Sustainability-focused Bitcoin miner CleanSpark unveiled plans Thursday to merge with Griid Infrastructure—and is set to acquire all of the mining firm’s common shares for $155 million.

Griid Infrastructure’s share price plummeted following the announcement. As of this writing, the company’s stock price had fallen 49% on the trading day to $1.20. Still, shares in Cincinnati-based mining firm have rallied 55% over the past month.

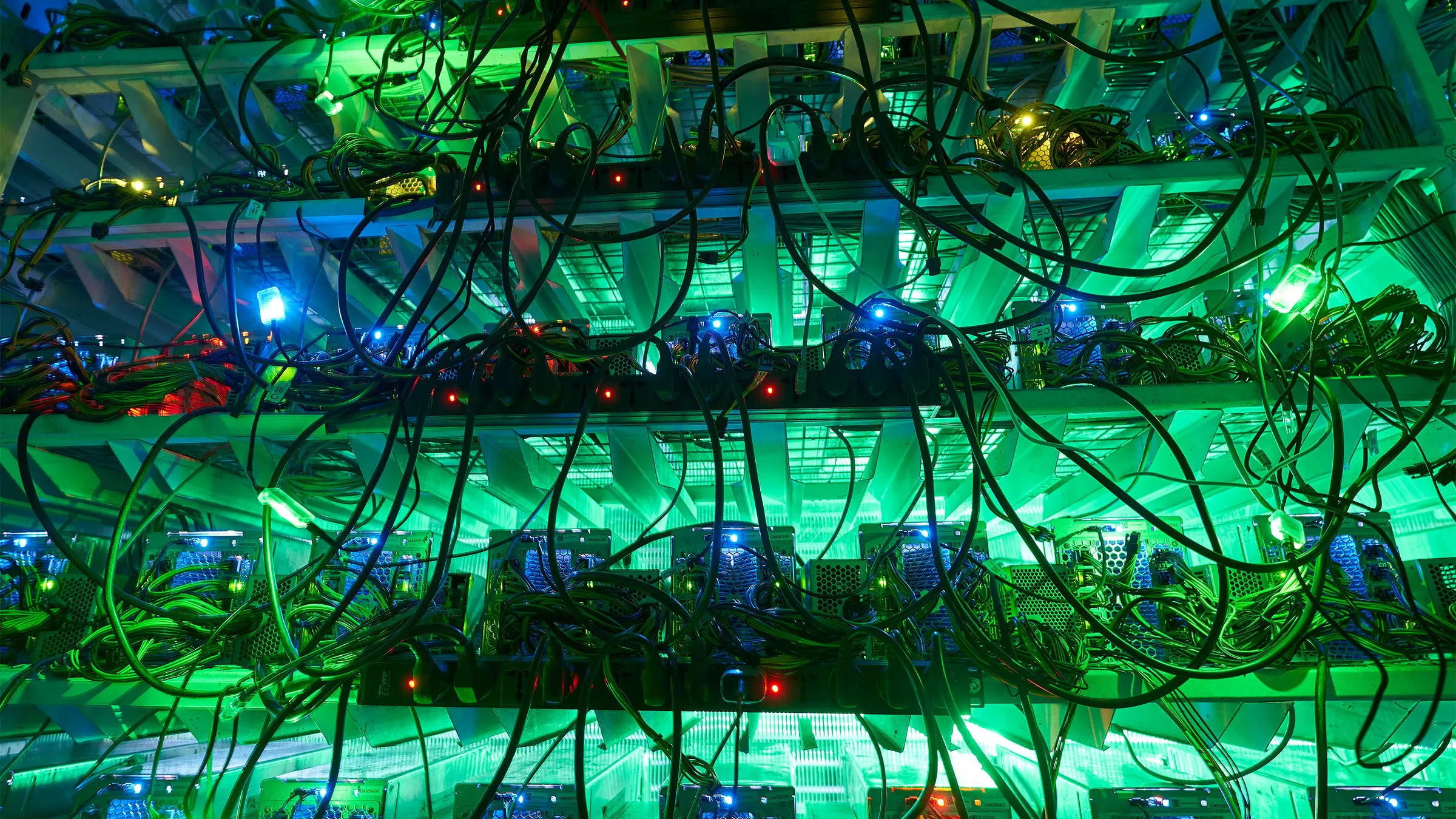

Alongside the merger agreement, 20 megawatts (MW) of Griid’s currently available power will be allocated to CleanSpark, the company said in a press release. As a result of the deal, CleanSpark estimates its power could grow by over 400 MW in the coming two years.

Griid’s “impressive pipeline” of energy infrastructure in Tennessee will dovetail with CleanSpark’s presence in Georgia and Mississippi, CleanSpark CEO Zach Bradford said in a statement. “This acquisition would give us a clear and steady path over the next three years,” he added.

In Georgia, CleanSpark has been able to build out over 400 MW of power capacity that its CEO said is backed by valuable, long-term power contracts. In addition to its existing power infrastructure in Mississippi, while also co-locating mining machines in New York, CleanSpark has announced additional mining facilities in Wyoming.

As part of the merger, CleanSpark agreed to assume all of Griid’s outstanding debt as part of the deal. Providing Griid with $5 million in working capital and a pay-down bridge loan of around $50.9 million, the move will provide Griid with funding during the transitionary period.

Established in 2018, Griid operates mining facilities in Watertown, New York and several others in Tennessee. One element of Griid’s business highlighted by CleanSpark is its “community-first approach to building data centers,” focusing itself in local communities.

Meanwhile, CleanSpark’s shares were little changed on the trading day. Showing a 0.44% increase, as of this writing, CleanSpark’s stock traded hands at $16.15.

The merger agreement comes as Bitcoin miners reckon with April’s so-called halving, a pre-programmed event that slashes the amount of new Bitcoin created once every four years. As a result of Bitcoin’s newfound digital scarcity, mining Bitcoin becomes less profitable.

Mergers and acquisitions have popped up recently among other miners too. Currently, the Canadian mining firm Bitfarms is defending itself from a hostile takeover by the mining giant Riot Platforms, which abandoned its plan in the face of a “poison pill” earlier this week.

Between CleanSpark and Griid’s board of directors, there’s been much less disagreement. Both companies’ boards have agreed to the deal’s terms, which is expected to close in the third quarter of this year.

Edited by Andrew Hayward