Rate hikes on the horizon

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

$67,996.00

2.92%$2,062.96

5.38%$1.44

2.81%$625.39

1.95%$0.999901

0.00%$87.64

4.78%$0.286521

0.27%$0.099081

3.18%$1.031

-0.24%$50.84

2.90%$0.292347

5.24%$498.73

0.31%$0.999936

-0.00%$8.74

0.57%$28.82

4.97%$9.24

4.04%$0.171756

7.96%$340.37

0.88%$0.999051

-0.11%$0.163589

4.10%$0.999376

-0.08%$0.00955207

0.92%$0.103204

3.57%$56.04

2.77%$1.00

0.03%$243.51

0.57%$9.33

-1.40%$0.947585

4.31%$0.0000061

0.11%$0.116576

1.81%$0.078163

2.04%$1.29

-0.75%$5,155.97

-0.31%$1.60

11.08%$4.01

6.98%$5,187.00

-0.34%$1.40

-2.18%$0.628131

3.52%$1.00

0.00%$1.12

0.01%$184.64

3.50%$0.997192

-0.03%$114.72

-2.48%$0.709179

1.12%$0.00000398

-1.50%$78.57

3.03%$1.00

0.03%$0.070217

4.62%$0.169907

-0.27%$2.24

0.18%$1.00

0.01%$0.00000162

-2.33%$1.15

8.01%$8.97

2.96%$2.44

10.56%$0.270938

3.41%$0.999556

0.02%$0.110715

-3.82%$0.404303

1.14%$11.00

0.01%$8.66

0.45%$7.21

1.96%$0.00176331

-0.99%$1.86

-2.51%$0.058963

2.95%$65.57

3.59%$1.91

-8.31%$0.01660153

-1.00%$0.109712

6.56%$0.03290372

6.95%$0.864674

1.41%$0.839302

10.30%$1.001

0.05%$0.00978004

3.89%$3.52

2.03%$0.090077

1.90%$1.24

0.22%$1.48

2.63%$1.00

-0.00%$1.005

5.52%$114.41

0.01%$0.963509

7.93%$0.03408759

13.99%$1.027

0.00%$1.12

3.25%$0.03548092

4.53%$0.00766952

3.08%$0.080255

-0.15%$0.099523

3.18%$1.096

0.01%$0.996766

-0.03%$0.00000627

3.90%$0.15752

3.86%$32.21

12.17%$1.00

0.02%$0.0128715

0.14%$0.998665

-0.07%$0.264458

4.97%$0.071042

1.78%$0.262086

-0.05%$1.087

-0.03%$0.999925

-0.01%$1.18

0.14%$0.694122

0.59%$0.00707612

2.53%$34.96

2.23%$1.31

0.23%$0.393908

2.92%$0.04720216

4.16%$166.50

-0.08%$0.517732

1.00%$1.00

0.01%$0.25431

2.83%$0.085282

3.91%$0.163877

2.10%$1.74

115.60%$1.46

2.34%$1.023

0.20%$0.999712

0.01%$130.92

4.08%$0.03329625

-3.87%$0.36849

8.15%$1.019

0.03%$0.438503

17.95%$0.00000034

1.90%$0.056531

2.78%$0.00000034

0.44%$16.35

0.92%$3.20

-1.56%$3.23

1.01%$0.01616923

-2.51%$1.53

2.53%$0.052893

0.01%$0.070164

1.71%$0.341442

4.99%$0.323158

6.73%$0.0060318

4.03%$0.02706092

0.22%$0.998418

0.03%$0.00002968

1.04%$0.240615

6.02%$17.61

2.35%$0.991279

0.11%$0.078188

6.54%$0.319589

2.67%$0.051031

1.35%$1.41

2.01%$0.122744

2.62%$1.58

-2.06%$0.00267225

2.83%$0.136807

6.22%$0.00248031

0.04%$6.41

1.36%$0.04425171

3.89%$0.02150182

5.61%$0.08598

3.93%$1.35

2.78%$1.83

4.07%$0.999533

0.12%$0.097722

8.78%$0.999993

-0.00%$0.985555

-0.29%$0.999953

0.02%$1.31

1.61%$10.95

16.02%$1.075

0.01%$0.213067

4.71%$0.00215483

0.01%$22.79

0.00%$0.00000098

2.96%$0.493999

-3.42%$0.098588

-0.90%$0.00003661

1.97%$2.79

3.88%$0.195505

4.18%$5,158.96

-2.85%$0.196478

-0.58%$0.192384

7.22%$0.856143

11.55%$0.052984

0.43%$1.00

0.00%$0.080966

3.96%$0.09716

2.81%$0.01997554

0.27%$0.00492955

0.65%$0.00378674

5.57%$1.00

0.00%$4.06

-3.06%$18.52

1.38%$1.001

0.07%$0.02385421

3.18%$0.115224

-5.58%$0.054455

3.96%$1.85

-1.69%$0.16916

4.80%$0.623577

0.05%$2.12

3.28%$0.02019973

0.61%$1.79

0.12%$2.04

-4.63%$48.00

0.02%$3.41

5.62%$0.994946

2.72%$0.00000787

1.21%$0.04143184

1.72%$1.26

-0.34%$0.336109

7.13%$0.9995

0.01%$0.998707

0.08%$0.147765

-1.68%$0.412007

1.50%$0.169234

-0.19%$1.012

-0.16%$0.304696

0.69%$0.654836

0.50%$0.136568

10.42%$0.096191

4.16%$4.58

0.65%$0.133181

2.75%$0.081971

0.37%$0.614068

1.36%$1,096.65

-0.11%$0.261136

-0.44%$0.074196

-3.11%$0.312658

-1.05%$11.28

4.58%$0.078189

2.03%$0.254112

-1.63%$0.0014897

1.17%$0.223359

1.74%$0.36296

-1.10%$0.00406219

2.45%$0.28133

-1.82%$0.02173666

-1.74%$0.130189

-0.92%$12.89

11.81%$0.04830973

16.64%$0.200844

3.06%$1.001

0.00%$2.36

-0.58%$0.115279

-2.16%$0.995882

0.07%$1.46

-1.09%$0.03027893

8.87%$0.239985

25.39%$1.00

-0.03%$0.332545

-0.05%$1.064

0.13%

Ethereum’s post-Shanghai bull run has hit a lull.

Its price touched lows of $2,080 on Monday morning, while Bitcoin struggled to hold onto the $30,000 support level.

The bullish run-up may have been paused in part due to the U.S. Federal Reserve's statements regarding one more rate hike in the upcoming May policy rate meeting.

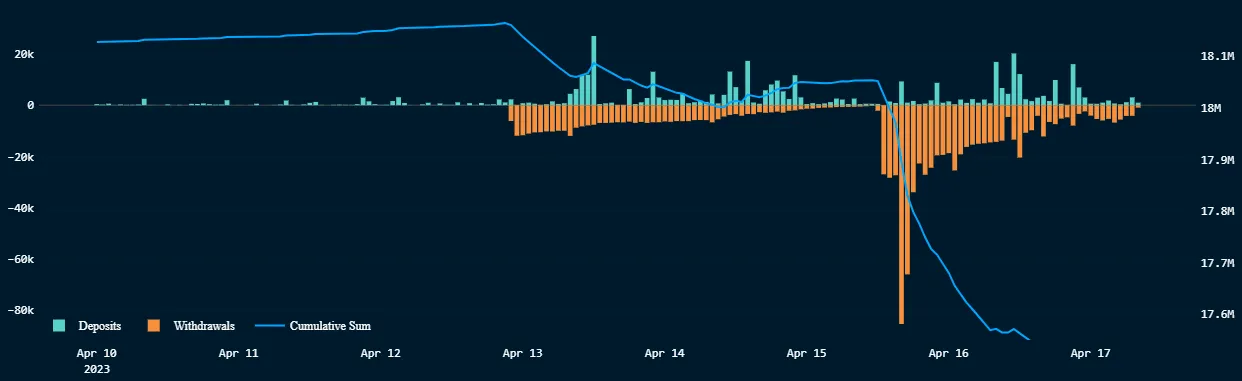

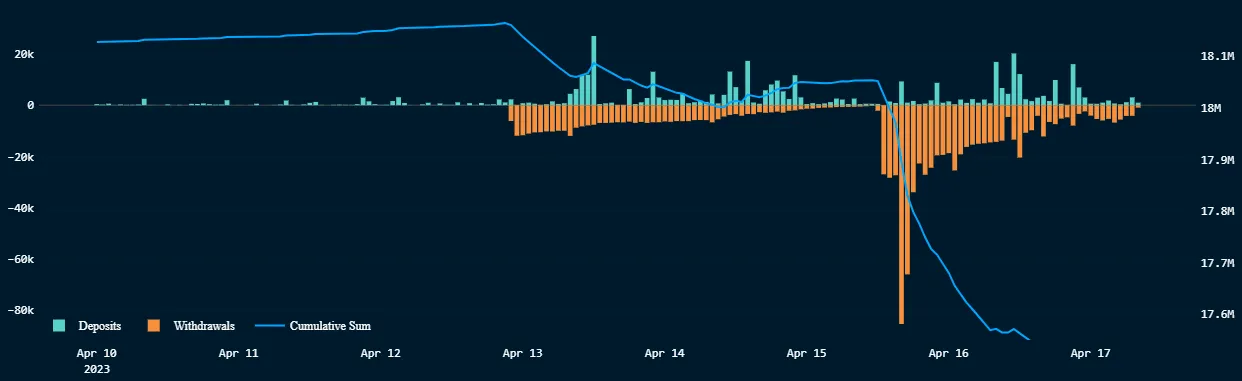

Additionally, withdrawals from Ethereum staking contracts continue to outpace deposits, potentially adding sell pressure to the asset, per data from Nansen. On April 15, there was also a massive 85,393 ETH withdrawal executed at 10 am ET followed by another 66,030 ETH withdrawal an hour later.

Ethereum's price has risen roughly 12% since last week’s Shanghai upgrade. It enabled withdrawals of staked ETH from the proof-of-staking chain, a feature not available since staking was first launched in December 2020.

The network quickly saw a hefty inflow of deposits to the staking contracts and the market reacted positively to the successful change, with Ethereum propelled to new yearly highs above $2,129.

However, on April 14, statements from Fed officials that hinted at another rate hike in May strengthened the dollar. A strong dollar can have a negative impact on other, more risky assets such as cryptocurrencies and stocks.

Christopher Waller, a member of the Fed’s governing board, and Atlanta Fed President, Raphael Bostic, told Reuters on Friday that the Fed may go through one more quarter-percentage gain before ending its quantitative tightening to curb inflation.

The CME FedWatch tool, a survey of CME’s interest rate traders, currently places an 88.2% chance that the Fed will increase its rate.

Another rate hike makes the dollar an attractive investment in annual returns, too, potentially diminishing the appeal of top cryptocurrencies like Ethereum to investors looking for stable yields.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.