What’s dragging Solana?

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

$67,825.00

2.29%$2,062.63

4.95%$1.44

1.63%$626.01

1.86%$0.999916

-0.01%$87.57

4.35%$0.2866

0.29%$0.098916

1.81%$1.032

-0.20%$50.76

2.40%$0.292035

4.58%$0.999882

-0.01%$497.33

-2.13%$8.74

0.57%$28.94

4.41%$9.22

3.70%$341.26

1.53%$0.165495

3.20%$0.998919

-0.02%$0.163998

3.56%$0.999492

-0.04%$0.00957036

2.63%$0.103692

3.76%$56.12

1.58%$1.00

0.03%$243.19

0.03%$9.33

-0.73%$0.945945

3.61%$0.00000609

-0.96%$0.117287

1.27%$0.078013

0.91%$1.29

-0.80%$1.61

9.80%$5,147.41

-0.44%$3.97

6.70%$5,179.90

-0.48%$1.38

-2.98%$0.627252

2.76%$1.00

0.00%$1.12

-0.00%$183.28

2.05%$0.997339

-0.03%$113.84

-3.28%$0.702361

-0.46%$0.00000396

-3.15%$78.37

2.30%$1.00

0.02%$0.070026

2.57%$0.169494

-0.49%$2.24

0.05%$0.999986

-0.01%$0.00000162

-2.31%$1.13

5.61%$8.95

1.96%$2.43

9.48%$0.999446

-0.00%$0.270198

2.47%$0.111044

-3.42%$0.403806

0.89%$8.66

0.66%$11.00

0.01%$7.21

2.00%$0.00182023

0.78%$1.86

-4.12%$0.058923

2.98%$65.49

2.06%$1.91

-7.78%$0.0166363

-2.45%$0.108911

5.44%$0.03308195

7.67%$0.87409

2.48%$0.857708

13.87%$1.00

-0.01%$0.00973736

2.51%$3.52

1.44%$0.089813

1.26%$1.24

0.30%$1.47

2.11%$0.999953

-0.03%$1.003

2.19%$114.41

0.01%$0.961975

7.60%$0.03376001

10.75%$1.027

0.00%$1.12

1.31%$0.03548538

4.31%$0.00764349

1.77%$0.080259

-0.33%$0.099313

3.12%$1.096

0.01%$0.996652

0.03%$32.08

13.14%$0.157935

3.60%$0.00000626

2.56%$1.00

0.02%$0.01286868

-0.04%$0.998408

-0.11%$0.263935

4.77%$0.070935

1.70%$1.087

-0.02%$0.257826

-3.87%$0.999967

-0.01%$1.18

0.34%$0.695972

-0.74%$0.00707367

1.50%$34.95

2.52%$1.31

0.09%$2.02

133.03%$0.391717

1.58%$0.04719997

4.63%$166.25

-0.32%$0.51431

-1.50%$1.00

-0.03%$0.254947

3.41%$0.085393

3.29%$0.163298

1.10%$1.46

0.46%$1.017

-0.66%$0.999701

-0.01%$130.89

3.63%$0.370045

6.97%$0.03290336

-5.34%$1.02

0.08%$0.00000034

2.31%$0.056939

3.22%$0.00000034

0.35%$16.30

-0.35%$3.19

-1.68%$3.22

0.65%$1.53

1.45%$0.01616525

-2.37%$0.052667

-1.06%$0.324906

6.97%$0.07004

1.26%$0.339164

2.77%$0.00605131

3.68%$0.405481

10.37%$0.998184

-0.06%$0.02699712

-0.66%$0.00002956

-0.09%$0.238594

5.68%$17.51

1.59%$0.991439

0.09%$0.319226

1.66%$0.078074

6.71%$0.050874

0.20%$1.40

1.07%$0.122425

1.71%$1.58

-1.86%$0.00267416

2.19%$0.136785

5.13%$0.00246971

-0.52%$6.39

0.14%$0.04420285

2.03%$0.02163539

4.46%$1.36

0.89%$0.085756

2.92%$1.83

3.96%$0.997863

-0.26%$0.098317

8.00%$0.999997

-0.00%$1.31

2.20%$0.985519

-0.31%$0.99998

0.00%$1.075

0.01%$0.00218643

1.53%$10.91

15.21%$0.212488

3.12%$22.79

0.00%$0.00000098

2.80%$0.492117

-4.08%$0.098496

-0.76%$0.00003643

0.85%$2.78

2.27%$5,188.74

-1.64%$0.193553

2.16%$0.196675

-0.80%$0.192993

7.04%$0.855376

11.44%$0.052972

0.41%$1.00

0.00%$0.096721

1.82%$0.07992

2.35%$0.00491075

-0.29%$0.01980092

-0.57%$4.10

-5.12%$1.00

0.00%$0.00377521

4.34%$18.48

0.88%$1.00

-0.10%$0.114798

-5.98%$0.02370501

1.76%$0.054289

2.86%$0.170205

4.64%$1.84

-2.37%$2.12

2.70%$0.620383

-0.98%$0.02020143

0.56%$1.80

0.13%$2.04

-6.25%$48.00

0.01%$0.994914

3.33%$3.37

6.32%$0.00000784

0.54%$1.26

-0.47%$0.0412344

0.34%$0.3355

7.04%$0.999623

0.08%$0.998612

0.06%$0.144728

-4.29%$0.169406

-0.55%$0.409447

0.33%$1.012

-0.21%$0.303973

0.05%$0.654347

0.05%$0.135465

9.28%$0.095691

2.95%$4.56

-0.03%$0.133353

3.04%$0.081791

-0.63%$0.610617

0.15%$1,096.44

-0.15%$0.260335

-0.79%$0.074336

-2.94%$0.313445

-0.80%$11.53

0.38%$0.254092

-1.84%$0.00149022

1.07%$0.077871

1.21%$0.222431

0.97%$0.00405521

1.17%$0.361013

-4.34%$0.280245

-2.75%$0.130203

-1.01%$0.0215006

-2.98%$12.78

12.49%$1.001

0.00%$0.200463

2.91%$0.03155331

14.01%$0.04740554

13.92%$0.247547

28.20%$2.35

-1.59%$0.995713

0.05%$1.46

-0.45%$0.114137

-3.10%$1.00

-0.04%$0.332435

-0.91%$1.063

-0.03%

As Solana’s Breakpoint event wraps up, so too has the token’s bullish price action.

Despite news that Google Cloud would begin running a Solana validator, the token backing the speedy layer-1 blockchain has plummeted double-digits.

The so-called Ethereum Killer’s native token, SOL, has dropped nearly 12% in value over the past 24 hours, according to data from Coingecko.

Solana is a proof-of-stake (PoS) layer-1 blockchain that offers many of the same operations as Ethereum, including decentralized finance (DeFi) applications and non-fungible tokens (NFTs).

SOL dropped from $36.29 to $31.02 early Monday morning. It has since staged a modest rally to $31.80 at press time. Trading volumes also saw a 19.22% dip to $2.77 billion over the same period.

Today’s bearish price action wiped off Solana’s weekly gains and put it down 4.2% over the week. SOL is still down 87.8% from its all-time high of $259.96, recorded a year before.

Over $8.37 million of Solana futures positions were liquidated over the past 24 hours, per data from Coinglass. The majority of liquidations (85.14%) came from blown-out long trades.

Green bars indicate blown-out long trades. Source: Coinglass.

With a market capitalization of nearly $11.29 billion, SOL is now the 10th-largest cryptocurrency after losing its long-held position ahead of Elon’s favorite crypto, Dogecoin.

SOL’s recent bearish price action comes amid a slump in Solana-based NFT volume. NFTs played a significant role in the blockchain’s success early this year.

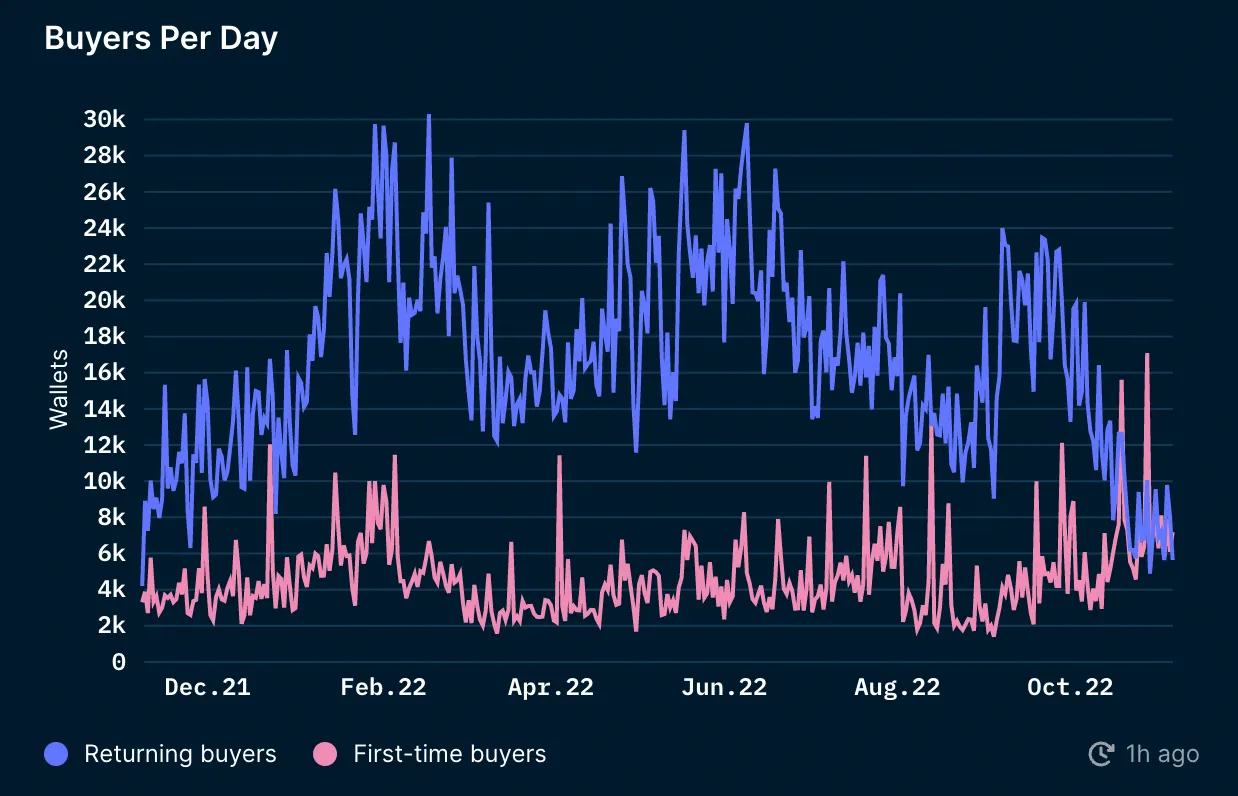

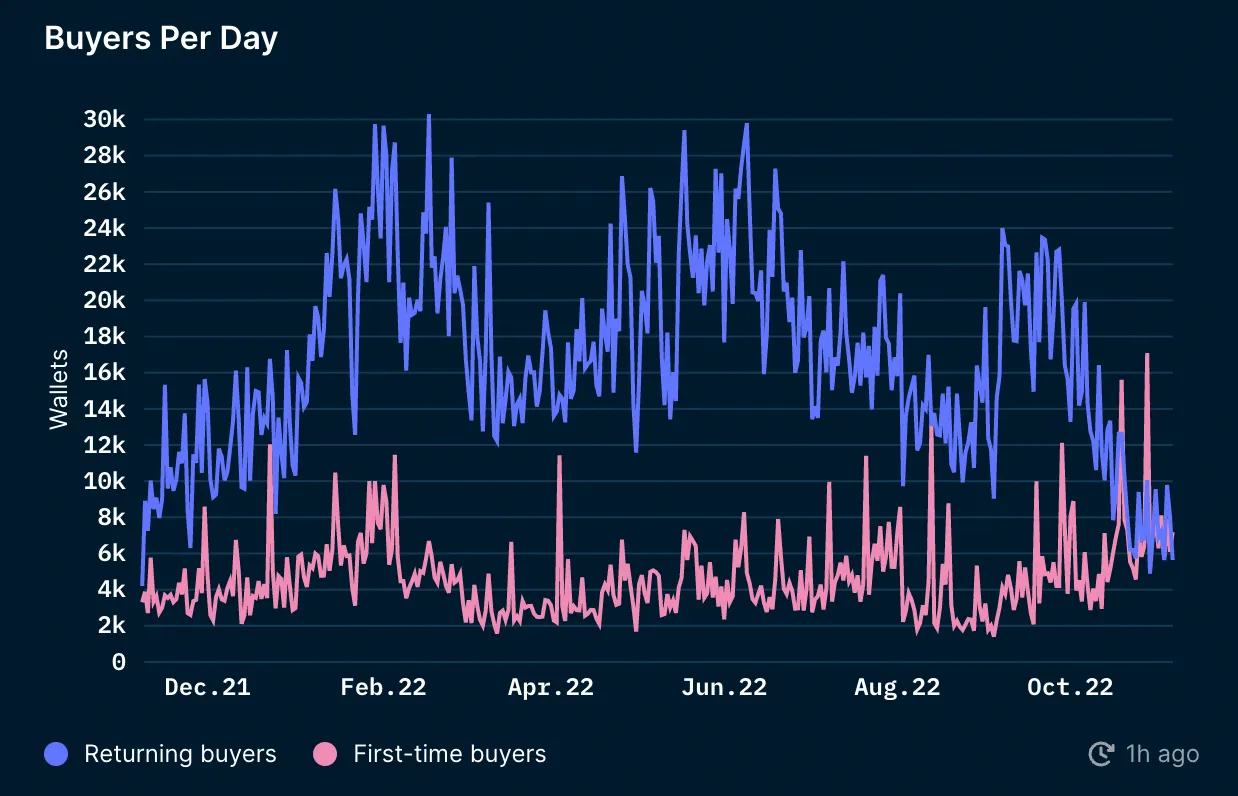

According to data from Nansen, returning NFT buyers on Solana reduced significantly to levels not seen since November 2021. Returning NFT buyers indicate investors’ growing interest in the network.

On the flip side, the first-time buyers metric has also dropped to 6.097 buyers yesterday compared to 17,090 buyers on October 28, 2022.

Beyond returning and first-time buyers, Solana NFT transactions overall have also reduced significantly over the past four weeks.

Transactions hit an all-time high of 650,000 during the second week of September. Since then, however, the value has been in free fall, with the network processing roughly 160,000 NFT transactions as of November 7.

Though Solana has been hit the hardest, the broader crypto market has taken a hefty blow over the past 24 hours.

The industry’s market capitalization has fallen by more than 3% to slightly above $1.02 trillion over the same period.

Leading assets in Bitcoin (BTC) and Ethereum (ETH) have also lost 2.52% and 3.87%, respectively, over the past 24 hours.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.