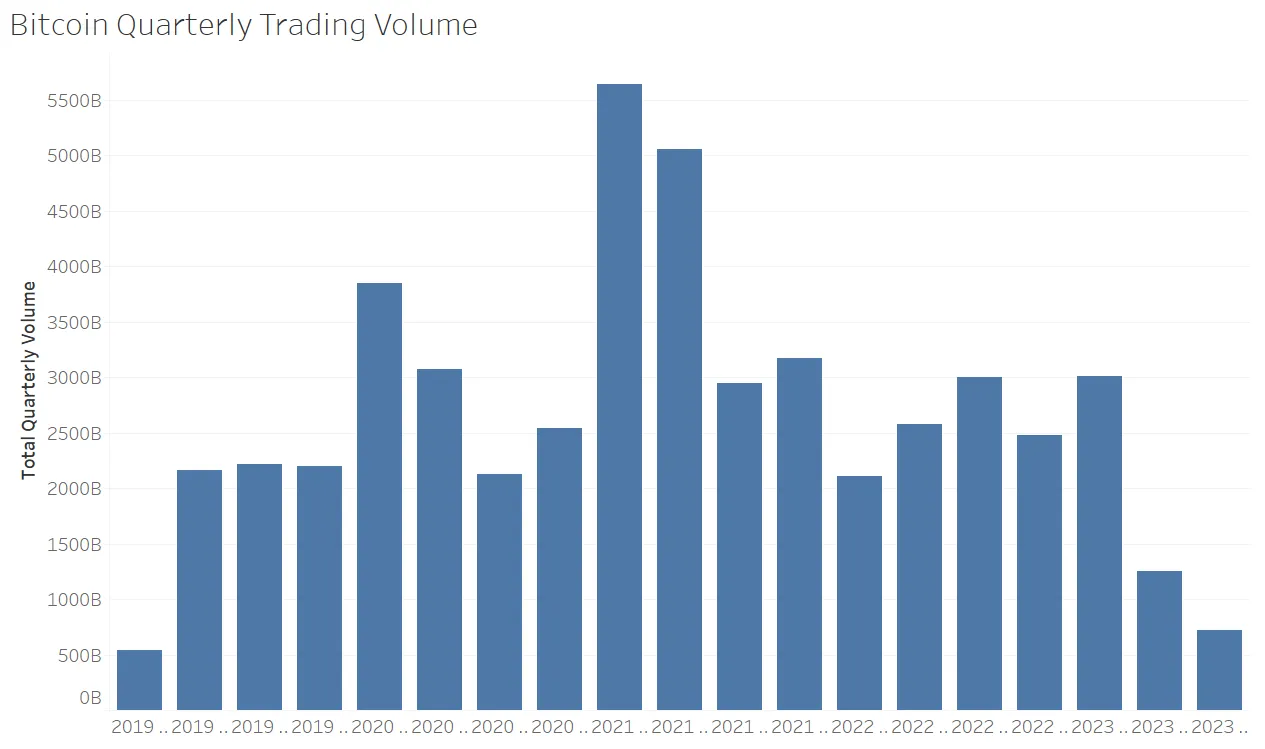

Bitcoin's spot trading volumes for the current quarter have totaled $721.10 billion, according to CoinGecko data.

If September's volumes mirror those of July and August, it will mark the lowest trading volumes for a quarter since Q1 2019. Quarterly trading volumes hovered over $2 trillion for most of the time between 2019 and 2023.

Over the previous two months, Bitcoin saw trading volumes of $345.89 billion and $354.84 billion, respectively.

If conditions remain unchanged and September's volumes hover around $350 billion, the quarterly trading volumes would come close to $1.05 trillion.

For comparison, last quarter, the total quarterly trading volumes were $1.25 trillion, marking a potential 14% decline month over month.

CoinGecko data shows that the total trading volume for Bitcoin in the first quarter of 2019 was $541.3 billion.

Bitcoin quarterly trading volumes. Source: CoinGecko.

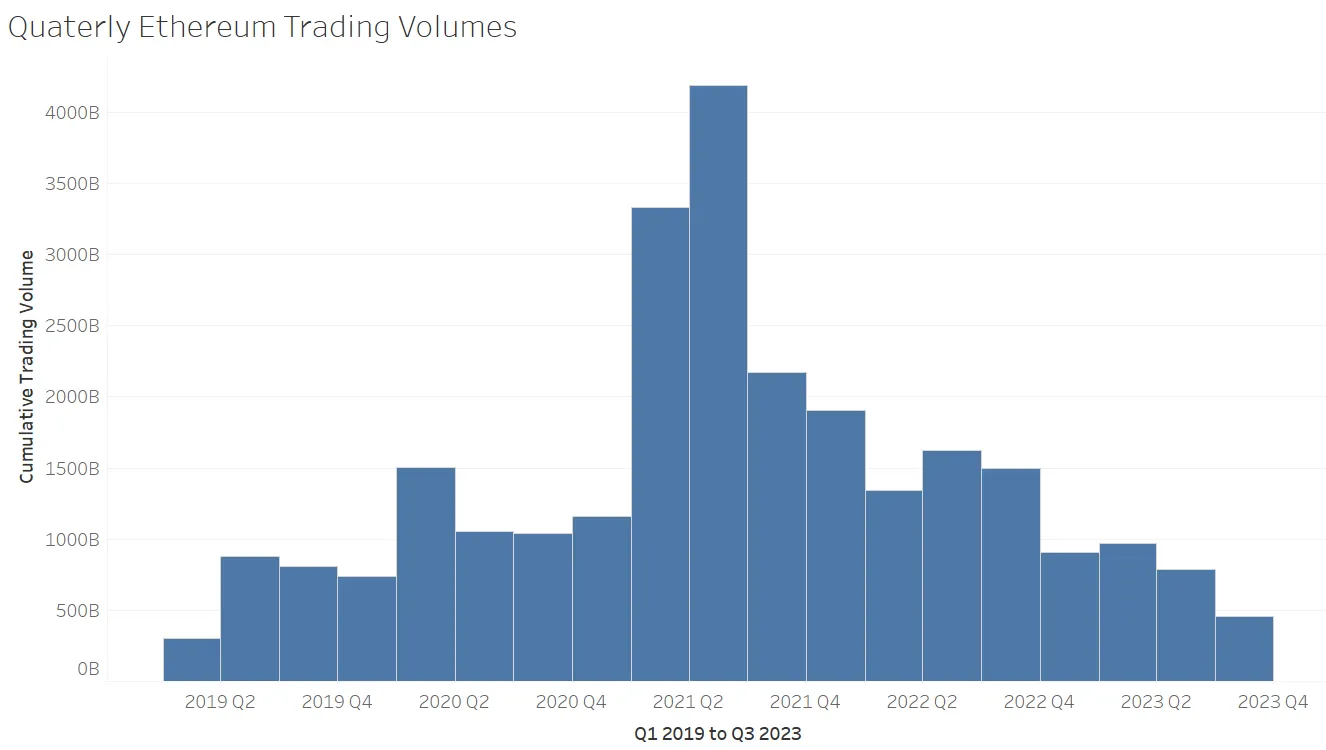

Ethereum paints the same picture

The conditions are similar for Ethereum (ETH).

In July and August, ETH recorded trading volumes of $232.06 billion and $212.92 billion, respectively.

If Ethereum’s September trading volumes reach approximately $220 billion, the cumulative quarterly trading volume for ETH would be just over $650 billion, a level not seen since 2019.

In Q4 2019, the total spot trading volumes for ETH amounted to $740.64 billion.

Ethereum quarterly trading volumes. Source: CoinGecko

According to a previous CoinGecko report, spot trading volumes for the entire crypto market on centralized crypto exchanges dropped by 43% in the second quarter of 2022.

Institutional trading firm Genesis Trading said in its last quarter report that derivatives will likely play a crucial role in the future growth of crypto volume, with “spot market liquidity suffering and spot order book depth chronically flagging.”