Welcome to DeFi D.I.Y., where Decrypt's DeFi whiz walks you through how to use a specific DeFi tool or platform. Today: staking Ethereum on Lido.

Not everyone has the 32 ETH needed to stake directly onto the Beacon Chain, or Phase 0 of the network's transition to Ethereum 2.0 and a proof-of-stake (PoS) consensus mechanism.

To serve this community of smaller token holders, several projects have emerged that let users stake any sum they want. Moreover, you can still earn a bit of yield on those holdings.

(Also, for the full spiel on Ethereum 2.0, check out our Learn piece here.)

Top services that offer low-volume staking include RocketPool, Stafi, Lido, and several crypto exchanges. The yield for each service differs, of course, but it's all relatively straightforward.

Let's dive into Lido specifically because it's become the most popular staking service, hosting more than 32% of all 12.7 million Ethereum staked on the Beacon Chain, according to Dune Analytics. In dollar terms, that means Lido currently hosts $24.3 billion at current prices.

The staking process on Lido is simple.

Click the "Stake now" button and head over to the staking dashboard. From there, you can choose between various proof-of-stake networks, including Solana, Kusama, Polygon, and Ethereum’s Beacon Chain.

Once you choose Ethereum, you’ll then be prompted to connect a Web3 wallet like Coinbase Wallet, WalletConnect, or MetaMask, among others.

A word of warning: If you've been playing around with Aribtrum, Fantom, or Avalanche, don't forget to swap back to Ethereum Mainnet in your wallet! Lido doesn't currently support these networks, so deploying capital could result in the permanent loss of funds.

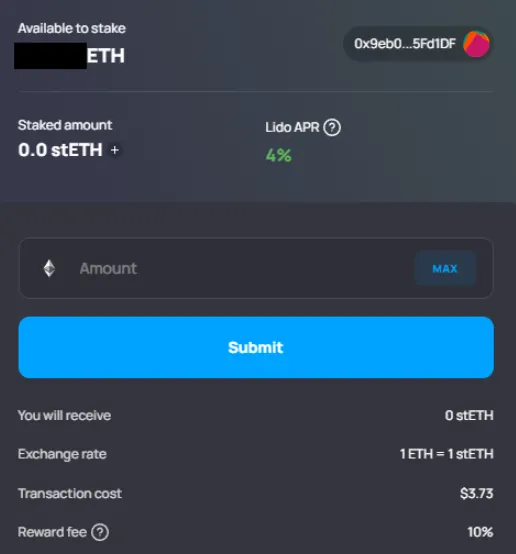

This is what your screen should look like:

The "stETH" ticker you see here stands for "staked ETH," and it's the token you will receive after you've deposited your Ethereum.

It's sort of like a receipt that shows you have ETH tied up in Lido, but it also means you can put that stETH to work elsewhere in crypto (like minting the stablecoin DAI on Maker, for instance).

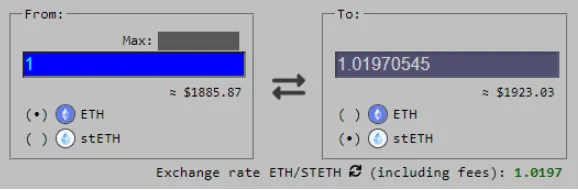

This is because stETH has real monetary value as it attempts to track the price of Ethereum. Currently, though, the staked version of Ethereum is trading at a slight discount to the original Ethereum, according to Curve Finance.

Once staked, you can stop there. Earning 4% is a pretty generous yield for such a simple task. What's more, this yield is expected to rise once Ethereum completes its upgrade slated for August.

"Through the merge with the proof of stake chain, fees previously earned by miners will pass on to being earned by those staking. This is expected to result in staking rewards between 7% and 12%," writes Lucas Outumuro of IntoTheBlock.

If you're feeling particularly ambitious on this U.S. holiday weekend, give it a shot.