First DAI, now BUSD. Terra’s UST is on a tear.

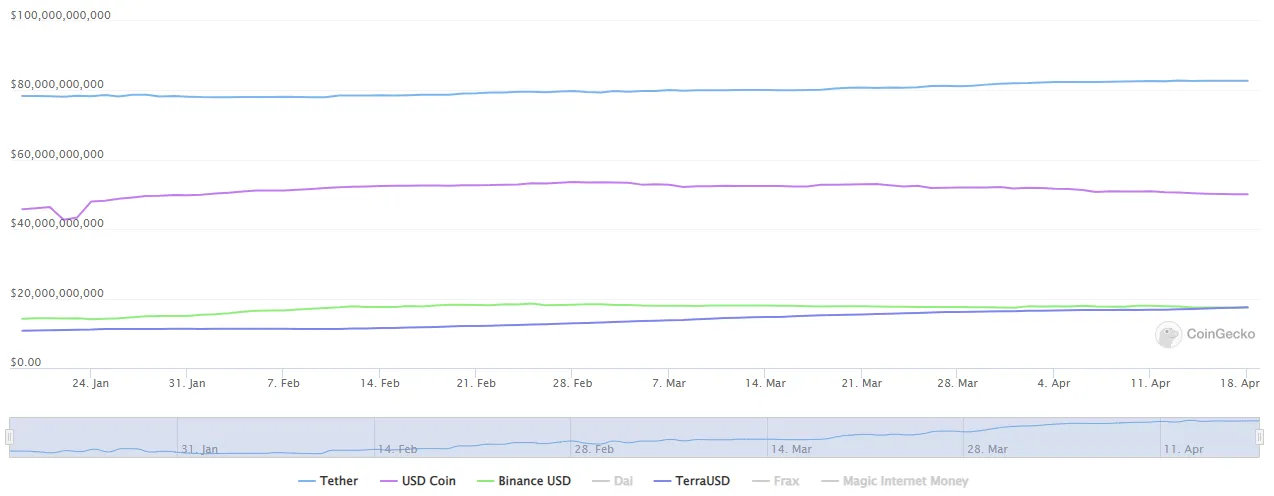

Today, the fast-growing TerraUSD (UST) stablecoin from the Terra ecosystem has hit another key milestone. With more than $17 billion in market capitalization, it's become crypto’s third-largest stablecoin.

Terra's stablecoin overtook Binance USD (BUSD) to grab third place, but the gap is thin: roughly $68 million.

The leading stablecoin as of this writing is Tether (USDT), which commands a whopping $82 billion market cap. USD Coin (USDC) is second at $49 billion.

Besides the difference in market caps, there’s also a fundamental difference in how these stablecoins are designed.

What is Terra’s UST?

BUSD is a fiat-backed stablecoin, meaning the stablecoin’s custodian, in this case Paxos, holds the equivalent amount of BUSD circulating in cash, cash equivalents, or other traditional assets.

USDC and USDT are built similarly, with attestations claiming that each company holds a dollar-equivalent asset for every stablecoin in circulation.

Terra's stablecoin is, however, built much differently. Instead of a centralized entity holding traditional assets, be it cash or bonds, this stablecoin is designed to keep its peg to the greenback via a mint-and-burn mechanism and savvy market arbitragers.

Here’s how it works: To create one UST, users must first buy and then destroy $1 of LUNA (Terra’s governance and staking token). The inverse is also true: Each time you swap $1 of LUNA for UST, you destroy one UST.

Because one UST always equals $1 worth of LUNA, there are many opportunities to make a profit whenever the stablecoin deviates from its peg. If, for example, UST drops to $0.99, arbitragers can always swap that UST for a $1 of LUNA and bag a small profit. They also destroy that UST in the process (which reduces supply and makes the asset scarcer).

It’s a unique mechanism, but it’s caught crypto by storm of late.

Not only has UST’s market cap jumped from just $2.8 billion to today’s figure in five months, but LUNA has also hit all-time high after all-time high along the way.