A lot of friends asking me if they missed the crypto rally. FWIW, I bought more $BTC and $ETH last night. #bullish.

— Mike Novogratz (@novogratz) November 16, 2020

$64,074.00

-0.78%$1,853.05

-0.04%$1.35

-0.22%$584.08

-2.05%$1.00

0.02%$79.11

1.74%$0.283253

0.60%$1.034

0.25%$0.091435

-1.25%$48.07

-0.40%$0.99999

0.02%$484.83

-2.03%$0.25868

-1.35%$8.56

6.33%$27.15

3.20%$0.998668

-0.03%$0.160044

-1.67%$321.21

4.41%$8.20

-0.84%$0.149701

-1.06%$1.00

0.11%$0.00929404

-0.13%$1.00

0.04%$0.095105

0.32%$242.87

2.23%$51.14

-0.18%$8.29

-0.77%$0.0000059

-1.71%$0.860395

-2.16%$1.29

-3.64%$0.111895

2.23%$0.074136

-0.36%$5,136.29

-1.49%$1.42

1.17%$5,169.27

-1.63%$3.34

-0.19%$1.24

-2.02%$1.00

0.00%$0.590516

2.61%$0.997638

0.03%$114.51

-0.12%$0.695745

-0.71%$0.00000395

-0.41%$0.999987

0.03%$167.37

-1.45%$1.12

0.00%$0.999763

0.00%$74.05

-0.66%$2.20

-1.85%$0.065995

4.92%$0.00000164

-0.74%$0.162714

1.82%$0.999809

0.08%$8.30

-0.61%$0.967415

-1.16%$0.246473

-0.74%$0.112728

5.73%$11.00

0.03%$2.12

1.50%$6.81

-0.23%$8.33

1.41%$0.376304

0.92%$0.00170244

-5.03%$2.00

-5.66%$0.056582

-2.82%$62.07

-1.07%$0.01598745

-8.32%$1.00

0.08%$0.820841

-0.71%$0.812059

9.78%$0.098093

-0.31%$1.23

-0.16%$3.37

1.72%$0.02914387

-1.69%$0.00913989

0.65%$114.40

0.01%$0.083613

-0.32%$0.999982

0.04%$1.027

0.01%$1.36

-1.71%$1.11

-0.08%$0.03339743

-0.92%$0.880221

-0.98%$0.824573

1.87%$1.74

10.80%$0.00710216

-2.92%$0.080119

-0.22%$1.095

0.01%$0.994482

-0.44%$0.092309

-1.41%$0.02942227

3.05%$0.999995

0.04%$0.00000574

-2.01%$0.999047

0.01%$28.43

7.68%$0.01253853

-3.58%$1.086

-0.08%$0.144951

-0.39%$1.00

0.05%$0.258416

7.17%$1.18

-0.22%$0.065946

-1.08%$0.237209

0.43%$32.43

1.66%$0.00645107

2.18%$0.04593557

0.97%$0.608607

3.01%$1.20

-1.44%$165.23

-1.64%$0.366183

-0.72%$1.00

0.16%$0.498609

9.94%$1.026

0.82%$1.43

3.10%$0.152675

-0.67%$0.03330425

-1.67%$0.078199

-0.48%$1.021

0.07%$0.999765

0.01%$0.224856

1.29%$0.00000033

-0.71%$0.00000033

-1.45%$119.84

1.21%$0.01642981

-0.66%$3.12

-6.06%$0.052944

-0.64%$15.50

2.45%$1.53

2.30%$3.16

0.36%$0.332241

12.05%$0.050285

-0.54%$0.994112

-0.37%$0.065809

-0.64%$0.02570756

-1.31%$0.0055497

-2.45%$0.991592

0.03%$1.45

3.88%$0.00002793

-0.44%$0.287255

5.78%$17.07

1.60%$0.299747

0.11%$1.63

0.67%$0.144167

6.34%$0.299657

0.33%$0.118339

-2.64%$0.04812827

-0.08%$0.00248346

0.25%$0.209947

1.63%$0.329646

13.17%$0.069134

1.89%$0.00251157

-1.49%$0.999384

0.04%$6.00

-0.94%$0.04168115

3.31%$0.999997

0.00%$0.988575

0.47%$0.02004227

-2.31%$1.075

0.01%$0.999885

0.04%$1.26

2.01%$1.69

0.20%$5,561.13

5.90%$0.078111

-0.64%$0.0021269

5.69%$0.498595

0.24%$22.79

0.00%$0.099305

-0.94%$0.00000095

-0.33%$1.19

0.44%$0.194506

-2.95%$0.00003469

-0.31%$1.00

0.00%$0.08718

0.26%$0.190918

3.01%$0.079603

3.13%$0.05158

-0.32%$2.60

-2.21%$0.180454

-3.84%$1.00

0.00%$0.01918827

-3.65%$0.176374

12.05%$0.117337

0.69%$0.00471431

-1.37%$0.772958

1.79%$0.089718

-1.57%$17.79

3.26%$8.71

-0.54%$1.00

0.07%$2.07

-0.63%$0.00349671

-0.31%$0.02284358

-6.47%$1.79

0.03%$0.0198495

-1.25%$48.00

0.03%$0.75857

49.24%$3.64

-3.26%$1.74

-2.19%$0.995818

0.30%$0.588222

3.22%$0.050388

-0.21%$1.25

-1.01%$1.97

-0.18%$3.29

14.08%$0.99853

0.06%$0.02610957

40.19%$0.149933

3.57%$0.00000749

-0.13%$0.999179

-0.01%$1.012

-0.11%$0.03909919

-1.49%$0.147818

-3.39%$0.304153

-1.87%$0.64801

3.54%$0.304605

-3.78%$0.388306

0.74%$0.159166

2.14%$1,097.43

-0.00%$8.60

-3.16%$0.074655

2.59%$0.318584

-0.07%$0.598573

9.23%$0.077971

-0.61%$0.125919

-5.97%$4.28

-0.85%$0.250143

-3.18%$0.125219

-0.37%$0.124688

-2.50%$0.360415

-3.74%$0.249745

2.72%$0.130198

0.18%$0.08756

-0.80%$0.994847

-0.02%$0.279374

0.75%$0.0014398

-0.51%$1.028

1.87%$1.85

-0.35%$11.02

-13.06%$0.00392849

2.22%$1.001

0.00%$0.213304

-3.70%$0.072839

-1.09%$0.999808

0.03%$0.191494

3.68%$0.329514

-2.61%$1.42

0.29%$1.063

0.03%$0.999932

0.03%$2.24

2.04%

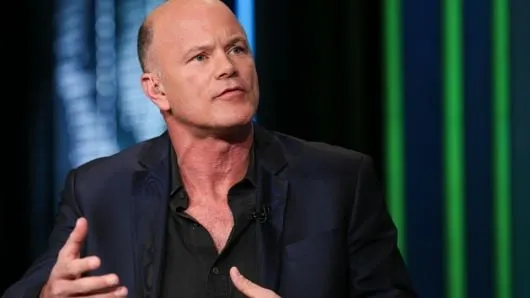

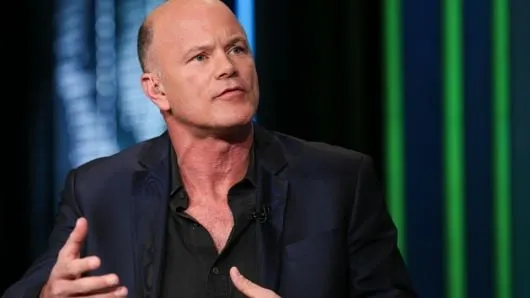

Cryptocurrency merchant bank Galaxy Digital said Monday it received the legal clearance to launch its “CI Galaxy Bitcoin Fund” in Canada, as per a release. The bank has partnered with Canadian fund manager CI Global Asset Management for the launch.

Owned by prominent Bitcoin bull Michael Novogratz, Galaxy Digital offers investors access and exposure to Bitcoin and other cryptocurrencies via its various partnerships. And while some of its funds, such as the Galaxy Institutional Bitcoin Fund, are only available to institutional firms in America, the new Canadian fund is open for investments from the general public.

The CI Galaxy Bitcoin Fund will invest directly in Bitcoin with its holdings of the asset priced using the Bloomberg Galaxy Bitcoin Index, which is designed to measure the performance of a single Bitcoin traded in US dollars.

The initial public offering will consist of ‘Class A’ units and ‘Class F’ units at a price of $10 per unit each. As investors purchase these units, Galaxy Digital will, in turn, allocate to the purchase an equivalent amount of Bitcoin from its own holdings.

As a closed-end investment fund, Galaxy Digital cannot issue newer shares for investors to purchase apart from the amount available at launch.

The fund will be available to Canadians in the near future and allow for a secure, regulated, and compliant exchange to gain exposure to Bitcoin (instead of trading on unregulated crypto exchanges which may put off serious investors—and Canada has had its fair share of those).

Its launch comes at a time when Bitcoin’s price is setting records. Just yesterday, the asset recorded its highest-ever three-weekly close at $15,960—indicating the market was now valuing Bitcoin at higher prices as demand for the digital gold grows.

Meanwhile, Novogratz continues to put more money where his mouth is. He said when Bitcoin hit $16,800 yesterday, “A lot of friends asking me if they missed the crypto rally. FWIW, I bought more $BTC and $ETH last night.” And he already owned a fair chunk.

A lot of friends asking me if they missed the crypto rally. FWIW, I bought more $BTC and $ETH last night. #bullish.

— Mike Novogratz (@novogratz) November 16, 2020

With his fund’s launch in Canada, the country’s investors can now join in on that action too.