Buying Crypto: The Early Days

“How to buy crypto” (or some variation of this) is still one of the most commonly searched phrases for those that are new to the burgeoning world of crypto, decentralized finance (DeFi), and blockchain technology. For some, this initial hurdle has deterred them from leaping into this dynamic industry that merges blockchain technology, exciting use cases, and the potential to turn your crypto purchases into high-return investments or convert them into collectible non-fungible tokens (NFTs).

In the early days (from Bitcoin’s inception to the mid 2010s), the first step was often the most frustrating. Early crypto adopters wanted to turn their fiat currency (USD, EUR, and so on) into cryptocurrencies such as bitcoin (BTC) and ether (ETH). However, there wasn’t always the financial infrastructure in place to accomplish this task.

One option was to give someone cash for crypto in a physical transaction. This required you to meet in person and came with some headaches and safety concerns. First, you needed to know someone who had crypto and lived nearby. If not, you had to search for them on a marketplace that matched crypto buyers with crypto sellers. Oftentimes, this may have left you without options if you lived in a region or area without other crypto enthusiasts.

The other primary option was to purchase crypto on a centralized crypto exchange (CEX). However, even many exchanges in the early days didn’t provide a mechanism for purchasing crypto using fiat — you already needed crypto to transfer to your crypto exchange account. Once this was accomplished, it was relatively easy to trade crypto-for-crypto using a variety of these CEXs.

Centralized Crypto Exchanges to the Rescue

Fortunately, CEXs started to solve the pain point for those that wanted to get exposure to BTC, ETH, and a variety of altcoins. Kraken and Coinbase were some of the earliest exchanges still in existence that allowed customers to purchase crypto via fiat through the use of a wire transfer or some other traditional payment option. The vast majority of users at this time (circa 2013) purchased crypto initially through a CEX. While this was better than meeting people in person in some sort of crypto-for-fiat swap meet, it still came with some issues that were less than ideal.

Some took issue with the costs and fees for making crypto purchases and trades. Others lamented that the CEX options were limited and lacked the competition necessary to lower fees or improve the user experience (UX). Perhaps most importantly, this option may not have been available to you if you lived in a certain country, lacked a bank account, or couldn’t access the financial rails (such as wire transfers) of the traditional finance (TradFi) world in your region.

Buying Crypto: What You Need To Know

There are now a variety of options for both fiat on-ramps (turning fiat into crypto) and fiat off-ramps (turning that crypto back into fiat). Many still make their first purchase on CEXs such as Gemini, Coinbase, or Kraken. Some feel perfectly comfortable buying, selling, trading, and storing crypto on one of these exchanges.

While the process and UX has significantly improved, these exchanges are still custodial exchanges that hold onto the crypto for you. This means that you must trust them to maintain your crypto account balances on your behalf. With the collapse of several high-profile exchanges (Mt. Gox, Quadriga CX, and FTX more recently), many crypto investors don’t feel comfortable using this arrangement.

They prefer to store their crypto non-custodially — meaning they control their crypto personally. This means that you store the crypto on a wallet that only you control. For this cohort of crypto investors, the process may look something like this:

- Link your financial institution (or wire money) to a centralized exchange.

- Buy crypto on this CEX.

- Send the crypto on your crypto exchange account to a non-custodial wallet that you control.

From here, these crypto users can often trade via a decentralized exchange (DEX) or utilize the ability to to make in-wallet trades via atomic swaps. Popular software and hardware wallets (Atomic, Exodus, Trezor, Ledger, and so on) allow crypto investors to maintain personal custody and control of their crypto funds.

However, many of these wallets still require you to acquire crypto from a CEX or some other fiat on-ramp first. Others may only provide one or two specific fiat on-ramps that can be cumbersome or incur high fees. Like other sectors within crypto, the fiat on- and off-ramps are evolving in ways that are meeting the market demands of the community.

Is There a Better Way To Buy Crypto?

For some, the need to use a CEX to first buy crypto (or buy more crypto later) is a step that they could do without. For one, the bank-to-CEX-to-(non-custodial)wallet can be a bit cumbersome. Is there a way to remove the intermediate step of having to use a CEX? Could there be a simpler way to turn your fiat into ETH and other cryptos? Could there be an option that provides you with more purchasing options and transparent pricing?

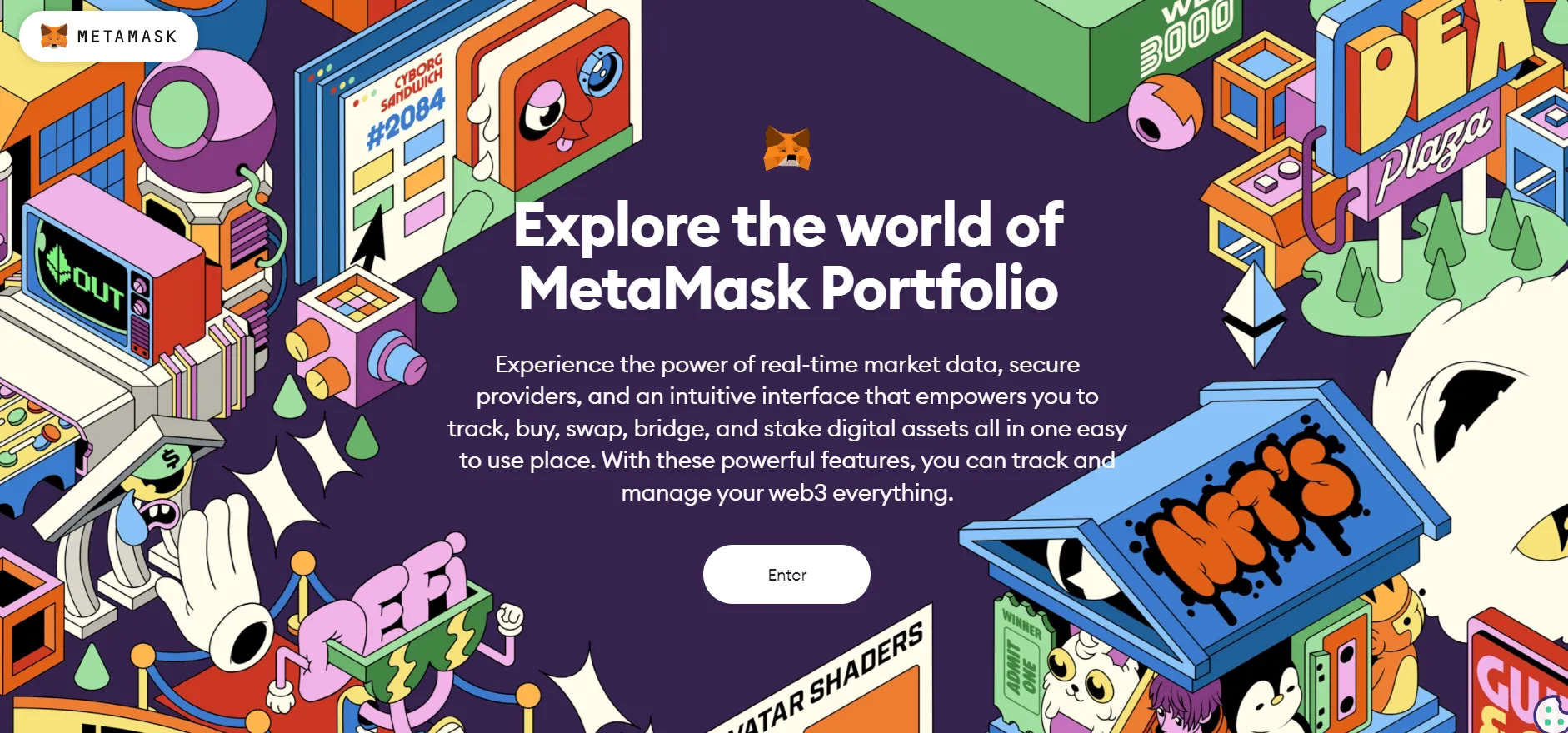

One of the most interesting options is MetaMask Portfolio. It integrates with the popular MetaMask wallet and provides you with a host of fiat on-ramping options that allow new users to get exposure to ETH and other popular crypto tokens. In the following articles in this series, we’ll give you step-by-step guides on purchasing and selling crypto, swapping crypto, bridging crypto, and staking crypto via MetaMask Portfolio.