In brief

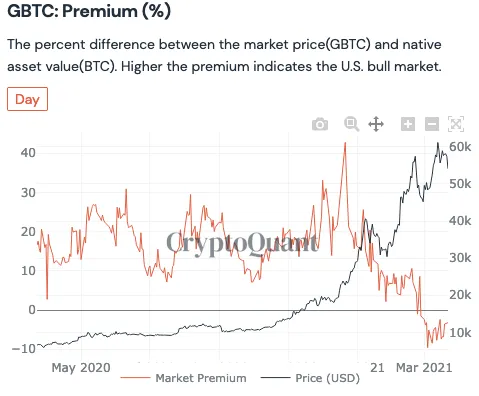

- Grayscale Bitcoin Trust's premium has stayed negative for a month, which could impact on the wider cryptocurrency space.

- One solution would be to introduce a Grayscale Bitcoin ETF, if the SEC allows it: but how would the firm choose to do so?

The Grayscale Bitcoin Trust (GBTC), a popular way for investors to get exposure to Bitcoin in the form of shares, has now had a negative premium for an entire month. This means the price of each share remains below the corresponding amount of Bitcoin it represents.

This negative premium is new terrain for Grayscale’s institutional investors. In the past, those wealthy investors have purchased shares in the trust in order to engage in a form of arbitrage, flipping them to retail investors at a profit months later once a regulatory “lock-up period” expired.

Now, the negative premium appears to be the cause of a recent collapse of inflows into the GBTC. As Bitcoin lending firm BlockFi CEO Zac Prince told the What Bitcoin Did podcast, one would have to be a “complete moron to subscribe to create new shares of GBTC while the liquid shares are trading at a discount.” He suggested investors might as well buy the shares on the open market if they want to buy any.

BlockFi itself has purchased significant portions of GBTC shares in the past, but now the new negative premium not only eliminates the arbitrage opportunity, it makes the shares themselves a shaky investment, especially in light of Grayscale charging an annual 2% fee to obtain and package the underlying Bitcoin.

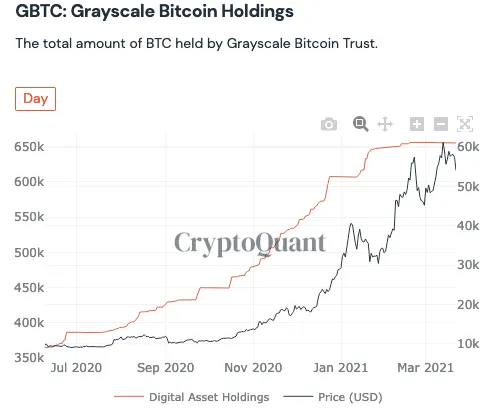

In fact, a report by crypto insights platform ByteTree stated that, if the negative premium remains and the selling pressure increases, this “could morph into a systemic risk.” The reason behind this is the sheer size of the Grayscale Bitcoin Trust, which currently holds 655,000 Bitcoin ($37.5 billion), according to data provider CryptoQuant—an amount significantly higher than any other fund.

Trying to turn the premium positive

As a result, Grayscale is trying to return the price of the shares to its Net Asset Value, or NAV. Its parent company Digital Currency Group announced on March 10 that it plans to purchase up to $250 million of GBTC shares with its own cash, helping to stimulate demand.

“Grayscale has a tremendous incentive to get the liquid shares back to NAV or a premium because, otherwise, their spigot of new subscriptions is completely shut down,” Prince noted on the podcast.

But the cause of the premium could also be a way for Grayscale to get itself out of this pickle. As reported by The Block, a report by JP Morgan suggested that the recent launches of two Bitcoin ETFs in Canada (since the report, a third has launched) have drawn investment away from the GBTC.

Meanwhile, institutional investors who have unloaded shares in order to collect on the arbitrage opportunity, have dragged prices down, according to JP Morgan. Other Bitcoin trusts offering lower fees have also emerged in the US, like Osprey Funds and Skybridge Capital. Prince pointed out that there are also some ETFs, like Ark W, which hold GBTC shares. So when Ark W has outflows, it’s forced to sell GBTC, adding to the selling pressure.

But it’s the ETF competition that brings about an opportunity for Grayscale.

The difference between a trust and an ETF

The Grayscale Bitcoin Trust was formed because the US Securities and Exchange Commission (SEC) has not yet granted any company permission to create a Bitcoin ETF. It has repeatedly delayed ETF applications—claiming, among other reasons, that the Bitcoin market was not ready yet.

Like a Bitcoin ETF, the Grayscale Bitcoin Trust was formed as a way to let institutional investors get exposure to the price of Bitcoin without actually owning Bitcoin itself. However, the main drawback is that, unlike an ETF, the trust doesn’t allow investors to sell their shares to Grayscale and receive the underlying Bitcoin back.

“There is currently, for the Grayscale trusts at least, no redemption mechanism. So things can go in but they can’t come out,” Prince said.

Without a redemption process, there’s no way for GBTC owners to swap their shares for Bitcoin. This friction point prevents investors or market markets from returning the shares to the price of the underlying Bitcoin. And it’s why Grayscale appears to be looking into creating a Bitcoin ETF.

The options for a Bitcoin ETF

There are hints that Grayscale is planning to introduce some form of Bitcoin ETF, with multiple job filings on its careers page seeking to fill roles for ETF specialists. Grayscale CEO Michael Sonnenshein told Decrypt that, "If Bitcoin ETFs, and other digital currency ETFs, were to be allowed by the SEC, it’s a safe bet to say that Grayscale would be very interested in operating a fund that draws on our history of operational excellence to meet what we anticipate would be a surge in investor demand."

"Beyond that, we don't discuss future business plans," Sonnenshein added.

While no ETF has yet been approved by the US Securities and Exchange Commission, the existence of three Bitcoin ETFs in Canada, one in Latin America and multiple Bitcoin electronic-traded notes (ETNs) in Europe, could put pressure on the SEC to change its position. If it does so, Grayscale will be able to join the fray—giving it two options going forward.

Grayscale’s first option is to convert the GBTC into an ETF, which Prince suggested could happen. He said that, were this to occur, it could enable the value of the shares to return to NAV, or even to a premium.

Messari CEO Ryan Selkis poured cold water on this idea. In a report on March 17, he pointed out that the SEC has previously issued a cease-and-desist order against Grayscale and Genesis Global Trading for offering redemptions on an earlier Bitcoin investment vehicle. He also claimed that converting GBTC to a Bitcoin ETF would force it to cut its 2% annual fee, which he described as the exchange’s golden goose—something it might be reluctant to lose.

It’s notable that Grayscale actually contemplated converting the GBTC into a Bitcoin ETF in 2017, but chose not to follow through with this idea at the time, according to Business Insider.

Grayscale’s second option is to introduce a Bitcoin ETF separately into its line-up, with the option of converting the GBTC over at a later date. This is the strategy currently being used by Skybridge Capital, which has filed for a Bitcoin ETF Trust to sit alongside its current Bitcoin Fund.

Bloomberg Intelligence ETF analyst James Seyffart argued this would be the right move. “There are definitely pros and cons to doing this but it will allow them to maintain that massive 2% fee on $GBTC ($760 million annually at current levels) while taking advantage of their absolutely dominant liquidity lead vs every other traded bitcoin fund on the planet,” he tweeted on March 16.

But until the SEC decides to approve a Bitcoin ETF, Grayscale’s hands will remain tied.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.