In brief

- Pancakeswap is now among the most used DEXs.

- It's based on Binance Smart Chain and boasts low-fee trading and quick transactions.

- The rise comes as traders seek alternatives to Ethereum-based DEXs.

Pancakeswap, a decentralized exchange (DEX) built on Binance Smart Chain, saw $400 million in trading volume yesterday and briefly became the world’s second-largest DEX service by trading volume, data from markets service CoinGecko shows.

The project was earlier written off by market pundits but has since emerged as an underdog growth story, with over $1.7 billion worth of various cryptocurrencies locked in the DEX.

Pancakeswap started off as a pale imitation of SushiSwap—the Ethereum-based, (now) third-largest decentralized exchange. Pancakeswap's use case was straightforward: Users provided liquidity to the platform (receiving FLIP tokens in return) and farmed SYRUP, the platform’s governance token.

This arrangement was similar to the many peer-to-peer exchanges that popped up in 2020 offering big “yields” to users becoming liquidity providers and the chance to govern the platform. However, newer products like a lottery service and a non-fungible token (NFT) art platform have furthered Pancakeswap’s use cases.

As of today, there are over 176 markets on Pancakeswap. Wrapped BNB, a token issued by crypto exchange Binance, is the most traded market with over $81 million in volume in the past day. CAKE is next with a $45 million volume, and there are then the meme tokens like “Birthday Cake,” “Burger Swap,” and “Monster Slayer Cash,” which each account for much smaller volumes.

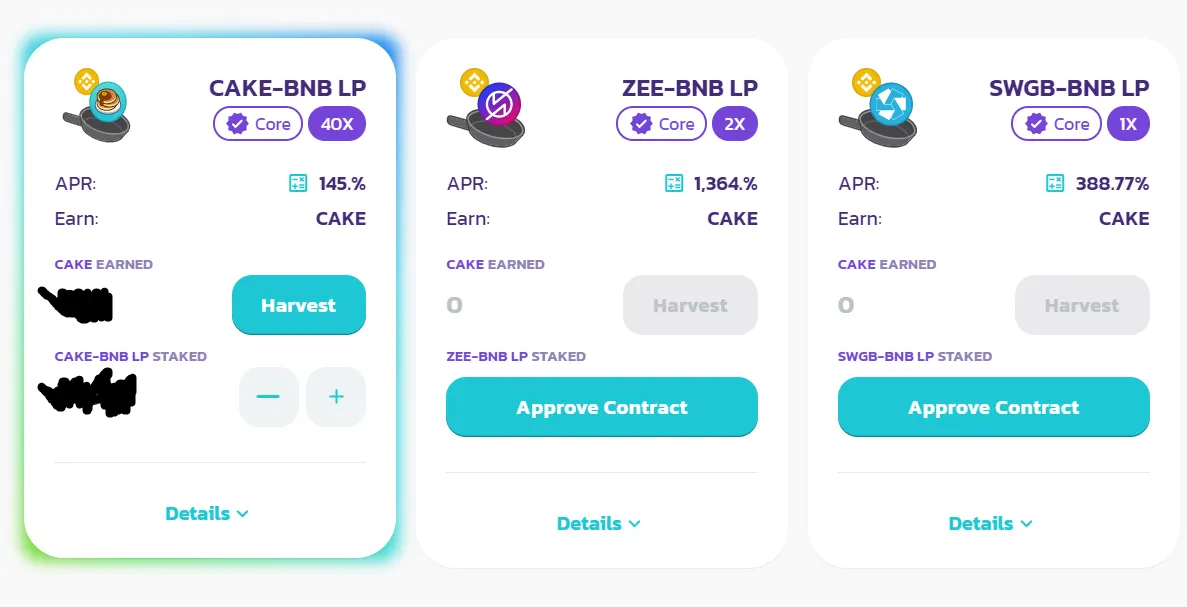

Pancakeswap’s high yield farms remain a draw for users. As the below image shows, the liquidity pool for ZEE/BNB (ZEE is the token for ZeroSwap, a multi-chain DEX aggregator) is paying out over 1,300% to users annually.

Considering that the volumes are not fake, much of Pancakeswap’s success has stemmed from its anonymous team choosing to build on the Binance Smart Chain (BSC), the public blockchain built and maintained by crypto exchange Binance.

The BSC network charges only a few cents per transaction and is a so-termed “high speed” blockchain—offering around 300 transactions per second, according to Binance CEO Changpeng Zhao. This is in contrast with Ethereum’s massive transaction fees (at extreme levels they can reach over $100, or even over $1,000) and its much slower speed (about 15 transactions per second). However, BSC is far less decentralized, meaning any 'decentralized' exchange built on top of it has a similar level of security—posing potential risks.

Low fees open up Pancakeswap to more users, who may wish to trade a small sum, like $100, without paying at least 25% of that as trading fees.

— PancakeSwap 🥞 #BSC (@PancakeSwap) February 15, 2021

The data attests that. CAKE, Pancakeswap’s native token, today boasts a $792 million market cap with a price of $6.97 per token. Over $76 million of the token have changed hands in the past day, and the CAKE token is continually “burned” (permanently taken out of circulation; potentially making it more valuable for holders).