In brief

- Korea's Kimchi Premium has returned, but is not as high as it was.

- The Kimchi Premium is the difference between the price of Bitcoin in South Korea and elsewhere.

- The South Korean government is cracking down on those trying to exploit it.

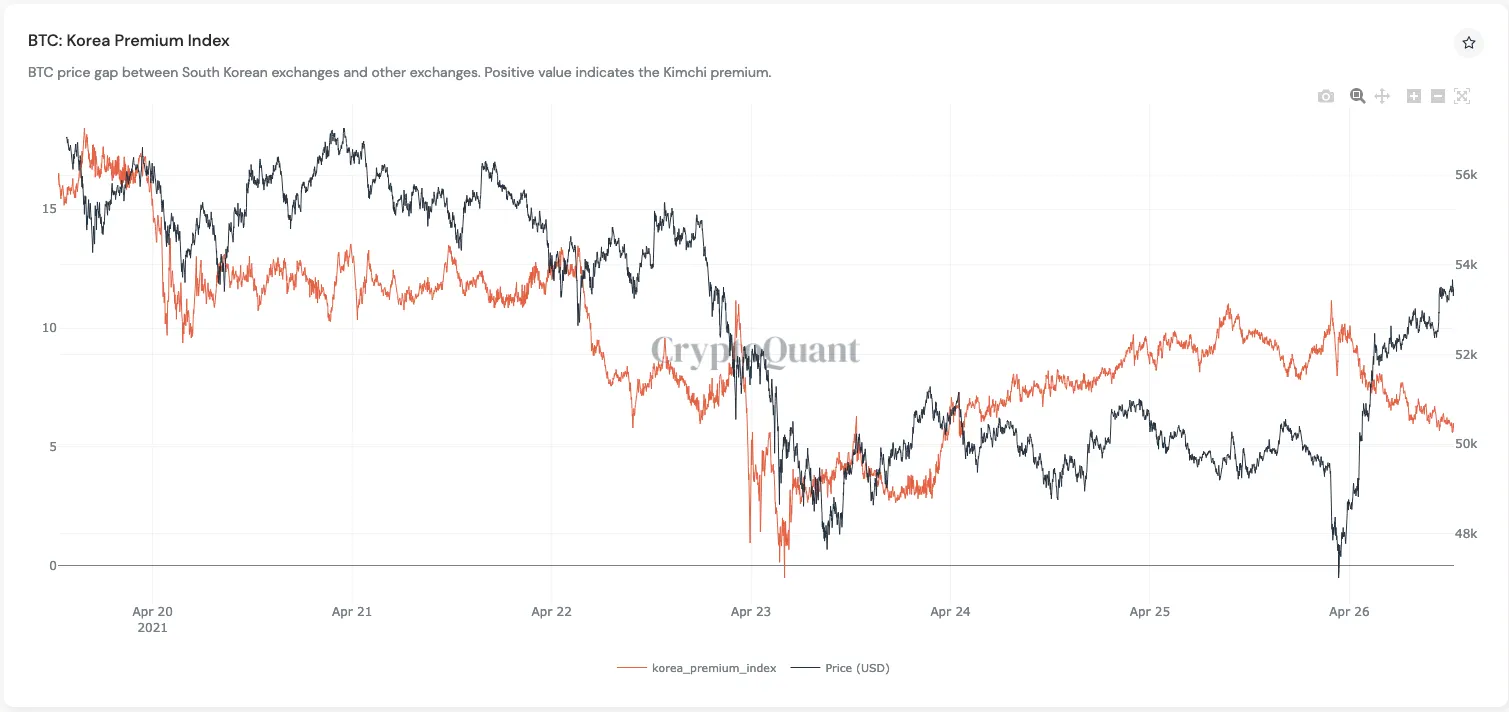

Korea’s so-called Kimchi Premium has returned after falling to zero last week, with Bitcoin currently selling 6% higher in South Korea than in the rest of the world.

The Kimchi Premium is the difference between the price of Bitcoin in Korean markets and the average price across all other countries. The reason behind this discrepancy is the tight Korean capital controls that make it hard to arbitrage the difference.

A few weeks ago, the premium was as high as 22%, according to data from CryptoQuant. At this time, Bitcoin was being sold in Korea for as high as $65,000, while the price was as low as $55,000 elsewhere.

Then the premium started drastically declining. On April 23, the premium briefly fell to zero, reaching parity with the rest of the world.

It didn’t stay that way for long. Over the weekend, the Kimchi Premium rose as high as 11%, with Bitcoin selling at $55,500 in Korea—$5,500 higher than elsewhere.

Over the last 12 hours, the premium has started falling again. It has slowly declined to its current value of 6%. So unless the premium returns with a vengeance, it could be on its way out.

Cracking down on those escaping the premium

While the premium is hard to take advantage of, some traders have managed to exploit it. Most famously, in early 2018, FTX CEO Sam Bankman-Fried used multiple financial intermediaries in Japan in order to buy Bitcoin in South Korea and sell it elsewhere. He reportedly moved up to $25 million a day when executing this trade.

More recently, Korean traders have been moving their money to China to buy Bitcoin at a cheaper rate there. But the South Korean government is beginning to crack down on this behavior.

According to local reports, the traders could be committing money laundering by going through this process to purchase Bitcoin. In order to prevent this, some banks have already started limiting—or flagging—transactions out of the country above certain limits. One bank is even requiring its customers to come to the branch to prove that they are sending the money for a legitimate purpose.