Several Decentralized Finance (DeFi) cryptocurrencies including Aave (AAVE), Uniswap (UNI), Lido Finance (LDO), and Curve (CRV) have posted significant gains over the past 24 hours.

AAVE, the native token of the popular cryptocurrency lending platform Aave, has jumped over 10% over the past 24 hours and is currently trading at just over $69, according to data from CoinMarketCap.

Recently, Aave has proposed plans for launching its own collateralized stablecoin, a key reason behind this specific asset’s bullish moves.

UNI, the token behind Uniswap, has also gained 2.1% over the past 24 hours. The DeFi token enjoys a market capitalization of $4.14 billion but has shed 87% from its all-time high of $44.97.

Elsewhere, LDO has also staged a recovery after stETH re-pegs.

The native token powering the crypto staking platform Lido is up 10% over the past 24 hours, and currently changes hands at around $0.68. Despite strong weekly gains, the token is 96% down from its all-time high of $18.62.

CRV, the token behind the decentralized exchange Curve, has also shown positive price movement over the past 24 hours. The 70th-largest cryptocurrency has a market capitalization of $543 million and is up 5% over the same period of time, reports CoinMarketCap.

Ethereum on-chain activity

The primary reasons behind today’s bullish action are improved on-chain activity and the bullish price movement of Ethereum.

Total transactions on Ethereum have increased by 2% to 1.19 million, over the past 24 hours, suggests data from Etherscan.

NFT sales volumes have risen steeply, posting an increase of 6.94% to $19.40 million over the past 24 hours, suggests data from Cryptoslam.

Ethereum-based NFT sales volume has been up 12.49% over the past 24 hours.

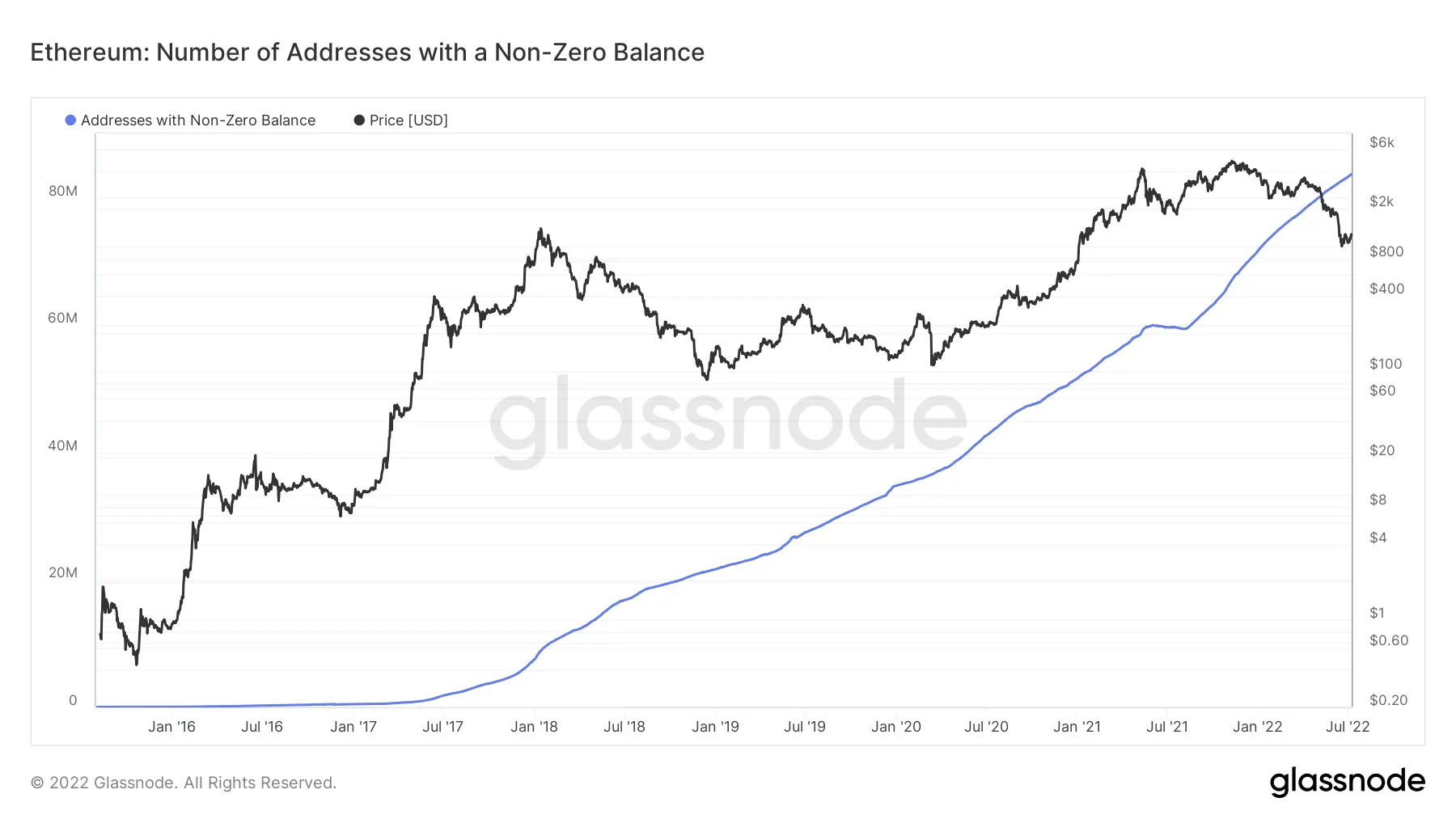

The number of addresses with non-zero balance on the Ethereum network is also on the rise after a slight decline in March 2022. Currently, there are nearly 83.58 million Ethereum addresses with a non-zero balance—a new all-time high for this specific metric.

The second-largest cryptocurrency by market capitalization, which underpins much of the DeFi ecosystem, Ethereum is up nearly 17% over the last week, according to data from CoinMarketCap.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.