The U.S. Securities and Exchange Commission’s crypto industry crackdown is continuing apace, with Robinhood Crypto this week joining the growing pack of companies that have been served notice of impending enforcement action by the SEC.

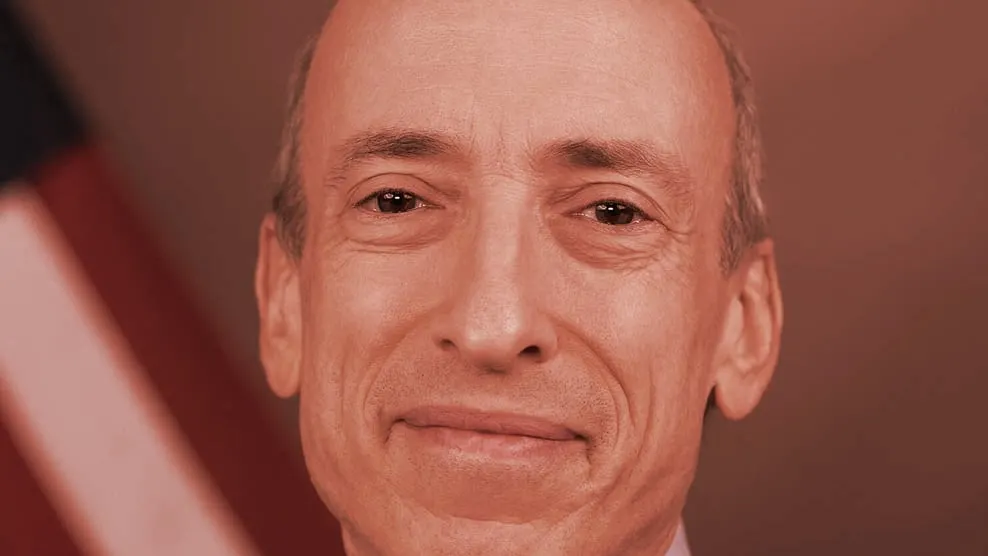

Gary Gensler, the SEC Chair himself, wouldn’t get into details on the Robinhood case or others when appearing on CNBC’s “Squawk Box” Tuesday morning, but he did field questions from host Aaron Ross Sorkin about why the firm appears so fixated on crypto right now.

In Gensler’s view, it has something to do with the financial media and crypto journalists. But it’s also because the crypto market has an “outsized” share of financial scams and fraud, in his view.

“Crypto is a small piece of our overall markets,” he said. “But it's an outsized piece of the scams and frauds and problems in our markets—because without prejudging any one token, much of this field is noncompliant with the protections of our securities laws. And so thus, you end up with an outsized ratio of journalist questions and crypto journalists to market cap.”

Gensler repeatedly bristled at the idea of Sorkin even wanting to ask crypto-related questions. When Sorkin asked if the amount of attention paid to the SEC’s crypto enforcement was “a function also of the fact that that's where your attention is,” Gensler pushed back.

“No, it's a function of where your attention is,” Gensler responded. “Think about it: I've been on your show, what, a dozen times? And every show, you ask about crypto. And my guessing is this will be a majority crypto interview, while the capital markets are $110 trillion. So it's also about where the financial media is focused.”

Gensler also wouldn’t comment on the recent lawsuit from Ethereum software firm Consensys, which filed a preemptive suit against the agency after it served the firm a Wells Notice over its MetaMask crypto wallet. (Disclosure: Consensys is one of 22 strategic investors in Decrypt.) A Wells notice is a letter the SEC sends when it intends to bring an enforcement action against a business or individual; it means a lawsuit against Consensys is likely on the way.

But Genlser likewise wouldn’t comment on whether the SEC sees Ethereum as a security or a commodity. In the Consensys suit, the firm alleged that the SEC has already been internally referring to Ethereum as a security for a year now. Now Consensys is seeking a declaration from a court that ETH is not a security.

Broadly, however, Gensler reaffirmed that he believes that most cryptocurrencies should be considered securities. And he added that he doesn’t believe that investors have the appropriate disclosures for investing in such assets.

“There’s a lot of people who have lost their hard-earned funds in the field that you seem to be so fascinated by,” Gensler snapped back at Sorkin. “Investors get to decide as long as they get the full, fair, complete, and truthful [...] information. They're not getting that in crypto.”