In brief

The Canadian #Bitcoin ETF now holds more than 10,000 BTC.https://t.co/QM1dLdTcWC pic.twitter.com/4x74In2X3l

— glassnode (@glassnode) February 26, 2021

$68,707.00

-1.14%$1,967.14

-4.59%$1.47

-3.41%$615.20

-2.32%$0.999907

-0.00%$86.00

-2.16%$0.280476

-0.50%$0.102213

-8.54%$1.02

0.00%$556.79

-0.98%$51.37

-1.48%$0.281224

-4.66%$0.99989

0.01%$8.47

-2.47%$30.24

-4.22%$0.998727

-0.02%$8.76

-3.10%$0.162349

-1.15%$327.24

-6.82%$0.170507

-2.61%$0.999666

0.00%$294.19

-8.47%$0.100576

-2.92%$55.07

-0.94%$1.00

0.06%$9.25

-3.10%$0.0000066

-4.48%$0.969996

-5.19%$1.47

-0.86%$0.00986215

1.58%$0.080495

-2.68%$0.100651

-5.70%$4,997.48

0.09%$5,027.93

0.09%$1.36

-3.77%$1.30

-1.97%$3.51

-3.11%$0.630369

-4.67%$125.69

-1.70%$0.00000444

-7.53%$1.00

0.00%$186.81

-1.79%$0.725523

0.64%$0.996567

-0.05%$79.36

-1.42%$0.183854

2.82%$2.37

-2.30%$1.12

0.00%$0.999663

-0.01%$0.00000171

-0.48%$0.066823

-3.61%$1.00

0.00%$8.73

-2.29%$1.054

-1.90%$0.275384

-5.94%$2.41

-4.63%$0.999181

0.01%$0.00220091

-5.42%$0.403932

-4.74%$0.107529

-0.85%$7.14

-1.95%$8.30

-3.84%$2.13

-1.28%$70.15

-4.81%$10.99

0.00%$0.01819995

0.44%$0.120914

-5.72%$0.056054

-5.85%$0.03190522

-3.68%$0.095806

-3.21%$0.835477

-2.75%$0.999748

0.19%$0.0097298

-1.69%$3.47

-2.34%$1.24

-0.07%$1.44

-3.91%$1.37

-2.12%$0.935086

-4.56%$0.03646203

-2.86%$0.964714

-4.58%$1.026

0.00%$0.00832639

-5.13%$0.99963

0.02%$114.29

0.00%$0.700997

-3.79%$1.11

0.25%$0.114228

-4.58%$0.080421

-0.14%$0.00000655

-7.44%$0.998553

0.15%$1.094

0.00%$0.999718

0.00%$0.16217

-2.86%$1.00

0.02%$0.075364

-2.95%$0.01294299

0.58%$0.998176

-0.02%$0.02647938

16.10%$1.091

0.10%$37.49

-5.10%$0.26359

-4.51%$1.19

0.07%$0.00704797

-8.80%$0.400492

-5.02%$1.30

-3.39%$0.632813

-7.91%$0.04004228

-6.12%$1.63

-3.12%$23.56

-4.07%$0.220173

11.68%$2.09

-4.66%$0.188585

-3.67%$0.173398

-2.97%$0.998803

-0.02%$1.11

-8.70%$161.37

5.13%$0.250955

-4.95%$0.204648

5.40%$0.08383

-3.33%$0.04118189

-0.65%$1.71

-7.62%$0.00000035

-2.98%$17.07

-0.05%$0.017654

0.62%$128.53

-3.30%$0.00000034

-2.46%$0.0571

-5.47%$0.472183

-5.67%$0.056627

-1.00%$0.999605

-0.01%$3.13

-4.00%$0.00003197

-7.12%$0.262396

-6.11%$0.339735

-4.17%$0.02776682

-3.72%$1.019

0.02%$0.317967

-6.40%$0.068599

-4.65%$0.00589561

-4.78%$2.98

2.29%$0.995782

-0.28%$0.339098

-5.05%$0.054926

-3.44%$0.307109

-8.70%$0.991218

-0.12%$0.076824

-5.07%$0.04893009

-3.96%$16.94

-1.52%$0.00275798

-3.66%$6.78

-0.44%$0.02356832

2.60%$0.00253669

0.74%$0.02167663

-6.20%$12.49

-8.85%$1.30

16.89%$1.39

-5.20%$0.087601

-4.26%$1.44

-0.96%$0.999286

0.16%$0.231502

-6.17%$0.999939

0.00%$1.074

0.00%$0.988035

-0.00%$0.999939

0.06%$0.519089

-2.32%$0.208641

-4.84%$0.096293

-6.24%$5,492.19

2.72%$1.25

-3.15%$0.00000097

1.38%$0.0020718

-3.77%$22.27

0.00%$0.00543179

-2.17%$0.1025

-4.62%$2.81

-4.53%$0.196959

-9.19%$20.24

1.16%$17.57

-1.20%$0.198067

-4.29%$0.130062

-3.74%$0.00407557

-5.17%$1.00

0.00%$0.052733

-0.39%$0.188111

-5.10%$0.00003429

-1.01%$0.079678

-4.66%$0.998965

-0.02%$1.46

-1.43%$0.04781682

-4.46%$1.00

0.00%$0.091717

0.81%$2.29

-3.94%$1.94

-2.81%$0.788353

-3.76%$4.07

25.09%$1.001

0.20%$0.053685

-1.25%$2.09

0.07%$0.619479

-5.63%$1.80

-0.86%$0.00000819

-4.46%$47.97

-0.00%$0.998334

0.04%$1.015

-0.01%$0.994288

0.03%$1.27

0.76%$0.0215966

-6.08%$0.347549

-4.76%$0.998782

-0.03%$0.974729

-2.49%$0.311912

-1.14%$4.89

-6.31%$1.82

-0.07%$0.405729

-2.69%$0.142201

4.64%$0.14197

-4.05%$0.166897

-3.97%$0.645595

-6.02%$0.085093

-5.04%$0.644498

3.07%$0.076864

-3.45%$0.095467

-3.17%$0.265994

-4.02%$0.00433656

-1.69%$8.72

1.67%$2.02

-4.20%$0.324762

-1.06%$0.081728

-6.96%$0.0015427

-3.06%$0.264838

-7.56%$1,097.13

0.01%$0.370819

-0.43%$0.99539

0.03%$0.131844

1.14%$0.207372

-4.73%$0.00239165

-4.68%$0.480088

0.62%$1.056

-0.02%$0.995596

0.00%$0.02091655

-10.99%$2.40

-4.56%$0.130785

-2.61%$0.210465

-1.66%$0.02999322

-2.02%$0.268925

-5.26%$0.04663267

0.26%$0.121757

-1.69%$0.998771

0.02%

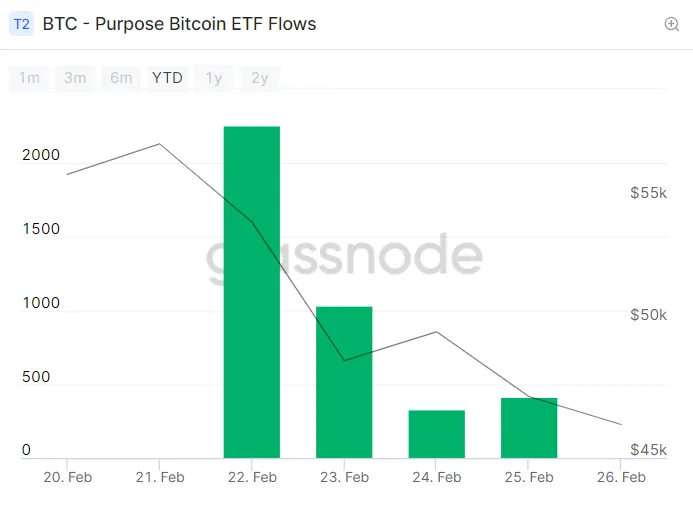

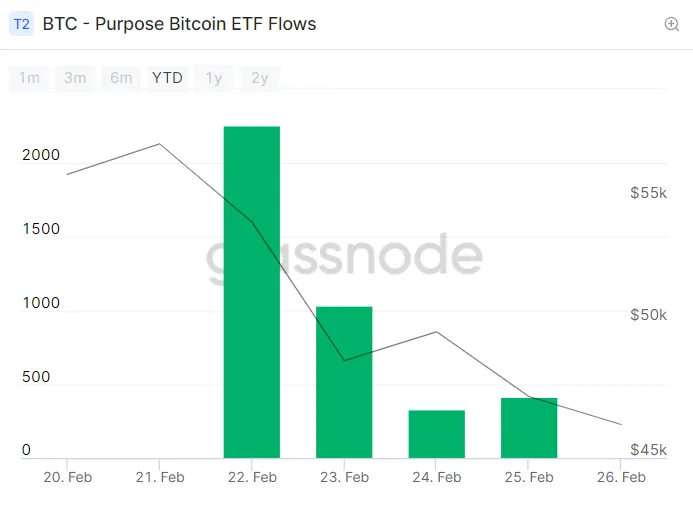

Purpose Investments now holds over 10,000 Bitcoin in just a week after the launch of its Bitcoin exchange-traded fund product, data from on-chain analytics service Glassnode shows. It's touted as the world’s “first” Bitcoin ETF.

One of the benefits for investors to purchase the Purpose Bitcoin ETF is that it holds “spot” (or actual) Bitcoin whenever an investor purchases its shares. This is different from most Bitcoin futures products, which allow investors to bet on rising/falling prices but tend to be settled in fiat money.

Data suggests such demand for spot Bitcoin among investors is high. As per Glassnode, the fund has taken in over 1,000 Bitcoin ($46 million) in the past four days, with over 417 Bitcoin in the past day alone.

The Canadian #Bitcoin ETF now holds more than 10,000 BTC.https://t.co/QM1dLdTcWC pic.twitter.com/4x74In2X3l

— glassnode (@glassnode) February 26, 2021

However, the overall buying activity suggests a downtrend. Over 2,251 Bitcoin flowed into the ETF at the start of the week, followed by 1,031 Bitcoin on Tuesday. Wednesday then saw a relatively low inflow of just 327 Bitcoin, while investors picked up 417 Bitcoin on Thursday.

Purpose’s Bitcoin investors can choose from three ETF tickers: a BTCC.U product for US dollars, a BTCC.B product for Canadian dollars, and the newly added BTCC product—a “hedged” offering that can be bought with Canadian dollars.

BTCC.U trades at $ 9.41, BTCC.B trades at $9.29, and BTCC trades at $10.34 on the Toronto Stock Exchange—meaning that, even as the value of the total Bitcoin held by Purpose is $464 million, the fund’s total net asset value (inclusive of fees) is over $624 million.

The fund’s demand for Bitcoin comes on the back of a stellar opening day on February 18, when it attracted over $80 million in its first hour of trading and a total of $165 million on the first day itself. And investors clearly seem to want even more.