Futures trading is coming to crypto exchange Binance.

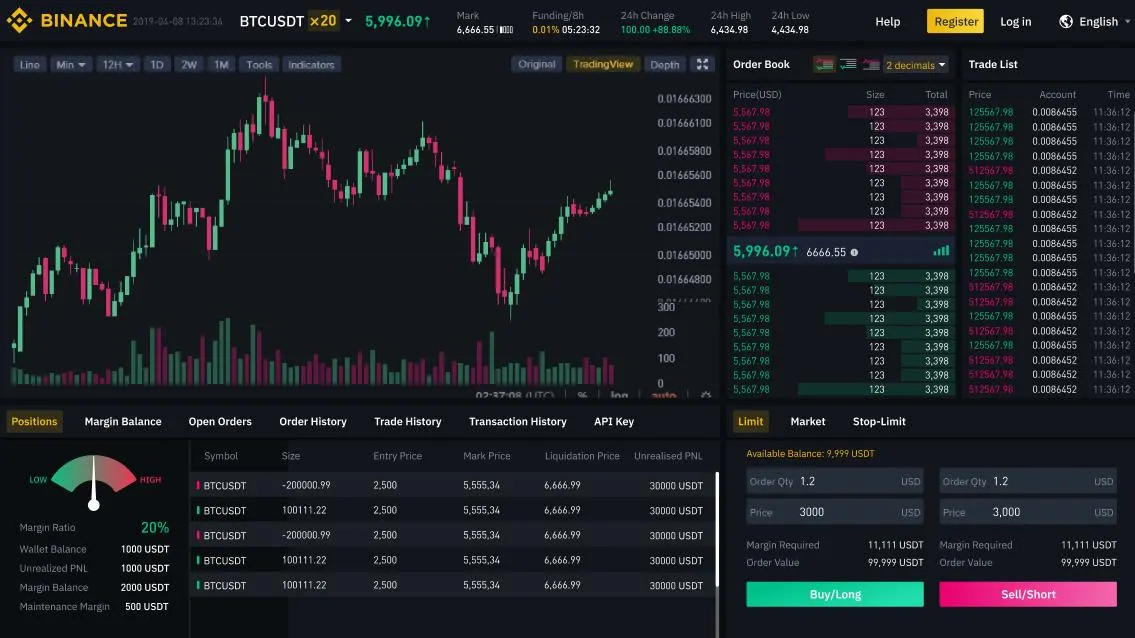

Binance CEO Changpeng Zhao (CZ) made the announcement on stage at the Asia Blockchain Summit in Taipei, revealing that it will support trading with up to 20x leverage.

“Binance will be launching a futures platform very soon. I don’t have the exact date yet. The simulation test version will be live in a few weeks,” he explained.

This comes shortly after Binance announced its roll out of margin trading for all of its users. Margin trading allows traders to borrow money to use when making trades. It currently offers two times leverage—with plans to increase this in the future. Futures trading on the other hand involves betting on the expected future price of a cryptocurrency.

BitMEX is currently the world’s biggest provider of leveraged futures trading in the crypto markets. It recently surpassed $1 trillion in trading volume over the last year, according to BitMEX CEO Arthur Hayes.

Should BitMEX be worried by Binance encroaching on its turf? It took Binance just four months to emerge out of nowhere to become the largest crypto exchange in the industry. While BitMEX certainly has the first mover advantage, so did many other exchanges that Binance left in the dust.

But Hayes doesn’t appear to be too worried. Ran Neuner, the host of CNBC Africa’s crypto show, posted a photo on Twitter showing Hayes and CZ embracing, alongside Litecoin founder Charlie Lee and Tron founder Justin Sun. They’re just one big happy family–until one of them takes all the other’s customers.