Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

$66,927.00

1.58%$1,961.38

1.64%$1.38

1.77%$616.52

0.37%$0.999909

-0.01%$84.24

3.22%$0.281821

-0.40%$1.029

-1.87%$0.093905

0.81%$49.80

1.37%$0.281093

1.26%$0.999514

-0.03%$456.72

-0.71%$8.96

2.17%$30.97

13.61%$0.167509

-1.69%$8.85

1.65%$337.45

-0.04%$0.999211

-0.01%$0.159762

0.64%$0.999661

-0.03%$0.00924535

-1.23%$0.100727

0.19%$0.999927

-0.04%$54.38

-0.11%$9.15

2.35%$220.31

0.81%$0.902377

0.37%$0.00000579

0.16%$1.28

-1.09%$0.076237

0.83%$0.11291

2.05%$5,309.61

0.84%$1.64

2.91%$5,385.22

1.70%$1.45

1.47%$3.81

2.01%$0.636569

0.31%$1.00

0.00%$1.12

0.00%$0.99998

-0.00%$183.52

4.53%$0.716868

2.27%$0.996686

0.01%$112.04

-0.62%$76.83

0.86%$0.171157

0.43%$0.067843

1.08%$0.00000367

-0.33%$2.16

-0.46%$0.999873

-0.01%$1.15

5.64%$0.00000156

-2.12%$8.68

0.46%$2.44

-4.34%$0.999354

0.01%$0.261393

1.82%$11.00

0.00%$0.109125

0.23%$0.400516

3.10%$6.99

0.42%$0.00191888

7.08%$7.85

-6.02%$1.77

-3.08%$0.01758573

2.24%$0.058365

0.43%$63.83

-0.63%$1.84

-0.50%$0.863273

1.76%$0.103679

1.14%$1.001

-0.03%$3.47

1.93%$0.03005409

-0.51%$0.00942237

1.58%$1.24

-0.00%$0.087613

1.31%$0.998348

0.45%$114.44

0.00%$0.958963

2.20%$1.028

0.00%$1.41

-0.28%$1.00

-0.03%$1.11

0.85%$0.03336628

-1.40%$0.03209461

-6.26%$0.00729219

-0.74%$0.079861

-1.39%$0.601169

-4.58%$0.099502

-0.77%$1.096

0.00%$0.161139

5.96%$0.998318

-0.19%$30.66

-12.23%$0.00000602

1.75%$1.00

0.01%$0.01294488

1.04%$0.998546

-0.05%$0.260489

0.93%$1.088

-0.04%$0.712574

4.06%$0.068581

-0.48%$0.256488

9.40%$1.18

-0.11%$1.00

0.03%$0.00700147

3.14%$183.58

8.46%$1.31

1.08%$0.04768409

0.35%$33.03

-0.60%$0.382804

-0.01%$1.86

27.88%$1.00

0.09%$0.507187

2.89%$0.250472

3.62%$1.76

8.41%$0.03460982

2.82%$0.157176

0.73%$0.99976

0.01%$0.081432

2.26%$1.39

2.21%$1.018

-0.00%$126.34

1.20%$0.00000034

-1.88%$3.41

1.30%$0.00000033

-0.52%$0.356493

5.96%$0.930087

-1.48%$0.055536

-0.14%$15.75

0.14%$3.11

1.59%$0.0156418

-2.24%$0.068515

2.04%$0.313517

5.35%$0.326045

2.14%$0.995689

-0.04%$0.02640696

1.24%$0.04921086

-0.61%$0.00562427

-0.04%$17.69

0.93%$0.99949

0.95%$0.00002788

-2.26%$0.07707

2.09%$0.228183

-1.29%$0.306017

1.84%$0.121306

1.70%$0.04888989

1.03%$1.54

0.19%$12.69

13.26%$0.00261447

2.88%$0.00004506

5.51%$1.30

-1.59%$5.45

19.79%$0.00243421

0.32%$6.12

1.14%$1.02

18.35%$0.02116394

2.56%$1.001

0.24%$0.124681

4.66%$0.10126

9.99%$1.82

-0.95%$0.04146237

1.84%$0.084299

0.98%$1.31

1.52%$0.999997

-0.00%$0.984022

0.00%$0.999789

0.01%$1.076

0.00%$1.29

2.86%$0.293484

-17.93%$0.000001

1.69%$22.79

0.00%$0.495693

-2.67%$0.00208307

3.66%$0.099214

0.50%$0.194324

-5.01%$2.72

0.53%$0.191375

1.76%$0.193623

3.33%$1.00

0.00%$4,994.66

-0.14%$0.080363

2.16%$0.096773

0.43%$0.052048

-2.67%$0.181086

7.48%$1.00

0.00%$0.00480256

-1.19%$0.01913417

-0.43%$18.17

-1.53%$0.174935

4.64%$1.00

-0.02%$2.21

2.53%$0.00359474

-1.87%$0.02043064

1.91%$0.053239

1.94%$1.81

0.93%$0.164766

4.62%$2.03

-1.57%$0.609076

3.30%$48.00

0.01%$1.77

2.30%$3.43

-1.00%$0.106332

-0.48%$0.994952

-0.21%$0.02183391

-3.12%$1.26

0.32%$0.03984895

-0.29%$0.997698

-0.52%$0.32433

4.12%$0.998079

-0.04%$0.00000723

-2.26%$0.399817

0.57%$0.164926

0.07%$0.651682

1.81%$0.295712

-3.15%$0.13672

1.43%$1.016

0.05%$0.134809

1.85%$0.620158

4.08%$4.51

1.61%$0.263966

0.33%$0.075267

-0.47%$1,096.47

-0.01%$0.08072

0.92%$0.093264

2.40%$0.07818

3.51%$0.02203512

5.53%$11.33

2.07%$0.263021

25.27%$0.130664

0.81%$0.249875

2.90%$0.00146514

1.02%$1.56

0.96%$0.00383653

-2.59%$0.300055

2.60%$0.214227

0.78%$0.272285

-1.34%$1.001

0.00%$0.184412

-1.14%$1.08

-0.00%$0.995219

0.01%$2.33

1.42%$7.46

-4.86%$1.00

0.02%$0.999635

0.42%$0.999811

0.01%$1.064

-0.03%$0.999409

-0.01%$0.991896

-2.61%

Cryptocurrencies behind several layer 1 blockchain networks have all jumped double-digits this morning.

Solana, a speedy proof-of-stake (PoS) blockchain, has enjoyed a jump of more than 16% over the past 24 hours. The layer-1 token's rise could be attributed to Coinbase, the largest U.S.-based crypto exchange, listing two Solana-based tokens, Bonfida (FIDA) and Orca (ORCA).

Additionally, the network’s leading crypto wallet, Phantom, just raked in another $109 million. Paradigm led the latest round, pushing the wallet provider's valuation to $1.2 billion.

Tezos is also enjoying a heady start to February. Another PoS-based network, XTZ has risen 5% over the past 24 hours, according to data provided by CoinMarketCap.

Often pitched as a “green alternative” to Ethereum, the network’s most recent rise comes on the heels of a new deal between Warner Music Group and a Tezos-based NFT marketplace called OneOf.

“Partnering with OneOf, a leader in the emerging technology space of Web3 and NFTs, gives our artists an edge in more authentically building one-to-one relationships with their fans and winning in the new Web3 economy,” Oana Ruxandra, Warner’s VP of business development.

Terra, a DeFi-centric layer-1 protocol built using Cosmos, has also rebounded by nearly 12% after a brutal week which resulted in LUNA, the network’s native token, shedding nearly 20%.

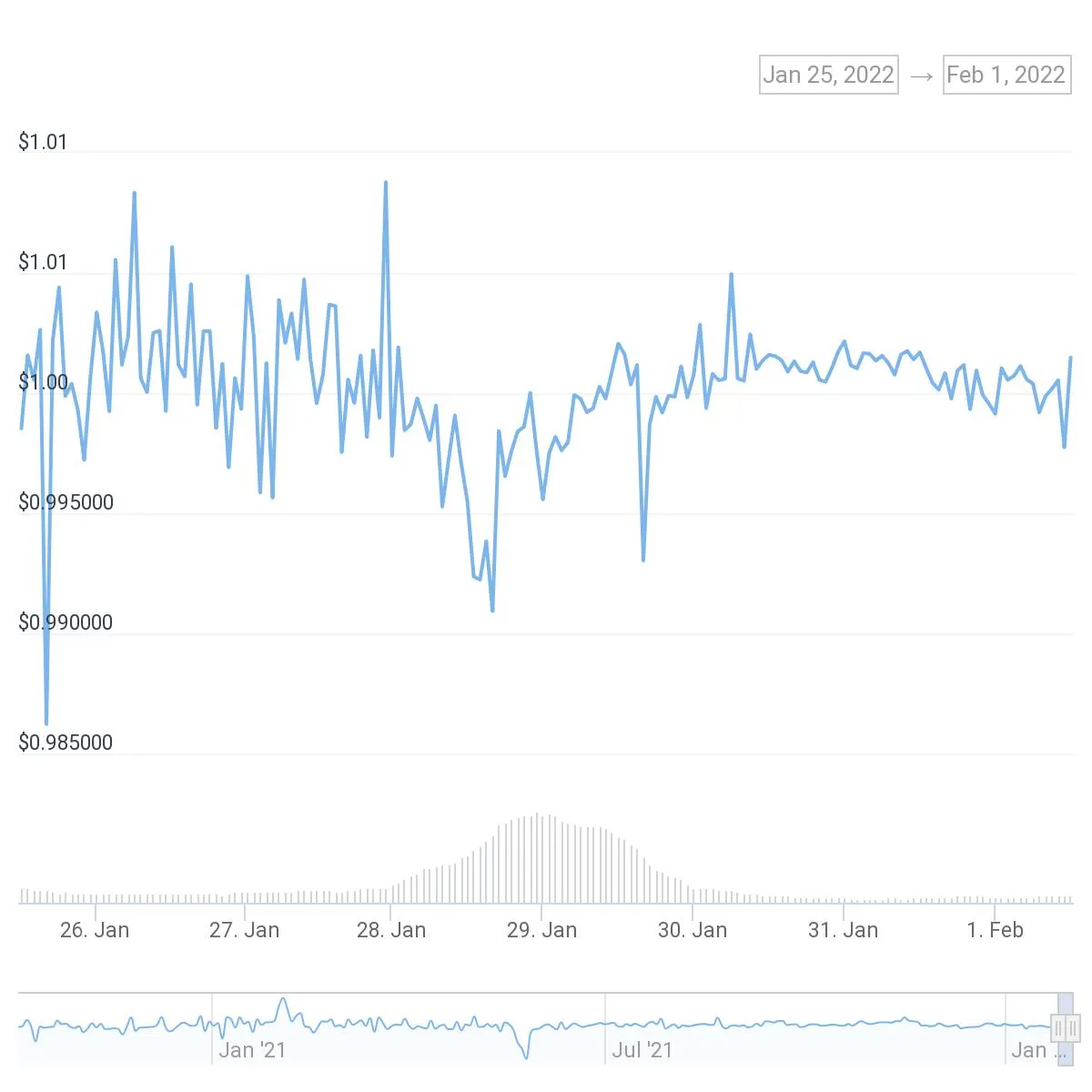

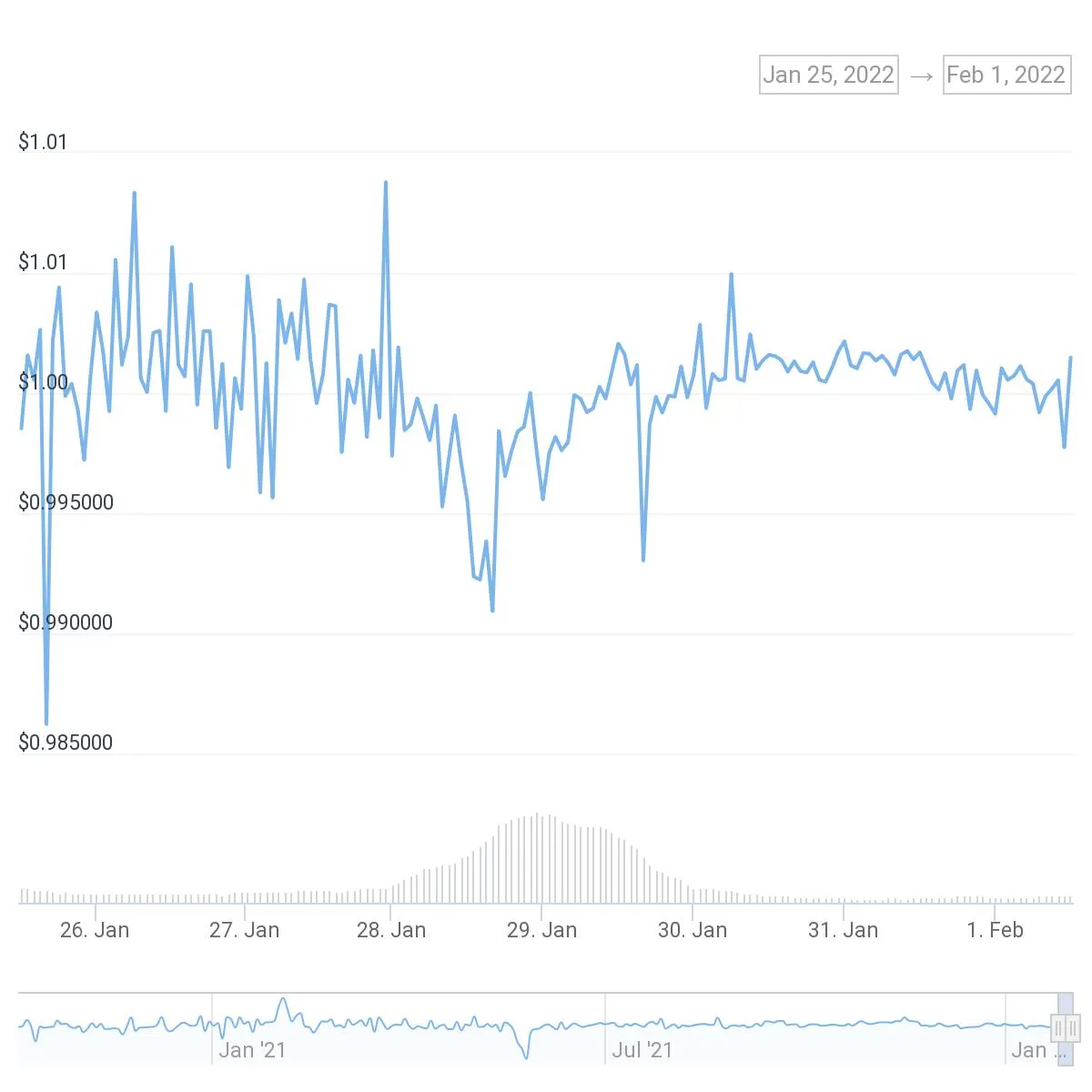

LUNA’s gains appear to revolve around returning trust in the network’s U.S. dollar-pegged stablecoin. Last week, the stablecoin briefly fell below $0.99, according to CoinGecko.

As for Bitcoin and Ethereum, the leading cryptocurrencies are also enjoying a rebound since both fell to lows not seen since last summer.

Today, Bitcoin is up by nearly 2.6% and Ethereum is up 7%.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.