Two commissioners of the U.S. Securities and Exchange Commission (SEC), Mark T. Uyeda and Hester M. Peirce, have published a public letter of dissent on September 13 against the regulator’s decision to regard the sale of Stoner Cats NFTs as a securities sale.

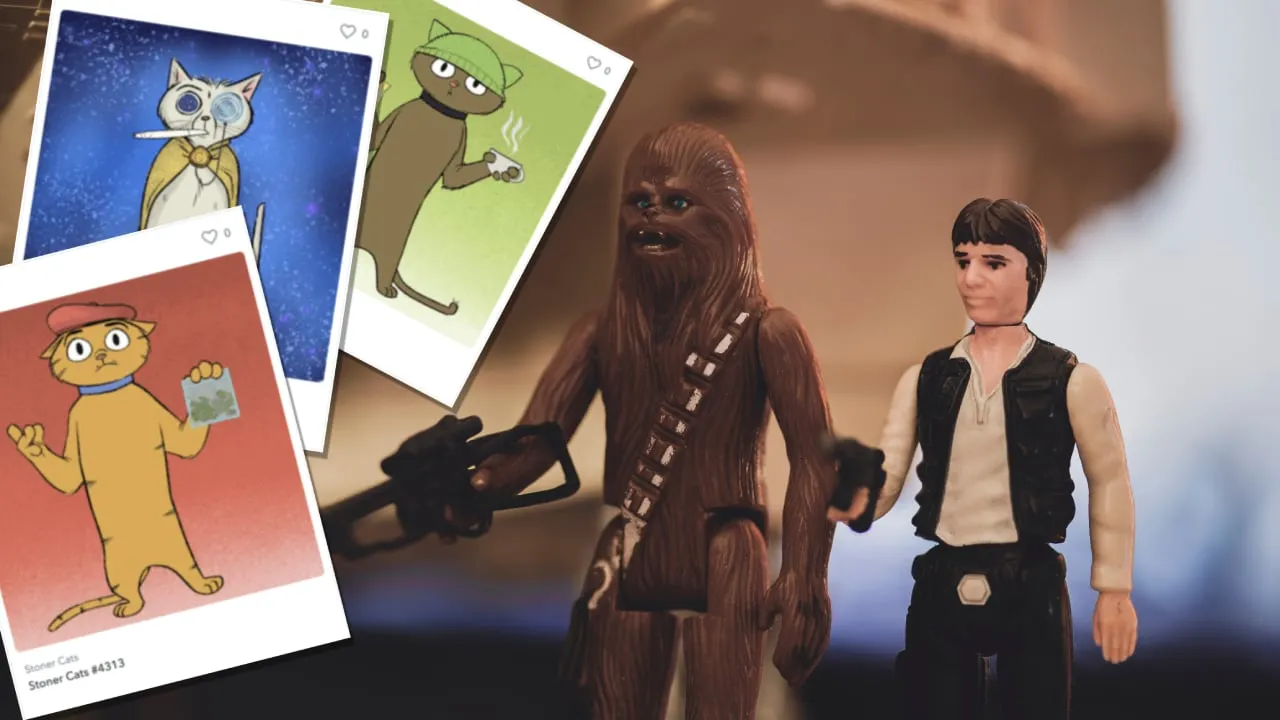

The Republican commissioners argued that the sale of Stoner Cats should be identified as “fan crowdfunding—a common phenomenon in the world of artists, creators, and entertainers,” and similar to “Star Wars collectibles sold in the 1970s” rather than a securities sale.

The regulatory body officially charged the creators of the project Stoner Cats with selling unregistered securities around the launch of NFTs in 2021.

There has been a lot of talk about cats at the SEC over the past week: https://t.co/VHFt4CVEV0 and https://t.co/pFXmkGxd2r

— Hester Peirce (@HesterPeirce) September 13, 2023

The SEC reasoned that the project highlighted specific benefits of owning the NFTs, with the ability to sell them on a secondary market and earn royalties.

Peirce and Uyeda raised opposition to the SEC’s decision, arguing that the decision “lacks any meaningful limiting principle” and “carries implications for creators of all kinds.”

The two SEC commissioners brought up the sale of “Early Bird Certificate Packages” in 1977 which were redeemable for character action figures and membership in the Star Wars fan club to counter the SEC’s decision.

The letter noted that if the regulator’s decision on Stoner Cats is taken as precedent, it should have applied to these IOU certificates for Star Wars merchandise, since they could have been resold.

“Using the analysis of today’s enforcement action, the SEC should have parachuted in to save those kids from Star Wars mania,” they wrote.

What is Stoner Cats?

The Stoner Cats NFTs offered owners exclusive access to the six episodes of the animated cartoon series of the same name starring Ashton Kutcher, Mila Kunis, “Family Guy” creator Seth MacFarlane and comedian Chris Rock.

The NFTs were also a way for fans to "engage directly with the content they want to watch and be a part of the content creation process."

According to the project’s team, money raised from the sale of NFTs went directly to the people behind the show.

Peirce and Uyeda argue in their dissent letter that “the fact that money is involved does not transform NFTs into securities.”

The two commissioners requested the SEC provide “clear guidelines” for artists and other creators on how to "experiment with NFTs.”