In brief

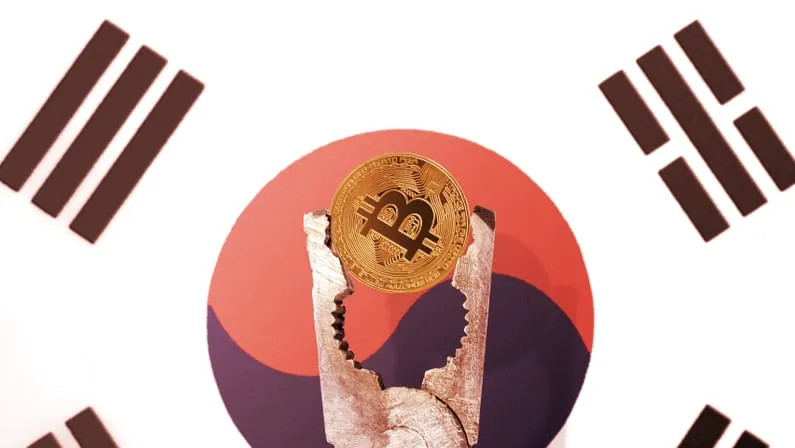

- South Korean exchanges are required to introduce real-name verification systems before September 24.

- However, many smaller trading platforms struggle to secure the necessary banking partnerships.

With less than four months left for South Korean cryptocurrency exchanges to obtain business licenses, many struggle to comply with new regulatory requirements, the Financial Times reports.

South Korea is considered among the most active crypto markets globally, with recent reports claiming that many of the country’s workers in their 20s and 30s are quitting their jobs to become full-time crypto traders.

At times, this enthusiasm has inflated the price of Bitcoin on local exchanges, with the so-called Kimchi premium having rocketed as high as 22% on one occasion earlier this year.

South Korea’s regulators have also been on high alert, implementing various measures to make sure users and businesses play by the rules.

According to the amendment to the Act on Reporting and Use of Specific Financial Information passed by the National Assembly in March 2020, cryptocurrency trading platforms will have to comply with the Financial Action Task Force’s (FATF) guidelines aimed at combating money laundering and terrorist financing.

Additionally, exchanges are required to obtain approval from the Financial Services Commission (FSC) and the Korea Internet and Security Agency to operate in the country, with the deadline set for September 24.

Most importantly, though, the new rules oblige exchanges and wallet operators to incorporate real-name verification systems—something that requires partnerships with approved financial institutions.

However, while Korea’s major exchanges, such as Upbit, Bithumb, Korbit, and Coinone, have reportedly secured the required banking partnerships and are preparing to register with the FSC, many smaller platforms face problems.

Though popular in South Korea, banks are still reluctant to do business with cryptocurrency businesses. One specific area of concern for the banks is that they would be liable for any illicit activity related to cryptocurrencies.

Crypto crisis in South Korea

“We are facing an existential crisis. We want to legitimize our business, but banks are reluctant to offer us real-name accounts,” Lee Chul-ie, the CEO of cryptocurrency exchange Foblgate, told the FT.

More problems are likely to occur if smaller exchanges “are left to operate in the grey area,” said Lee Chul-ie, adding that the new regulatory regime favors the large trading platforms. He fears that without a banking partner, Foblgate will have to move the business abroad.

However, some experts argue that the crypto market in South Korea “is overcrowded with too many trading platforms,” and stricter regulatory measures were needed to provide better investor protection and transparency.

Thus, if smaller exchanges cannot convince banks before September, South Korea will be left with only a few key, highly-regulated players.