In brief

- Gemini has a new service called Earn, which works a little like a savings account.

- The company says it can offer as much as 7.4% APY.

- Gemini is beginning to look more and more like a bank.

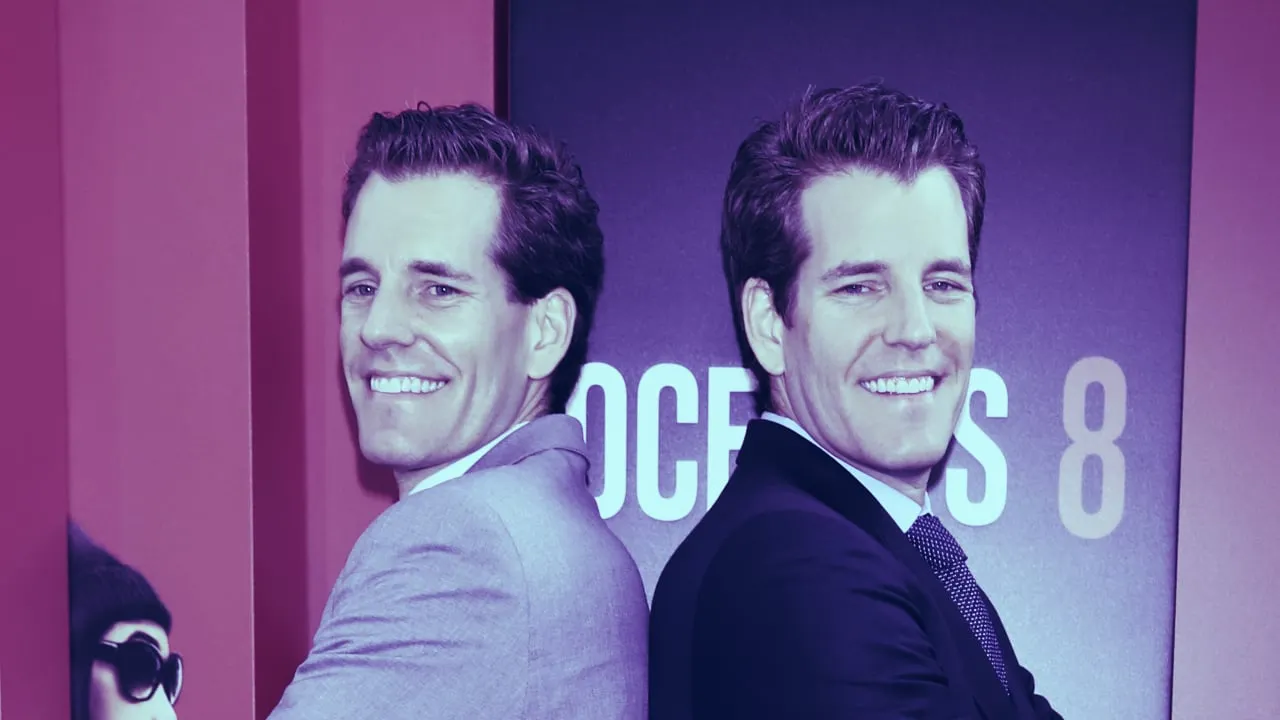

Gemini, the crypto company helmed by the Winklevoss twins, has launched a new investment service called Earn.

Locking up your cryptocurrency in the Earn program is a little like putting your money in a savings account: according to a press release, Gemini “allows customers to lend their digital assets to disclosed institutional borrowers” via uninsured loans.

Those loans are offered through Genesis Global Capital, and as with savings accounts, a portion of the money made by the lender is passed on to the customer. The company says Earn’s annual percentage yields can be as much as 7.4%.

It’s the latest sign that Gemini is looking to become more of a bank-like business; the company has had a state trust charter in New York for years, but Anchorage remains the only crypto company to secure a federal banking charter from the OCC.

The release also makes sure to note that Gemini “is not a depository institution,” and Earn is “not a depository account.”

Crypto lender BlockFi runs a similar program, as does Celsius Network. Gemini, though, claims to be the only such service that operates in all 50 states.

In another stab at a bank-like offering, Gemini recently introduced a company credit card geared toward Bitcoin rewards. It’s set to launch later this year.