Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

$65,008.00

2.94%$1,892.33

3.71%$1.37

3.10%$596.10

1.13%$0.999876

-0.00%$82.12

7.00%$0.286239

1.84%$1.034

0.24%$0.092772

1.76%$48.54

2.42%$0.999911

-0.00%$490.77

1.97%$0.266064

3.44%$8.77

12.08%$26.94

2.66%$337.19

7.00%$0.161615

0.79%$0.999162

0.01%$8.47

4.00%$0.152984

2.62%$0.999867

0.08%$0.00930986

0.84%$0.09684

3.71%$0.999961

-0.07%$52.67

3.85%$235.90

1.28%$8.57

3.98%$0.00000595

0.49%$0.87747

2.53%$1.29

-2.37%$0.11359

6.74%$0.075303

2.06%$5,167.50

0.17%$1.43

1.72%$5,202.57

0.12%$3.50

5.54%$1.27

1.61%$0.599963

3.46%$1.00

0.00%$116.73

3.61%$0.997625

0.07%$0.695058

0.29%$172.83

3.13%$0.00000392

0.16%$0.999807

0.01%$1.12

0.00%$75.07

2.73%$0.999997

-0.00%$2.21

0.74%$0.066823

6.25%$0.164162

1.79%$0.00000165

0.11%$0.999604

0.07%$8.37

1.94%$0.993588

2.17%$0.253142

3.73%$0.113035

8.02%$2.18

7.80%$11.00

0.03%$6.87

3.97%$0.393459

7.53%$8.46

3.71%$0.00172629

-1.54%$2.04

-1.07%$0.01606514

-6.86%$0.057095

-0.39%$64.35

1.70%$0.999743

-0.06%$0.83089

2.24%$0.100671

5.50%$1.24

0.19%$0.00934695

4.28%$3.40

4.58%$0.787821

4.94%$0.0293384

-0.60%$0.085054

2.37%$114.40

0.01%$0.999918

0.02%$1.027

0.01%$1.38

2.37%$1.10

-1.00%$0.904794

3.91%$0.847434

5.67%$0.03311467

-1.48%$1.76

14.39%$0.0071912

0.64%$0.080118

0.01%$1.095

0.01%$0.99753

0.07%$0.093165

2.08%$0.999832

0.02%$0.00000586

2.28%$0.0284396

-1.89%$0.01297714

-0.36%$0.999297

0.07%$0.269034

19.05%$0.146903

3.78%$27.52

1.45%$1.089

0.18%$0.999816

0.00%$1.18

0.16%$0.067311

3.37%$0.244256

5.19%$0.661628

14.54%$33.16

5.16%$0.0066199

6.27%$1.24

3.42%$0.04591945

1.78%$0.372606

1.66%$166.93

0.04%$0.999813

0.07%$0.508525

14.42%$1.44

5.50%$1.018

1.41%$0.154323

1.76%$0.03371351

0.09%$0.07952

2.78%$0.233818

7.86%$1.02

-0.01%$0.999647

-0.00%$0.00000033

0.02%$0.00000033

1.06%$122.32

3.29%$15.98

7.69%$0.054201

2.99%$0.01649645

0.28%$3.16

-1.10%$3.18

1.29%$0.328035

7.65%$1.49

-0.50%$0.052078

5.25%$0.997883

-0.03%$0.066677

2.23%$0.00571995

3.70%$0.02614264

2.28%$0.299153

10.08%$0.00002846

3.04%$0.310186

5.87%$0.989769

-0.27%$17.43

2.82%$0.373105

24.39%$0.075654

14.22%$1.61

-1.20%$1.39

1.85%$0.303177

3.20%$0.04940631

3.29%$0.219434

10.35%$0.138987

5.12%$0.118251

1.23%$0.00248173

0.07%$0.0025672

2.78%$6.10

2.93%$0.998656

-0.27%$0.04183584

5.10%$0.999993

-0.00%$0.02016273

0.23%$1.29

6.88%$0.988473

0.02%$1.075

0.01%$0.999738

-0.01%$0.079905

3.11%$0.508628

3.13%$1.69

0.55%$22.79

0.00%$0.00210813

2.79%$1.25

5.14%$0.099309

1.60%$5,380.91

3.79%$0.00000095

-0.49%$0.087565

2.74%$0.195813

-1.27%$0.00003532

1.46%$0.195146

5.12%$1.00

0.00%$0.052392

1.23%$2.64

0.94%$0.02002535

7.18%$0.07841

3.52%$0.182768

-0.27%$0.179928

21.04%$1.00

0.00%$9.13

11.15%$0.119709

5.29%$0.00475407

0.88%$0.09126

2.28%$18.05

5.71%$0.769695

0.76%$3.90

11.36%$0.02381134

-0.37%$1.00

-0.04%$0.00352951

2.28%$1.81

5.92%$0.0201956

-1.00%$1.79

0.04%$2.03

-0.66%$47.99

0.03%$0.602499

3.87%$0.051398

4.57%$3.43

7.29%$0.995742

0.13%$2.00

5.85%$1.26

0.10%$0.155384

11.59%$0.73445

30.30%$0.00000756

2.21%$0.03972005

2.02%$0.998267

0.04%$1.001

0.07%$0.149452

-0.12%$1.014

0.03%$0.313289

0.35%$0.301651

-1.48%$0.164389

8.10%$0.396581

4.04%$0.651159

3.75%$0.620295

8.37%$0.02345838

-9.94%$0.075673

3.63%$0.081032

4.86%$1,097.76

0.02%$0.318905

0.08%$4.37

3.51%$8.44

-2.45%$0.12475

-0.50%$0.09009

4.41%$0.253131

1.36%$0.285723

3.20%$0.125667

-4.73%$0.364421

4.12%$0.131321

0.51%$1.89

3.02%$11.16

-5.81%$0.248613

3.11%$0.994624

-0.02%$0.121538

-2.28%$0.00144143

-0.15%$0.216345

-0.44%$0.121642

28.96%$0.00394349

3.23%$1.001

0.00%$0.074138

3.30%$0.978276

-2.69%$0.999408

-0.01%$2.32

5.17%$0.192324

6.89%$1.062

0.01%$0.331616

-1.08%$0.999803

0.00%

The price of Bitcoin slipped under $41,000 Monday morning, erasing the previous week's gains as its rally cooled.

At time of publication, Bitcoin is trading at just over $40,600, down 2.9% in the last 24 hours and 3.9% on the week, according to data from CoinGecko.

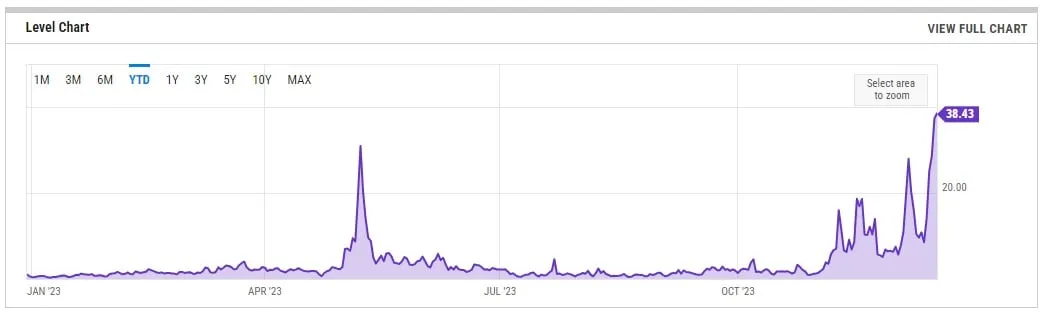

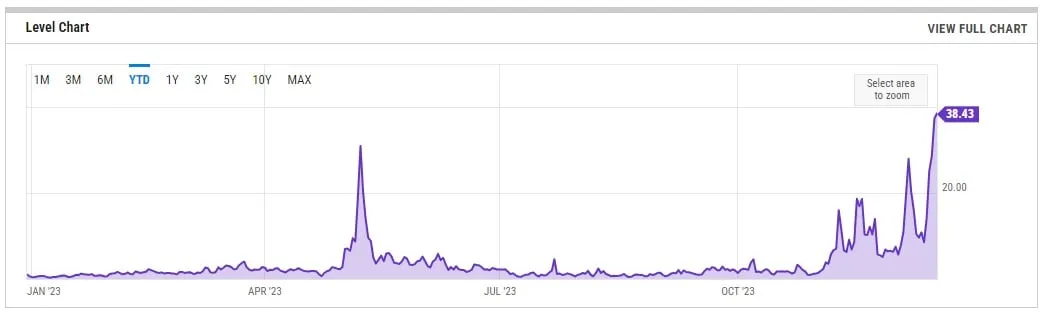

The price slump comes as Bitcoin's average transaction fee has surged to a yearly high of $38.43, per data from Ycharts.

The surge in transaction fees has been attributed to the growing popularity of Bitcoin Ordinals, a type of unique digital asset inscribed on a satoshi, the smallest unit of Bitcoin; according to a Dune Analytics inscriptions analysis dashboard by "@dgtl_assets," miners earned just under $10 million in transaction fees from Ordinals on Saturday 16th December, and $8.4 million on Sunday 17th December.

High transaction fees caused by Ordinals also appear to be clogging the Bitcoin network, with mempool.space indicating that just under 290,000 transactions are unconfirmed at the time of publication, with transaction fees under $1.37 having no priority.

Bitcoin's slump is mirrored in the wider crypto market, with the total market cap of all cryptocurrencies down 3.5% in the past day to $1.59 trillion, while every coin in the top 20 on CoinGecko is trading down on the day, barring stablecoins. Avalanche leads the losses within the top 20, trading at $37.28, down over 11% in the past 24 hours.

Ethereum, the second-largest cryptocurrency by market capitalization, is currently trading at around $2,100, down almost 4% on the day. Meme coins have been hit hard by the market slump, with Dogecoin down almost 8%, Shiba Inu down 10% and Solana-based meme coin BONK down over 12%.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.