Last week was a wild one for the speedy, proof-of-stake network Fantom. A large holder of Fantom’s FTM tokens took out a massive loan and brought the network to its knees.

Things have cooled off since, but the episode brought to light how very traditional financial activity (like lending and borrowing) can still wreak havoc on cutting-edge technologies.

Here’s the story of how a Fantom whale nearly crashed the network. (Crypto networks don’t typically "crash" in the traditional sense of the word; instead, they get so expensive and congested that they become nearly impossible to use.)

The degen in question reportedly goes by the pseudonym Roosh in the Fantom community, and he deposited $50 million worth of FTM (roughly 59 million FTM tokens) on a DeFi protocol called Scream to take out a loan for two other tokens.

Scream is a lending protocol, like Aave or Compound, built on Fantom.

The two tokens were SOLID, from the protocol-to-protocol crypto exchange called Solidex (learn more here), and DEUS, the native token for a Swiss-army financial services platform called Deus Finance. You can see the whale’s wallet here.

So, to recap so far: Roosh put $50 million of FTM into Scream to get out SOLID and DEUS.

The whale received 37 million of these two tokens because Scream, like just about every other DeFi platform, only executes over-collateralized loans. You must deposit more money than you receive. To mint MakerDAO’s DAI stablecoin, for example, you need to put in $1.5 worth of ETH in order to get just $1 worth of DAI.

The ratio for how much of one asset you can borrow for another is called the loan-to-value (LTV) ratio. It varies from platform to platform, asset to asset, and is primarily a function of how volatile or exotic the asset you’re borrowing is. A highly volatile, small-cap cryptocurrency will likely have a high LTV. It may seem inefficient, but in crypto, where wild price swings are inevitable, projects need that extra, over-collateralized cushion.

In the case of this Fantom whale, he put this precise idea to the test.

After locking up $50 million in FTM on Scream and borrowing DEUS and SOLID, the whale then locked up his haul of those two smaller tokens in a four-year staking contract. So, he’s levered and illiquid.

Then the market began moving, and when Bitcoin starts moving, so do altcoins (like Fantom). And as the value of FTM dropped, Roosh’s LTV ratio on Scream also edged closer and closer to the level at which the protocol would begin liquidating (i.e. selling off the underlying to make up the debt) his position.

People within the Fantom community watched closely as this unfolded—after all, liquidating a $50 million position would have been catastrophic for the health of any crypto network. But because Roosh was essentially illiquid, he could not add to his collateral and stymy the liquidation.

Eventually, one of the members of the Deus Finance DAO lent Roosh $2 milllion to help prevent this.

Btw…did you tweet at Lafa or Dr liquid about causing a panic & loaning Roosh 2 mil very publicly or nah? pic.twitter.com/Ir7g1tgSdN

— ☀️ Alltheway08 🏴☠️🦜 (@alltheway08) May 3, 2022

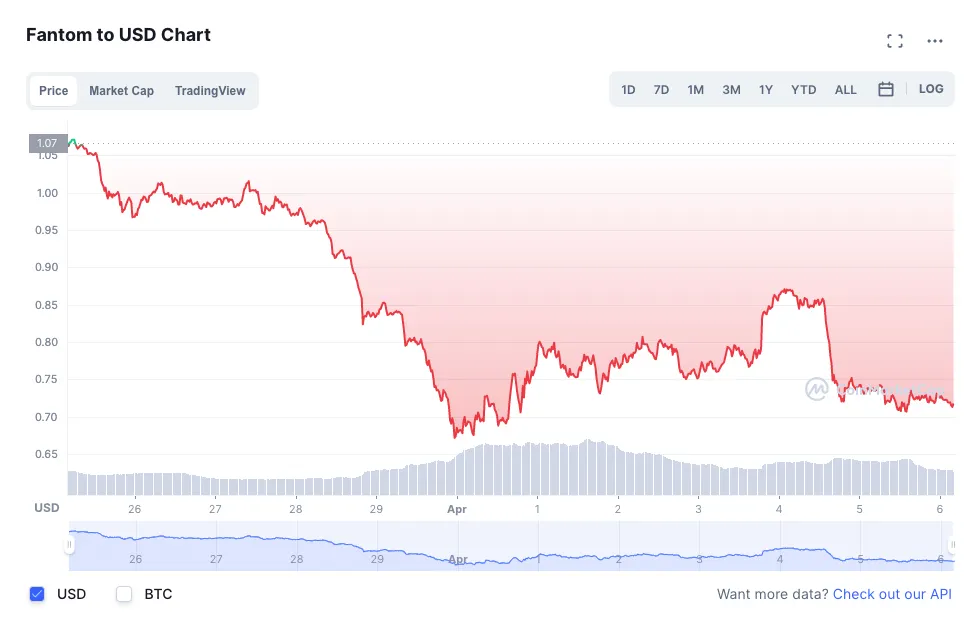

Still, a partial liquidation of 11 million FTM tokens occurred, and the price of FTM plummeted from $0.85 to $0.79, according to on-chain analyst Amna.

A second and third liquidation eventually happened, dropping FTM to $0.76. “Whale now only has 35 million FTM (down from 59 million FTM) as collateral," Amna wrote. "Fourth and continuing liquidations bring whale down to 30 to 18 million FTM.”

Here’s what that looked like in a handy chart. The liquidations began on April 29.

So, even if FTM holders weren’t aware of this specific liquidation event happening, they were certainly aware of the rapidly declining value of their holdings.

Unfortunately, anyone who attempted to trim those holdings during this drop would’ve been met with an ugly surprise.

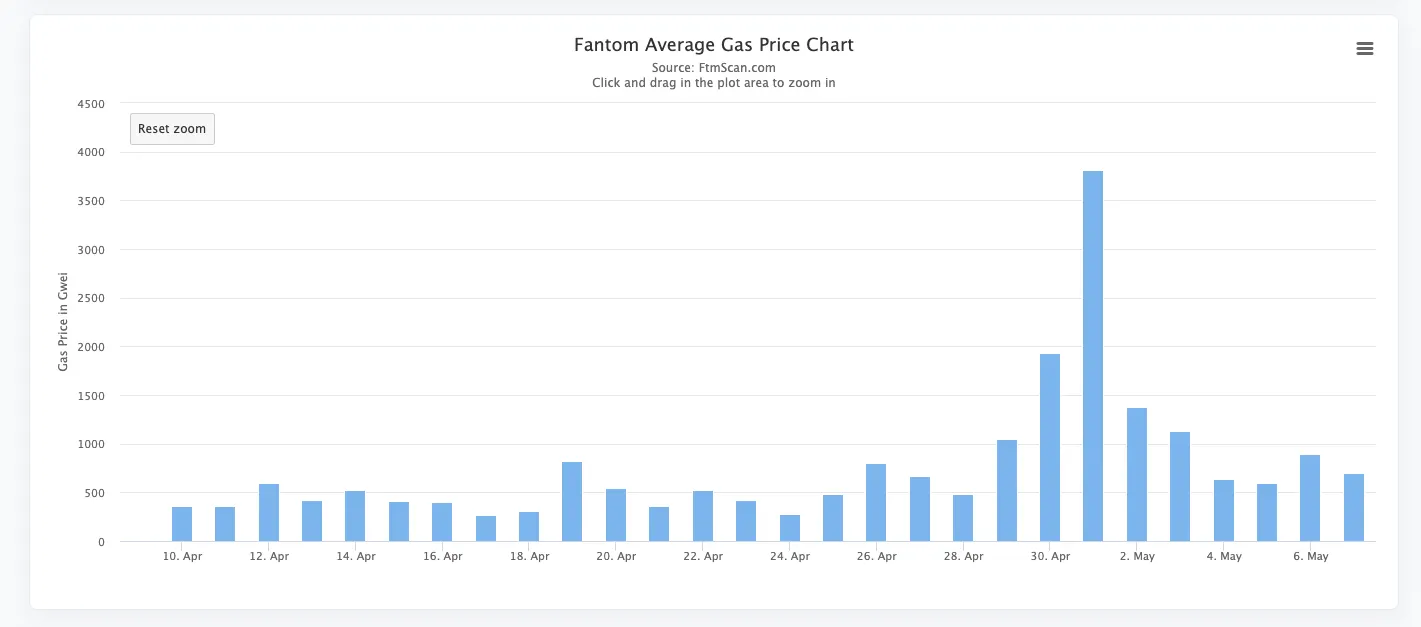

Because you have enormous chunks of FTM being sold off entirely on-chain, transaction fees on Fantom absolutely soared.

This is just an average gas fee, but crypto security expert Chris Blec shared on Twitter that these cascading liquidations caused transfers to hit nearly 20,000 gwei (the metric for how fees are measured) at one point.

“It’s expensive to get a [transaction] through in FTM. But FTM is cheap so it's still affordable. But it shows what a panic can do,” he tweeted after. “Imagine if this was the price on Ethereum.”

And here’s where things can get really, really dicey for a crypto network (not just Fantom): When a huge amount of a native token is being sold off piece by piece, panicky investors may run for the exit. But because fees are high and transactions are slow, they usually won’t be able to exit their positions. More broadly, other DeFi projects built on top of the network are also reduced to a snail’s pace.

And if you imagine that there are many other users who have borrowed assets on Fantom, they may have a difficult time topping up their collateral as their transactions fail to go through, which could lead to even further liquidation (and more on-chain activity, and even more congestion).

And all the way down you go as activity grinds to a halt while prices plummet. And voila, that’s essentially the recipe for a death spiral.

Exciting, no?

Obviously, this didn’t happen to Fantom, but it is a legitimate risk. And Fantom isn’t the only chain that’s vulnerable to this sort of event. So be careful out there.

Decrypting DeFi is our DeFi newsletter, led by this essay. Subscribers to our emails get to read the essay first, before it goes on the site. Subscribe here.