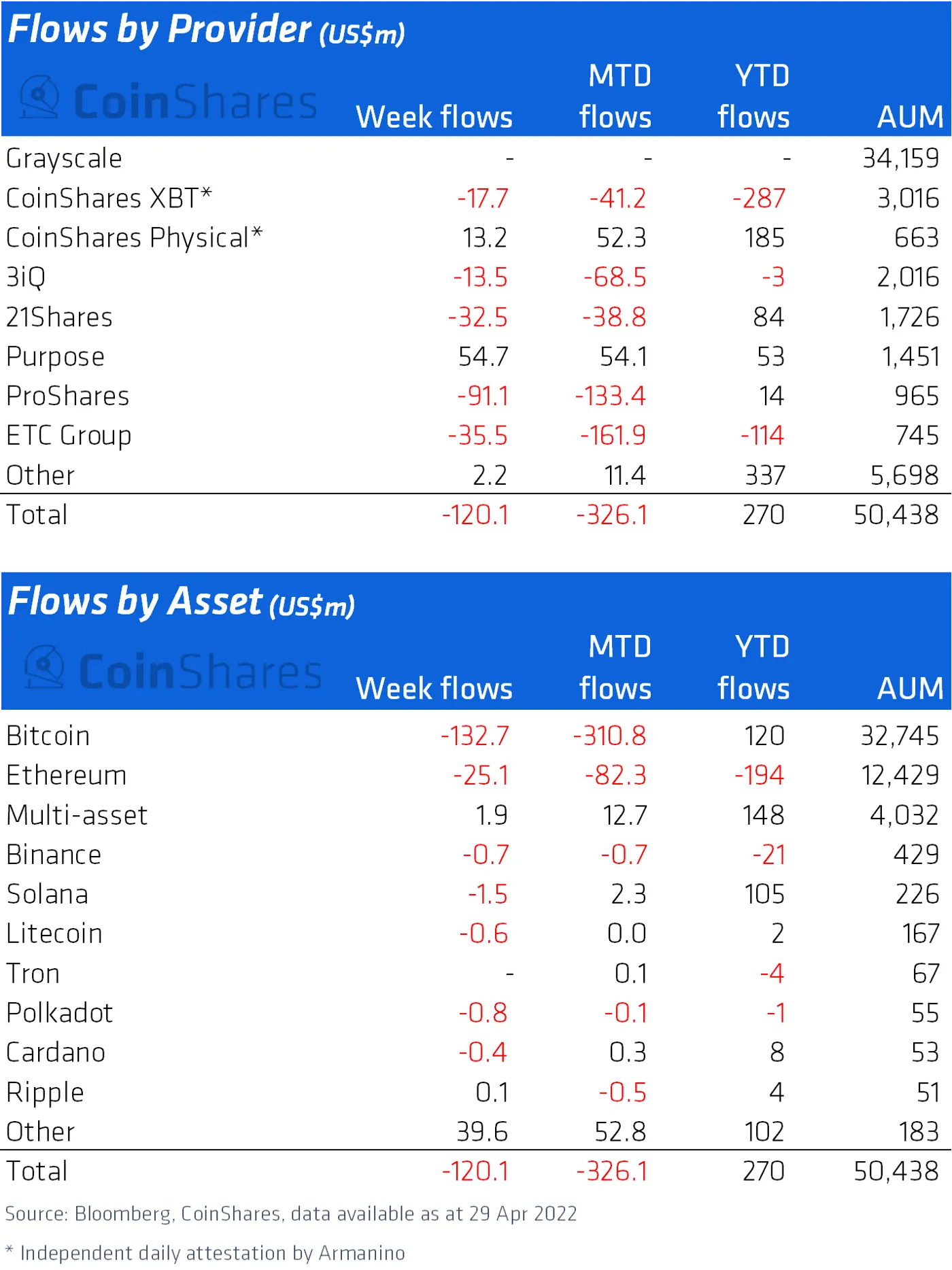

Bitcoin investment product outflows totaled $133 million last week, the highest week of outflows since June 2021, according to a new report from CoinShares.

Total outflows across all cryptocurrencies, including Bitcoin, hit $326 million month-to-date.

CoinShares tracks institutional allocations in crypto products like the Grayscale Bitcoin Trust (GBTC), 21Shares Crypto Basket Index ETP (HODL), and its own CoinShares XBT products which track Bitcoin and Ethereum, among other products.

“This doesn’t reflect the same bearishness seen at the beginning of this year,” writes CoinShares head of research James Butterfill in the report, referring to a four-week period at the start of 2022 when institutional investors pulled $467 million out of crypto funds.

Outflows can be considered bearish as it indicates that investors are moving out of a specific crypto and into other assets, be it cash, different cryptocurrencies, or otherwise. Conversely, inflows into an asset can be considered bullish.

The number two cryptocurrency hasn’t fared much better in the eyes of institutional investors.

In the same week, Ethereum outflows totaled $25 million. Since the start of 2022, only five weeks have seen net inflows for Ethereum-based investment products.

“The fund flows suggest investors have been favoring other protocols such as Solana and multi-asset (multi-coin) products,” Butterfill told Decrypt. “Earlier this year it was high gas fees that concerned investors, while transaction times were slow and coupled with uncertainty of the [Ethereum 2.0] timelines, particularly the Merge. This has prompted investors to seek alternatives.”

Investors turn from Bitcoin to FTX token

Scanning other assets the CoinShares report tracked, the “Other” section enjoyed $39.6 million in net inflows over the past week–a bullish signal from investors.

Included in that section is FTX exchange’s native token, the FTX Token (FTT), which saw inflows totaling a whopping $38 million, according to Butterfill.

Institutions may have been bullish on FTX this past week due, in some part, to the crypto exchange having just wrapped up its 2,000-person Crypto Bahamas conference.

The crypto exchange’s FTX Token (FTT), is a utility token, which grants holders trading fee discounts among other bonuses when using the exchange.

For instance, having $100 worth of FTT grants the holder a 3% discount on trading fees. Users with at least $5,000 worth of FTT start to get discounts on FTX’s over-the-counter (OTC) trading desk, which matches buyers and sellers.

On Wednesday, FTT was the 25th-largest token, trading at $38.35 at a $5.24 billion market capitalization, according to CoinMarketCap.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.