In brief

- The Bitcoin futures market continues its steady recovery nearly two months out from Black Thursday.

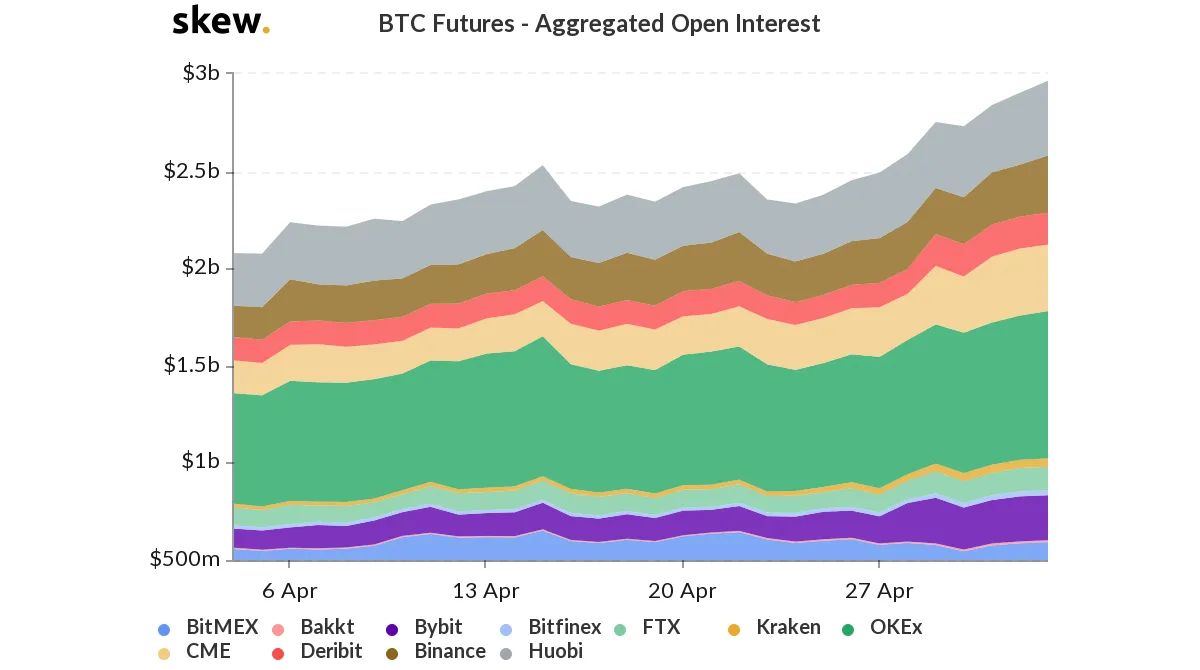

- The total value of open trades on Bitcoin’s futures market is now roughly $3 billion.

- As both retail and institutional futures markets see increased activity, volumes are still $2 billion away from the market’s $5 billion all-time high.

After falling off a cliff in the middle of March, the total amount of outstanding value in the Bitcoin futures market is now once again nearing $3 billion.

Per data from market analytics firm Skew, total open interest across all regulated and unregulated Bitcoin futures markets is closing in on $3 billion, a roughly 30% increase from last week’s positive moves.

This uptick in derivatives is nearly two months out from a brutal selloff that clipped Bitcoin’s open interest in half. The recent activity puts Bitcoin futures just a billion bucks shy of its open interest before the March 12 selloff, but it has another billion more to go from here for it to reach its $5 billion open interest all-time high in mid February.

The overwhelming majority of this volume is concentrated in the order books of five exchanges: Binance, Huobi, Bybit, OKEx and BitMex. BitMex, once the king of Bitcoin’s derivatives trading hill, has tumbled since mid-March to a consistent position as the fourth or fifth-most voluminous futures hub on the market.

Binance, Huobi and OKEx, in that order, have benefited most from BitMex’s decline, as it’s not uncommon for these trading posts to see between $5-9 billion in 24-hour volume on a busy day.

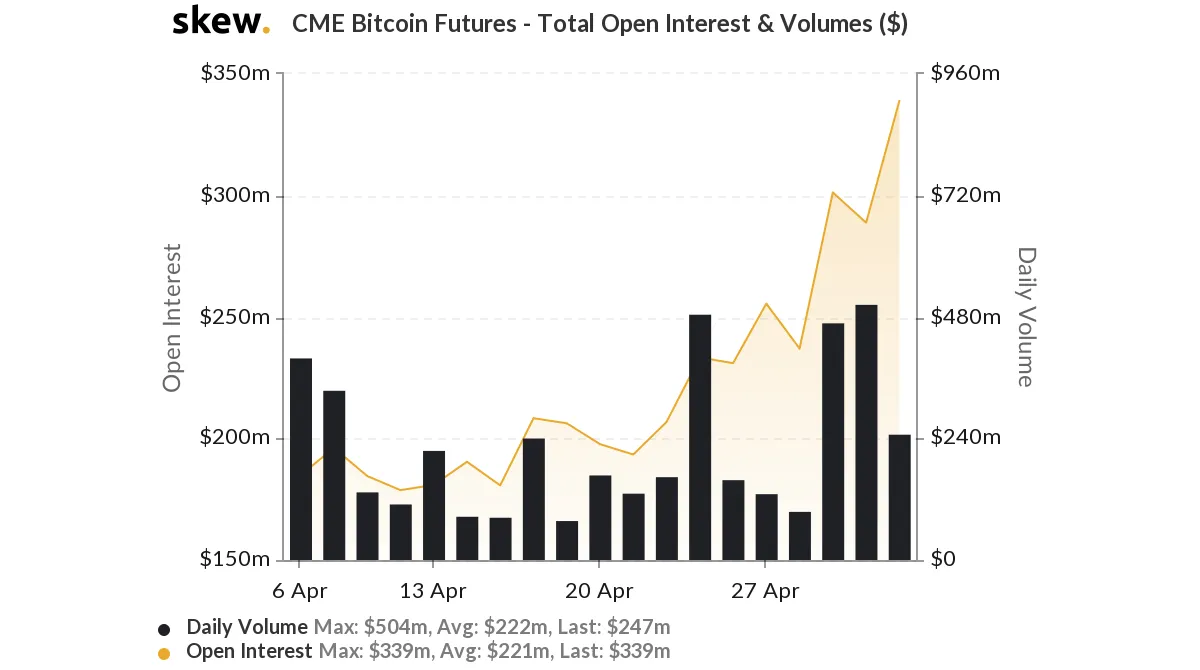

Meanwhile, in Bitcoin’s institutional trading circles, open interest is recovering as healthily as in retail circles. Bakkt’s outstanding futures contracts have surpassed pre-Black Thursday levels to reach $10 million, according to data from Skew. At the same time, CME’s futures market, which settles $72 million for every $1 million that Bakkt settles, has now exceeded pre-crash and all-time high volumes at $339 million.

At the moment, the price of Bitcoin remains relatively steady at just under $9,000, currently trading for around $8,800.