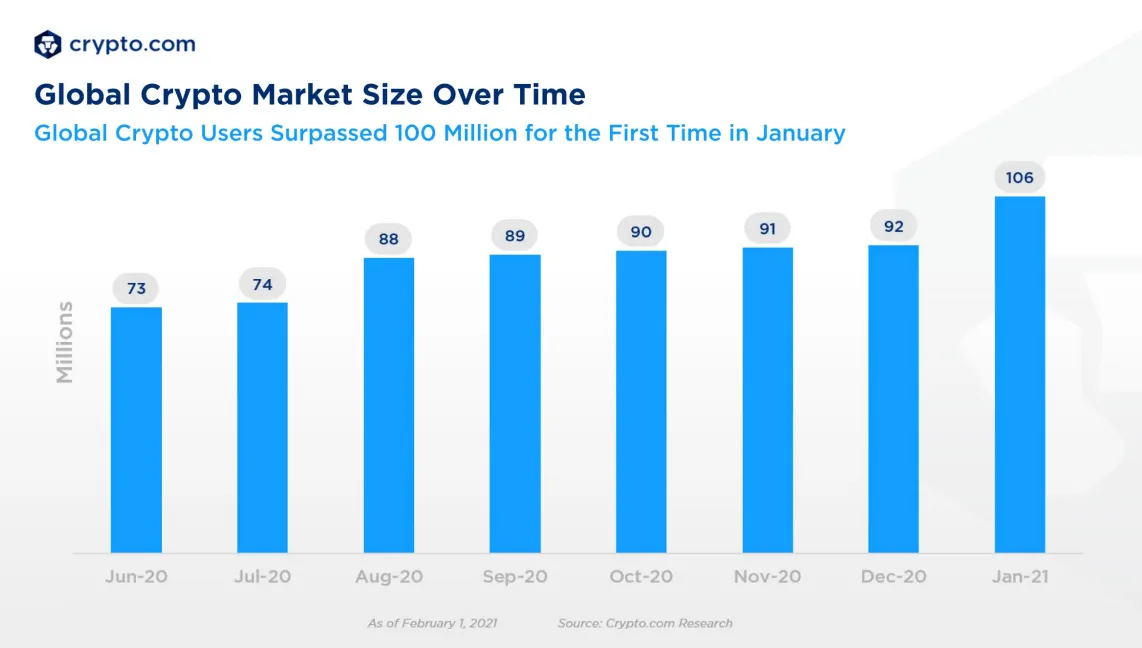

Cryptocurrencies are now used by more than 106 million people worldwide, according to a report by Crypto.com published today.

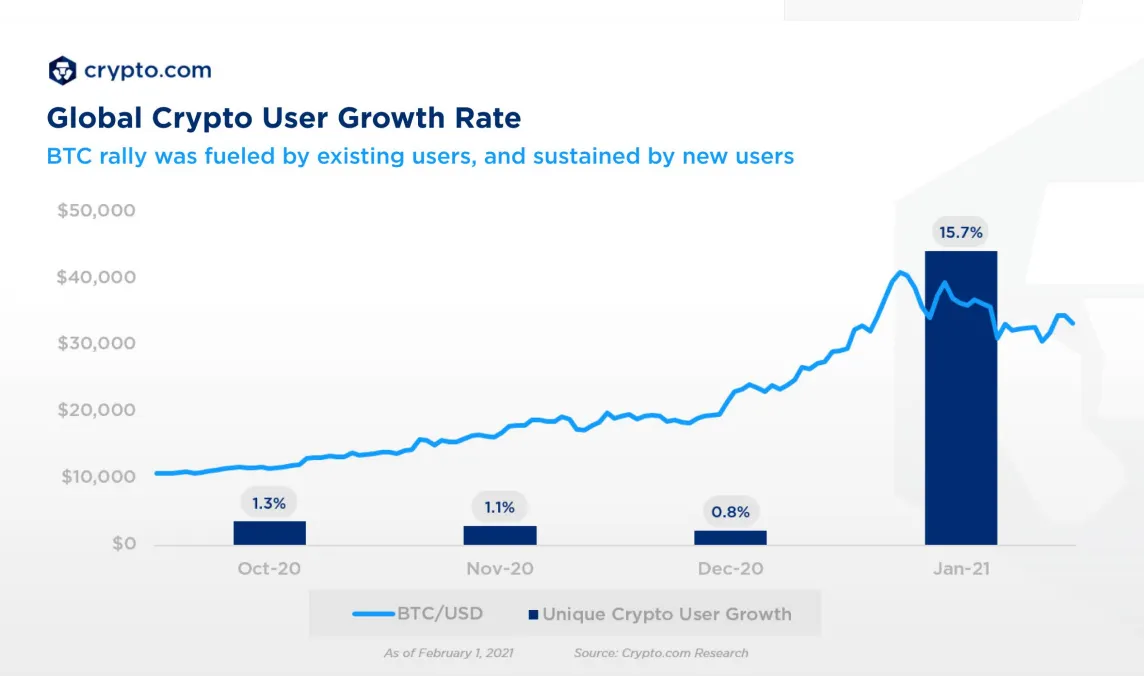

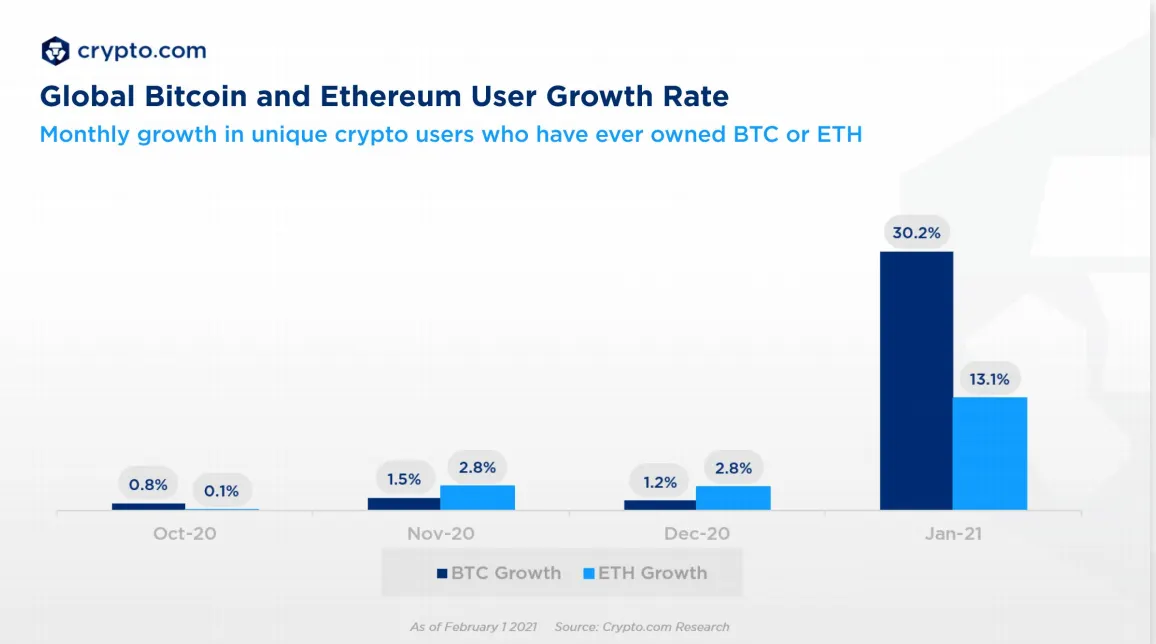

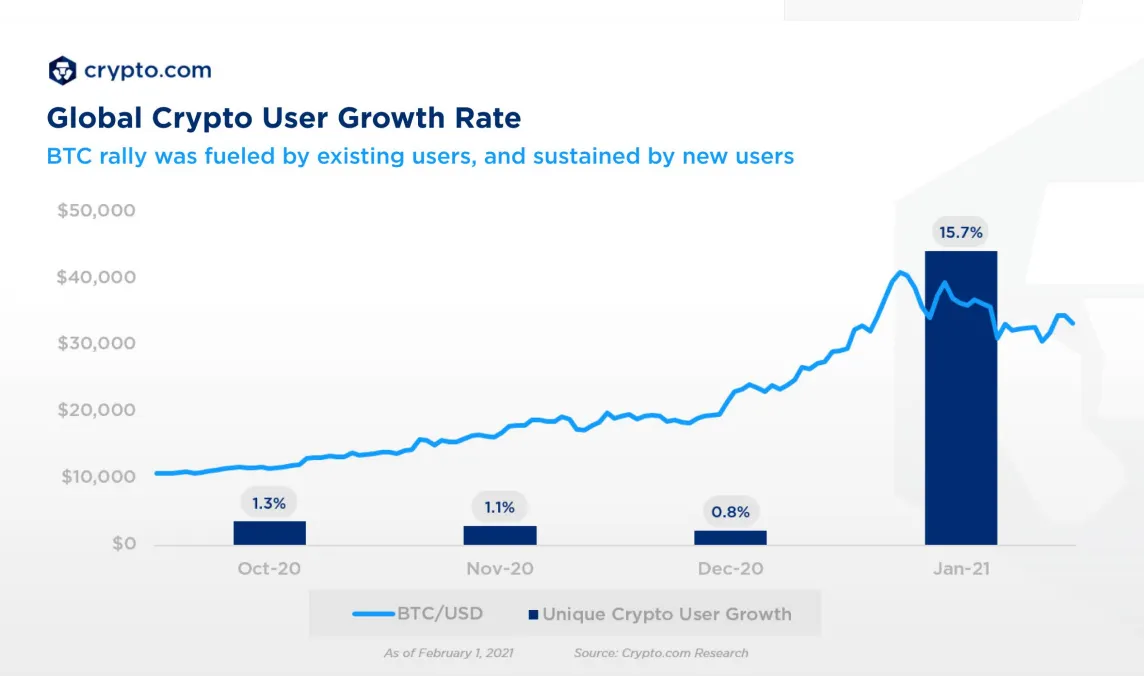

The cryptocurrency exchange identified a 15.7% increase in adoption in January alone and suggested that, while Bitcoin’s most recent rally was fuelled by existing users, it was new adopters who helped the price stay high.

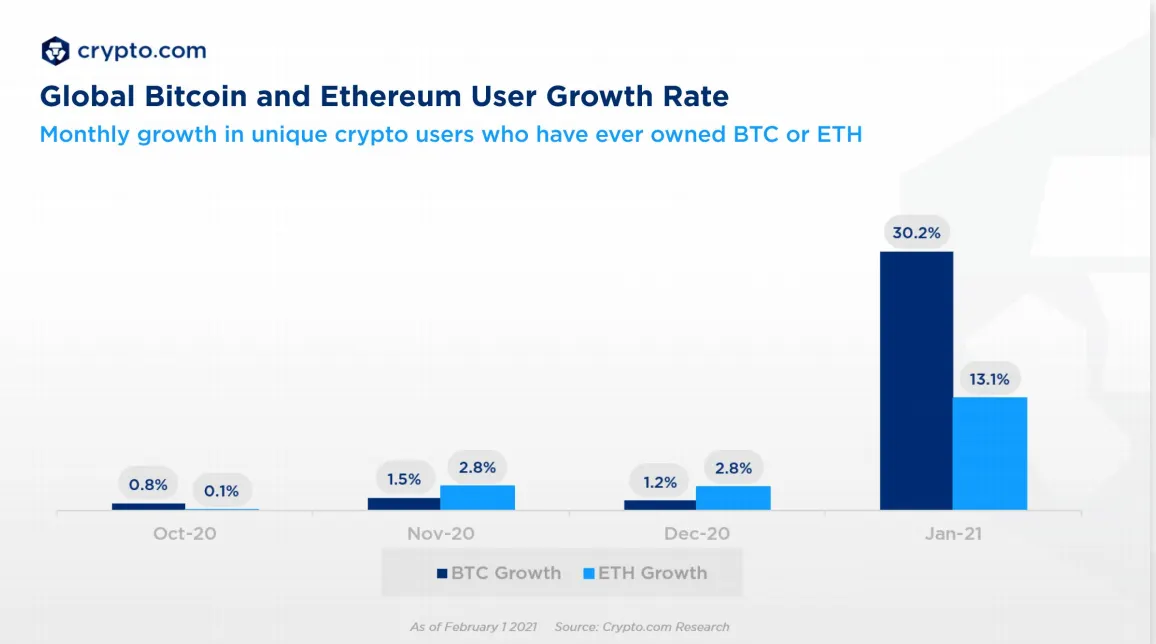

Strong growth in Bitcoin’s price was the number one driver for the increase in users, according to the research, which incorporated data from 24 crypto exchanges.

But other likely factors include the popularity of decentralized finance (DeFi,)—a new financial ecosystem that uses blockchain technology to provide financial services without third parties.

The Crypto.com data also shows that Ethereum, the second-largest cryptocurrency by market cap, led the crypto market’s growth in August 2020, which coincides with the height of the DeFi boom.

Increased investment from institutions, led by Microstrategy and Square, was another big contributing factor, per crypto.com. (MicroStrategy kept this up, today revealing it has bought another $1 billion in Bitcoin)

After PayPal started offering the ability for its customers to buy and sell cryptocurrency in late 2020, adoption rates significantly rose then too, the researchers noted.

In a separate report published last week, Statista suggested that Nigeria is the leading country for cryptocurrency adoption; one in three of the data analytics startup’s survey respondents said they had used or owned cryptocurrency in 2020. Nigeria also dominates search traffic for the keyword “Bitcoin,” according to Google Trends.

And crypto adoption is also increasing in South-East Asia. Per Statista, one-fifth of Vietnamese survey respondents said they used cryptocurrencies last year—despite the central bank’s refusal to recognize the asset class as a legal means of payment.