Floor prices for "blue chip" NFT collections CryptoPunks and Bored Ape Yacht Club (BAYC) both fell well below $100,000 worth of ETH this week for the first time in months, as the broader NFT market slumped to trading stats not seen in years.

Though the NFTs have rebounded somewhat, it currently costs 49.8 ETH ($93,692 at writing) to acquire a CryptoPunk, according to NFT Price Floor. While still a pretty penny, that’s down more than 30% from just a month ago, when the cheapest CryptoPunk on the market could be had for just over $128,000 worth of ETH.

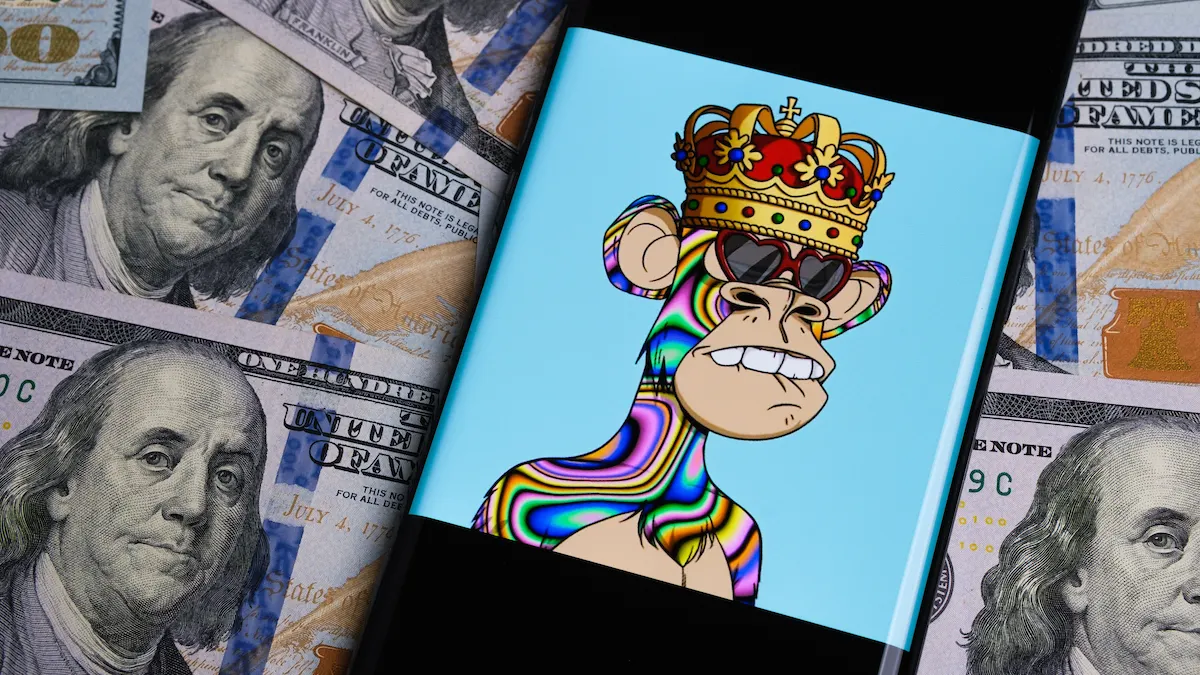

It’s a similar story for Bored Apes, the celebrity-friendly flagship project from NFT behemoth Yuga Labs. Aping into the collection currently costs at least 49 ETH, or about $92,200; purchasing a Bored Ape hasn’t required such little ETH since November 2021.

Those drooping figures appear to be the symptom of a larger concern: fewer and fewer trades are taking place across the entire NFT market. Since mid-April, daily trades across all NFT marketplaces have plummeted an astonishing 71%, according to Dune Analytics.

That decrease in activity has been incremental and consistent across platforms. Such a low tally of NFT trades—just shy of 20,000 on Thursday—has not been seen since late 2021.

Reasons for the recent dropoff remain unclear. Ethereum’s post-Shanghai price lift did slow this week, but the cryptocurrency of the largest NFT market is still looking relatively strong, clocking in at about $1,845 at writing, per CoinGecko.

One specific factor disproportionately responsible for recent rosy headlines about the enduring strength of the NFT marketplace has been the rise of Blur, a relatively new NFT trading platform that rapidly overtook OpenSea as the top NFT marketplace in late February.

Blur’s ascension, though, was fueled by a rewards system that incentivized traders to abandon other marketplaces and flip as many NFTs as possible, even if back and forth between themselves.

Though the NFT marketplace surged in February and in March to about $2 billion in total trading each month, that growth was almost entirely fueled by volume from Blur that some industry experts have labeled as manipulated “wash trading.”

Activity on Blur has continued to dominate the market, accounting for over 60% of all NFT trading volume over the last week. But it may well be that Blur’s strategy of luring customers from other platforms and encouraging them to make meaningless trades for financial rewards has begun to dampen genuine NFT marketplace activity.

Some have pointed to recent spikes in gas fees, likely caused by the rise of meme coins like PEPE in the last week, as potential explainers for the phenomenon. In a Twitter thread Thursday, analytics firm SeaLaunch pointed to a variety of macro factors that may have played a role, ranging from high gas fees to traders facing liquidity issues around the U.S. tax deadline.

Others have pointed to the dismal figures as an indication that the long-awaited “bottom” of the crypto and NFT bear market is finally in. But as the last year has shown, there's sometimes even lower to go.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.